Bloomberg News

Korean Exports Head for Record on Holiday Demand, Higher Prices

[Stay on top of transportation news: Get TTNews in your inbox.]

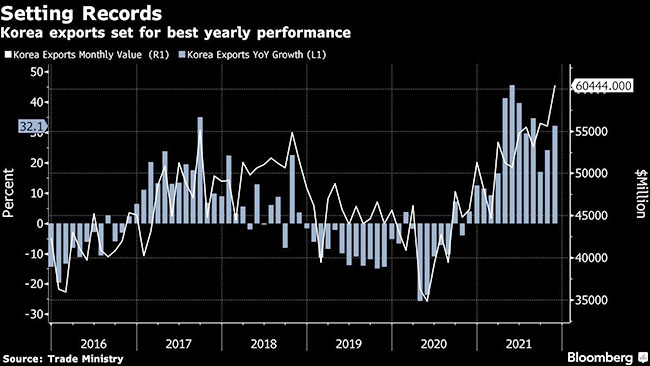

South Korea’s exports are on track to post an annual record, buoyed by year-end holiday demand and higher product prices even as supply chain bottlenecks continued to pressure manufacturers.

Exports rose 32.1% in November from a year earlier to $60.4 billion, a monthly record, data from the trade ministry showed Dec. 1. The ministry said overseas shipment are on track to reach the highest annual value in the country’s trade history.

Korea’s shipments to China last month also were the highest ever, while exports to other key markets posted double-digit gains. Sales of chips, the country’s cash cow, jumped 40%.

The result bodes well for a Korean economy that’s relied on exports to underpin growth amid on-again, off-again COVID-19 restrictions that hampered a recovery in household spending. The approaching holiday season likely provided a fillip to overseas demand, while a stabilization in China’s manufacturing sector offered additional support.

Korea’s manufacturing sector also improved, with the purchasing managers’ index edging up to 50.9 from 50.2 in October, according to IHS Markit data. While the level indicates a month-on-month expansion in activity, it still is this year’s second-lowest reading.

“Despite the headline PMI rising slightly in November, this masked a second successive contraction in output levels, while new order growth broadly stagnated as supply shortages hit demand,” IHS Markit economist Usamah Bhatti said.

For global trade, much remains uncertain heading into next year. The new omicron variant of the coronavirus has the potential to derail the reopening of economies, and could cause further disruptions to already-strained supply chains.

The ministry touted the country’s strong trade performance in the Dec. 1 statement, but also warned against threats from the spread of the new variant, raw material supply issues and rising shipping costs.

The development of the pandemic also will have a significant bearing on Korea’s monetary policy. The Bank of Korea has spearheaded the region’s tightening with two interest-rate increases since August, with the most recent hike occurring just before omicron emerged.

Big rig braking is an engineering marvel. Host Michael Freeze finds out more about the advanced technology that halts 18-wheelers, no matter the weight, instantaneously. Hear a snippet above, and get the full program by going to RoadSigns.TTNews.com.

Korea’s imports also surged in November, rising by 43.6% from a year earlier to leave a trade surplus of $3.09 billion.

Overseas shipments to the U.S. were up 22% in the month, while those to the European Union gained 18.9% and to Japan increased 33.1%.

Overall exports of petrochemicals were up 63%, as gasoline items jumped more than 100%. Automobile exports climbed 3.3%, while mobile communications devices advanced 16.5%.

November’s export performance was a combination of rising prices and volumes, the ministry said. Export prices rose 22.1%, while volume gained 8.2%.

Want more news? Listen to today's daily briefing below or go here for more info: