Senior Reporter

Medium-Duty December Sales Post Slight Gain to End Near-Record Year

[Stay on top of transportation news: Get TTNews in your inbox.]

Medium-duty truck sales in December rose nearly 5% overall compared with a year earlier and annual volume for 2019 was the highest since 2006, WardsAuto.com reported.

Sales in December reached 23,068, up 4.6% compared with 22,045 a year earlier.

The full-year volume rose 7.3% to 254,744 compared with the 2018 period. It was the best volume since 2006, when medium-duty sales reached 260,416, according to Ward’s.

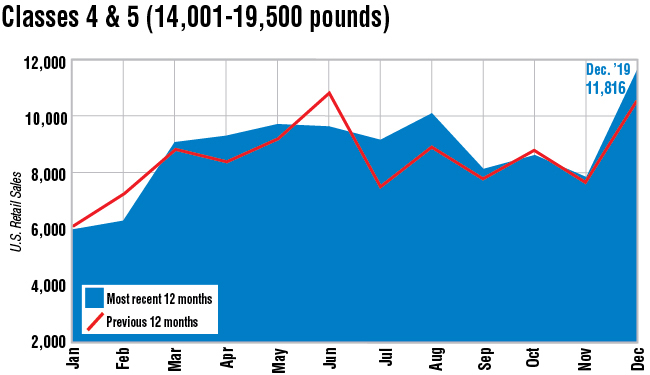

Broken down by vehicle segment, however, the only gain in December was in Classes 4-5. Sales for these trucks rose 11.3% to 11,816.

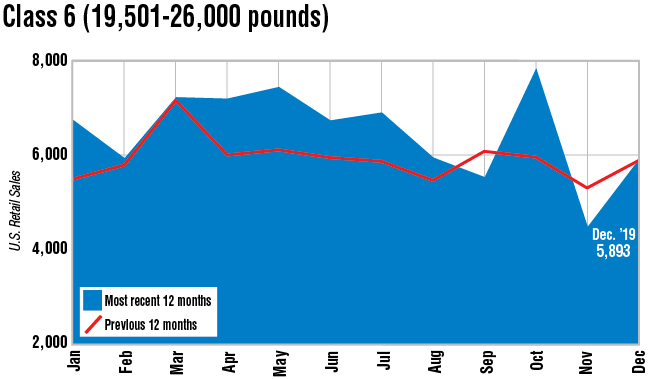

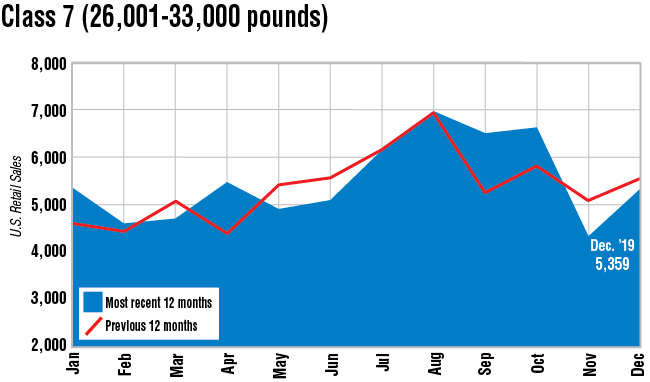

Class 7 sales in December slipped 2.9% to 5,359 compared with a year earlier, while Class 6 sales dipped 0.3% to 5,893 compared with a year earlier.

By way of explaining the declines in Classes 6-7, ACT Vice President Steve Tam said, “Some of your largest medium-duty customers are lease-rental folks and they were in the marketplace in a huge way in 2018. They kind of took a step back from that in 2019. They are very happy with the average of their fleets.”

As for the pickup in Classes 4-5, Tam said, “It is most likely tied to the subtle shift down the GVW [gross vehicle weight] scale as the result of increased e-commerce and home delivery activity.” He added, “It’s just more of a temporary share shift.”

In Class 4, Isuzu Commercial Truck of America sold the most, moving 1,358 units and claiming a 55% share.

Ford Motor Co. led in Class 5 with 5,371 sales and a 57% share.

In Class 6 — dominated by four truck makers — Freightliner and Ford were nip and tuck for the lead, with Freightliner’s sales of 1,420 edging out Ford’s 1,415.

Freightliner is a brand of Daimler Trucks North America.

Below them, International, a brand of Navistar Inc., sold 1,164 trucks, while Hino Trucks, a Toyota Group company, had sales of 1,107 in Class 6. In Class 7, Freightliner remained the leader with 2,075 sales, good for a 39% share. That said, its sales dropped by 214 trucks compared with the 2018 period. Peterbilt Motors Co., a unit of Paccar Inc., sold 988 in Class 7, or 266 more than a year earlier.

Also in the Class 7 segment, International sold 265 fewer trucks for a total of 1,010 compared with year earlier.

Hino notched an additional 80 sales in Class 7 to reach 310 in the month compared with the 2018 period.

Other truck makers showed little change year over year in the Class 7 segment.

Meanwhile, Kenworth Truck Co., also a unit of Paccar Inc., was the latest to announce its initial steps into electrification.

“Kenworth plans to produce up to 100 medium-duty cabover electric trucks in 2020,” Kevin Baney, Kenworth general manager, said in a release.

Want more news? Listen to today's daily briefing: