Senior Reporter

Medium-Duty Sales Rise 36.7% in March, Led by Class 5

[Stay on top of transportation news: Get TTNews in your inbox.]

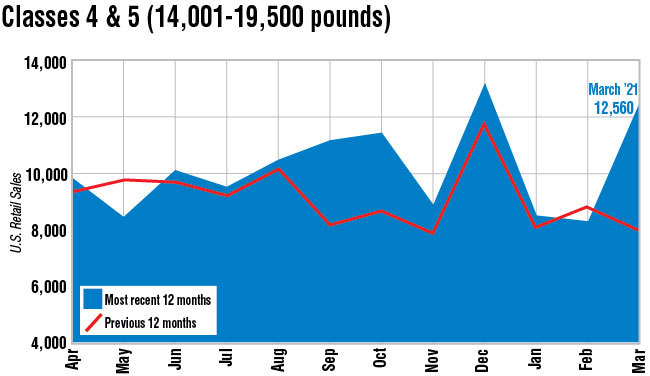

U.S. retail sales of Classes 4-7 trucks in March climbed 36.7% compared with a year earlier, riding the surge in demand in Class 5, WardsAuto.com reported.

Sales were 23,575 compared with 17,244 a year earlier, according to Wards. First-quarter sales climbed 16.5% to 59,754 compared with 51,271 in the same 2020 period.

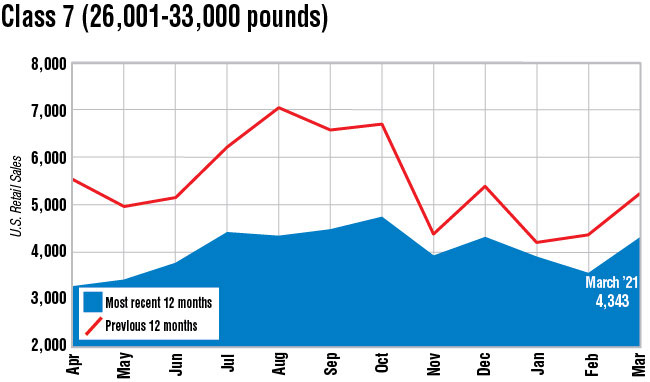

Class 7 was the only segment to post a decline. It dropped 16.6% to 4,343 compared with 5,205 a year earlier.

In Class 7, Freightliner led with 2,042 sales and notched a 46% market share. International, a brand of Navistar Inc., was next with 949 sales. Peterbilt Motors Co., a unit of Paccar Inc., was third with 789.

Freightliner is a unit of Daimler Trucks North America.

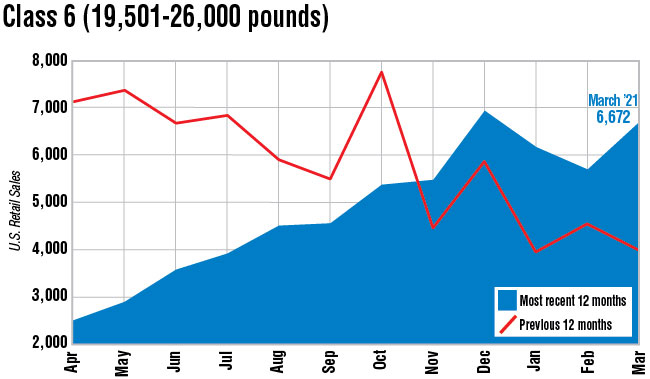

Class 6 sales rose 66.7% to 6,672 compared with 4,003 in the 2020 period. Freightliner sold a leading 2,426, in its typical back-and-forth with Ford Motor Co., which sold 2,101.

“The lease rental guys [that rely on Class 6 trucks] were huge in the market in 2019 but only participated in the market in 2020 in almost a perfunctory fashion,” said ACT Research Vice President Steve Tam. “So the 6,672 against 4,003 is largely a story of an easy comparable.”

Tam said 6,600 or so was about the number of sales averaged on a monthly basis in 2019. In 2018 the average was about 6,000.

“I don’t want to discount the March number in Class 6 and say it’s a return to normal, it’s a little bit above normal,” he said, “but it’s not as impressive as the year-over-year comp makes it sound.”

That is not true for Classes 4-5, Tam said, as March sales climbed 56.3% to 12,560.

In the lighter classes, Class 5 had the preponderance of sales with 10,117, up from 6,241 a year earlier. Ford sold 5,485, good for a 54.2% market share. Stellantis N.V. was next with its Ram model and sales of 2,267.

Isuzu Commercial Truck of America once again led in Class 4 with sales of 1,207 out of a total 2,443, compared with total sales in Class 4 of 1,795 a year earlier.

“I think that’s more a story of e-commerce, online buying and home delivery. All the kinds of consumer buying and distribution patterns that are morphing right now,” he said. “So much of that is the final-mile or last-mile delivery taking place in smaller vehicles.”

He pointed out new entrants like Amazon are entering the space and buying their own trucks to displace parcel carriers and the postal service. “So the new Amazon trucks are brand-new capacity. That’s excess capacity.”

Tam said there will be this transition period of that excess capacity and “the other providers are either going to have to find new work or rationalize their fleet.”

Want more news? Listen to today's daily briefing below or go here for more info: