Bloomberg News

Gas Demand Stalls at Height of Summer Driving Season

[Stay on top of transportation news: Get TTNews in your inbox.]

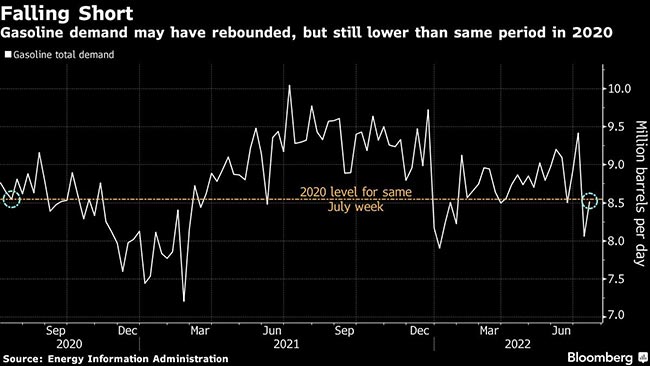

U.S. gasoline demand remains below where it was this time two years ago as historically high prices keep more drivers off the road than COVID-19 did in the summer of 2020.

A small week-over-week rebound in demand last week was not enough to top the same period in 2020. On a seasonal four-week rolling average — which smooths out weekly fluctuations — consumption is just above the same time two years ago, but below every other year going back to 2000, according to data from the U.S. Energy Information Administration. Gasoline inventories rose by 3.5 million barrels, a larger build than was reported by the American Petroleum Institute earlier in the week.

Stalling demand in the middle of summer suggests the recent drop in pump prices has not been enough to entice drivers back on the road. The summer months are when demand tends to be more elastic than the rest of the year, and it appears more people are doing away with road trips in 2022. Daily life has become costlier with high gasoline prices helping push inflation to 9.1% in June on an annual basis.

Average pump prices in the U.S. have fallen for 36 straight days in the longest streak of declines since April 2020, with some states seeing costs below $4 a gallon, according to auto club AAA. But the national average of $4.467 a gallon is still 41% higher than the same time last year.

The drop in Nymex gasoline futures, the basis for wholesale and therefore retail prices, has largely stalled in the past two weeks. This could moderate the decline in pump prices in the near future.

— With assistance from Sophie Caronello.

Want more news? Listen to today's daily briefing below or go here for more info: