Bloomberg News

LNG Shipping Rates Dip on Lower Demand Despite Red Sea Chaos

[Stay on top of transportation news: Get TTNews in your inbox.]

It’s getting cheaper — at least for now — to rent a liquefied natural gas tanker despite turmoil in the Red Sea that is forcing some vessels to take longer and more costly routes.

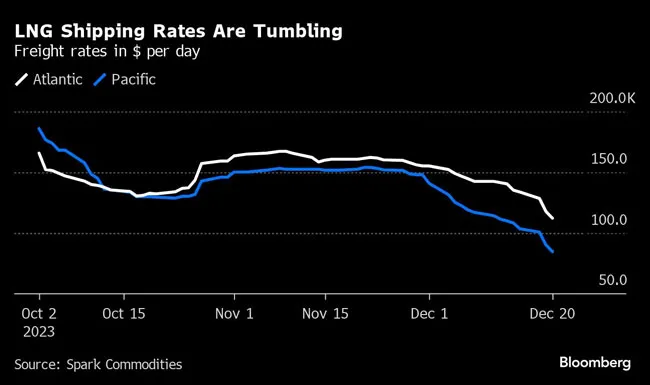

The slump in LNG shipping rates started in late November but accelerated this week, with prices in the Pacific basin tumbling below $100,000 a day for the first time since August, data from Spark Commodities show. Atlantic basin rates are also tanking, shedding 16% since Dec. 15.

The drop is partially because of lower demand for LNG — and vessels to haul it — amid mild weather. There are also no major price gaps between consuming regions, meaning that markets remain segmented, according to Spark CEO Tim Mendelssohn.

Cheaper freight is a relief for shippers embarking on lengthy voyages around Africa after Houthi militants escalated their attacks on vessels in the Red Sea, a vital waterway for East-West trade. Sailing via the Cape of Good Hope can add two weeks to journeys, tying up vessels and potentially leading to a tighter shipping market.

“The current lack of demand and limited arbitrage opportunities have contributed to an increase in vessel availability, exerting downward pressure on spot rates,” shipbroker Fearnleys A/S said in a weekly note Dec. 20. “LNG prices have also decreased, primarily attributed to ample inventories despite declining temperatures in the North Asia region.”

At the moment in the LNG trade, fuel from the U.S. typically lands in Europe, while Asian buyers mainly source it from closer producers, such as Qatar or Australia. That means many vessels haven’t had to sail through the Suez Canal or the drought-stricken and congested Panama Canal.

To be sure, the redirection of cargoes — still in its early days — and increased risks of further attacks may result in a temporary surge in ton-miles, which could create additional demand for shipping, according to Fearnleys.

Similarly, if Asian LNG demand spikes, leading to higher prices there, “this could drive U.S. cargoes to Asia instead, in which case the situation at the Suez Canal could become much more impactful to freight and cargo prices,” Mendelssohn said.

“The last few years have shown that there is a risk of supply-side shocks to freight and cargo prices,” he added. “The lack of freight rate increases today is not necessarily a sure sign of price stability in the coming weeks.”

Want more news? Listen to today's daily briefing below or go here for more info: