Empire Petroleum Extends Network

Empire Petroleum Partners continues to expand its wholesale fuel distribution network with its latest deal: the purchase of 70 Corner Store convenience store properties and fuel stations in six states from Circle K Stores Inc. and CST Brands Inc.

The deal covers locations in Arizona, Colorado, Florida, Georgia, New Mexico and Texas. It also is a sign of things to come with increasing consolidation among firms that distribute food and fuel.

Empire’s purchase is designed, in part, to satisfy requirements of the U.S. Federal Trade Commission in connection with the purchase of CST Brands by Canadian convenience store operator and fuel distributor Alimentation Couche-Tard, which has business throughout North America, plus northern Europe, Ireland, Poland, the Baltic states and Russia.

Empire Petroleum Partners, LLC Announces Purchase Of 70 Corner Store Stations From Circle K Stores Inc. And CST Br… https://t.co/JxkUtNoAQ7

— Seattle's Banker (@SeattlesBanker) September 7, 2017

The deal extends Empire’s network of filling stations in Colorado and Texas and adds markets in Arizona and Florida, Empire Chief Operating Officer Jeff Goodwin said.

In June, Dallas-based Empire teamed with Louisville, Ky., tank truck carrier Usher Transport to take over transportation and marketing assets of Superior Transport Inc., a company in Rome, Ga., that distributes fuel to 120 retail outlets in northern Alabama, northwestern Georgia and southern Tennessee.

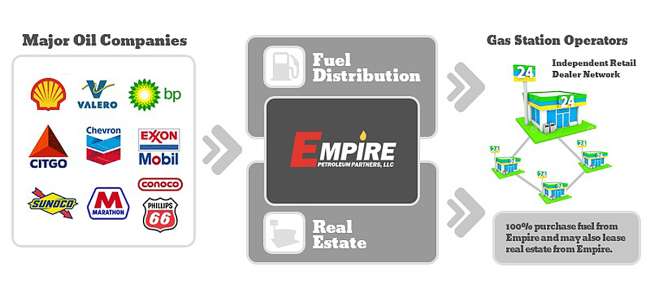

Empire started in 1998 as a fuel distributor for Getty in the Washington, D.C., area. The company added Sunoco and BP fuel stations in 2000 and Marathon, Chevron, Texaco, Valero and Gulf brands in 2010.

With the latest transactions, Empire sells fuel to more than 1,600 gas stations in 30 states. The business includes stations selling fuel under the Shell, ExxonMobil, Phillips 66, Crown and 76 brands, along with a group of privately branded stations called Empire’s Fast Fuels.

“We are excited to add these high-quality assets to our portfolio,” Empire CEO Rocky Dewbre said in a statement issued in connection with the Corner Store purchase Sept. 7. He also pledged to “continue executing on our aggressive growth strategy in the years to come.”

While Empire enters into contracts to supply fuel, it does not operate a fleet of trucks to transport fuel.

Empire Petroleum Partners has appointed Rocky Dewbre as company’s new #CEO, Dewbre to succeed the retiring Heithaus https://t.co/aA1mPcuD4i pic.twitter.com/TV0A8z3lKH — CSP Magazine (@CSPmagazine) July 7, 2017

Dewbre joined Empire after the retirement of former CEO Hank Heithaus on Sept. 15. He previously served as a member of the board of directors at CST Brands and was president and CEO of Susser Petroleum Partners from 1992 to 2014.

San Antonio-based CST Brands and fuel-distribution affiliate CrossAmerica Partners operated a combined 3,000 retail sites in 32 states and six Canadian provinces when it was acquired in June by Montreal-based Alimentation Couche-Tard for $4.4 billion. The combined operations make Couche-Tard the largest wholesaler of road transportation fuel in the United States company officials said.

On the day it purchased CST Brands, Couche-Tard sold a majority of the company’s Canadian business and assets to Parkland Fuel Corp., another wholesale distributor, based in Calgary, Alberta.

In July, Couche-Tard also agreed to acquire a group of 522 Holiday-branded company-owned and franchised fuel stations and convenience stores across the northern tier of U.S. states from the Erickson family in Minnesota. Holiday operates a fuel terminal in Newport, Minn., that supplies about one-third of the stations, which stretch from Michigan to Washington and Alaska.

With these transactions, Couche-Tard will be the largest independent convenience store operator in Canada and the United States with 9,471 stores, of which 8,129 will have fueling services. Fuel revenue accounted for more than two-thirds of the company’s total revenue of $37.9 billion for the fiscal year ended April 30.

Parkland also will see an increase in fuel sales with its purchase of CST Brands business in Canada.

“This transaction represents a large-scale expansion into Quebec and Atlantic Canada, Parkland CEO Bob Espey said, “and will increase the company’s footprint to over 1,700 sites and expand our carlock and home heat business significantly.”