Senior Reporter

Meritor Technologies Keep Crossing Borders

ATLANTA — Meritor Inc.’s EX + L air disc brakes are soon to be standard on all new Freightliner Cascadia models, capping a component journey that began in Europe years ago.

Meritor already has sold in Europe more than 7 million air disc brakes for commercial vehicles, working with truck makers including Volvo Trucks and Scania, a unit of VW Truck and Bus.

“There are technologies that roll across borders or regions,” Chris Villavarayan, president of global truck at Meritor, told Transport Topics.

“There are cost efficiencies that come from Asia that we bring into North America and Europe. Then there are technologies we develop in North America that we take into other regions,” he said.

He added, “In two years we will have an even lighter brake coming out specifically for the Class 8 market.” There will be an opportunity for some of those brakes, ultimately, to be used in Europe.

Freightliner, a unit of Daimler Trucks North America, holds the leading market share in U.S. Class 8 retail sales.

DTNA made the announcement at the annual meeting and exposition of the Technology & Maintenance Council, a division of American Trucking Associations.

Meritor has a U.S. position in disc brakes with Volvo Trucks North America, Mack Trucks and International Truck.

VTNA and Mack are units of Volvo Group. International is a unit of Navistar Inc.

“We are using capacity in Europe to bring the brakes across,” Villavarayan said. In addition, it is expanding its brake manufacturing facility in York, S.C., as the business ramps up.

Laser welding is another example of the shift underway among regions, he said.

Meritor uses that process on its 17X axle, launched in Europe in the mid 2000s and now available in North and South America. The next step could involve bringing the 17X axle to North America for 6X2 applications, Villavarayan said.

Before laser welding the external ring gear, the differential case, pinion housing to the carrier casting and axle housing were joined by 36 screws. With laser welding, the drive ring and differential case become an extremely stiff unit, thus eliminating fretting and allowing a higher torque capacity, according to Troy, Mich.-based Meritor.

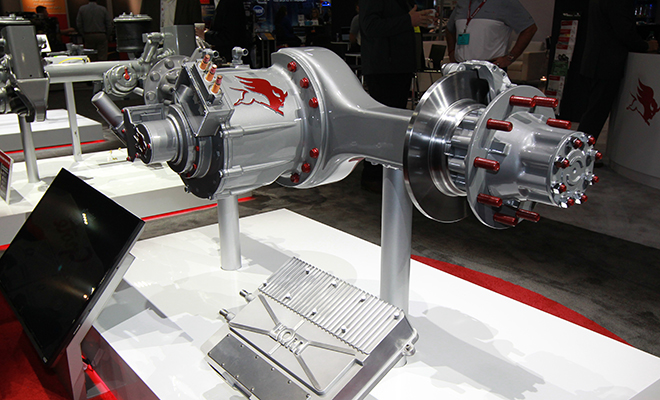

At TMC, Meritor displayed a medium-duty version of its e-axle that could be used in pickup and delivery operations, and in which the engine, as an electric motor, is being migrated into the axle.

Asked if the e-axle could be shipped to Europe at some point Villavarayan said, “Absolutely.”

For Europe, however, an e-axle is likely to be larger, such as Meritor’s 17X. Asked when that might happen, he said, “That’s one of those secrets that we’d like to hold dear to our hearts.”

The biggest difference between an electric axle and a traditional axle is that the e-axle provides propulsion and retardation of the vehicle, John Bennett, general manager of global product strategy for Meritor, told TT.

Meritor's e-axle by John Sommers II for Transport Topics

Bennett made his comments after Meritor and UQM Technologies Inc. announced an agreement in 2017 to develop an integrated electric axle that would replace or downsize internal combustion engines on some electric commercial vehicles.

Turning to life after the end of Meritor’s 27-year joint venture with Wabco Holdings Inc., Villavarayan said it was a seamless change.

“We are still supporting them this year and will for a majority of next year, as well. We are still working on packages that include axles and OnGuard [the collision mitigation system], and seeing further opportunities where we can work collaboratively,” he said.

Wabco acquired Meritor’s stake in the joint venture business for $250 million. The deal closed Oct. 3.

Some of that funding went toward acquisitions, such as for TransPower, and the product portfolio and related technologies of Fabco Holdings Inc. and its subsidiaries, he said.

TransPower supplies integrated drive systems, full electric truck solutions and energy-storage subsystems.

Fabco makes transfer cases, specialty gear boxes, auxiliary transmissions and power takeoff units for medium, heavy-duty and heavy-haul vehicles for on- and off-highway, construction, defense, rail and other industrial applications.

“Between those two we are seeing about $50 million in annual revenue,” Villavarayan said.

Lastly, he said investments in advanced driver safety systems, autonomous vehicles and e-mobility, for example, “are so large and drive such scale, you are driven even more to being global.”