Labor Data Surprises as Job Market Runs Hotter Than Forecast

[Stay on top of transportation news: Get TTNews in your inbox.]

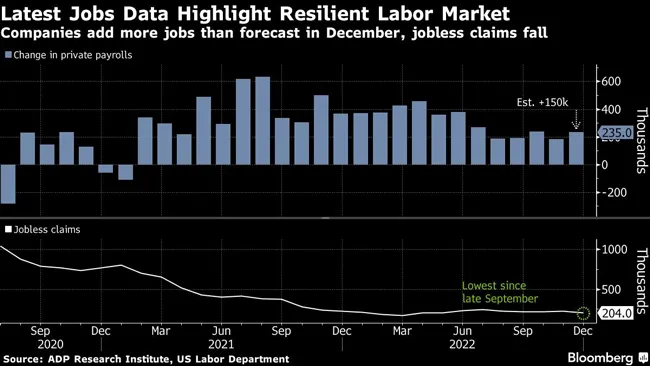

Data released Jan. 5 reinforced the strength of the labor market, with hiring at U.S. companies far exceeding expectations and applications for jobless benefits falling to a three-month low.

Private payrolls increased 235,000 last month, led by small and medium-sized businesses, according to data from ADP Research Institute in collaboration with Stanford Digital Economy Lab. The figure exceeded all but one forecast in a Bloomberg survey of economists.

Additionally, applications for unemployment benefits fell last week to the lowest since late September, according to Labor Department data. In the prior week, continuing claims for those benefits also declined.

Job gains were concentrated in businesses with less than 500 employees. The largest companies cut 151,000 workers from payrolls, the most since April 2020. Leisure and hospitality, education and health services, professional and business services and construction led jobs growth.

“The labor market is strong but fragmented, with hiring varying sharply by industry and establishment size,” Nela Richardson, chief economist at ADP, said Jan. 5 in a statement. “Business segments that hired aggressively in the first half of 2022 have slowed hiring and in some cases cut jobs in the last month of the year.”

The figures suggest the labor market, while cooling in certain pockets, remains strong. Despite concerns of a looming recession, labor demand still far outstrips supply, keeping upward pressure on wages and giving consumers the wherewithal to keep spending. Layoffs also remain extremely low and openings are elevated.

Treasury yields spiked and the S&P 500 opened lower as investors speculated the Federal Reserve has room to keep raising rates.

The ADP report also includes a fresh look at wage growth in the month, a key focus and concern for the Fed in its inflation fight. Chair Jerome Powell has pointed to wages as the main driver of price growth in services excluding housing and energy, a leading factor in his overall inflation outlook.

In a welcome sign for the Fed, the data showed a sharp deceleration in wage growth in December. Those who changed jobs experienced a 15.2% pay increase from a year ago, the lowest in 10 months. For those who stayed at their job, the median increase in annual pay was 7.3%, down from 7.6% in the prior month.

What is the outlook for trucking in 2023? How will the industry change with the current government, economic and business trends? Join host Michael Freeze and TT reporters Eugene Mulero and Connor Wolf. Hear the program above and at RoadSigns.TTNews.com.

The figures precede the government’s payrolls report on Jan. 6, which is forecast to show companies added 183,000 jobs in December and a moderation in wage growth. The unemployment rate is seen holding at a historically low level of 3.7%.

All but one region posted job growth, with the tech-heavy West shedding 142,000 positions, per ADP. Amazon.com Inc. is laying off more than 18,000 employees — the biggest reduction in its history — in the latest sign that the industry’s slump is deepening.

ADP, which updated its methodology last year, bases its figures on payroll data of more than 25 million U.S. workers.

There are other signs that economic growth picked up at the end of the year. The U.S. trade deficit shrank in November to a more than two-year low as imports retreated, which may provide a tailwind for gross domestic product in the fourth quarter.

— With assistance from Ana Monteiro and Jordan Yadoo.

Want more news? Listen to today's daily briefing below or go here for more info: