Staff Reporter

Economic Changes Drive a New Trucking Environment, Panelists Say

[Stay on top of transportation news: Get TTNews in your inbox.]

The trucking industry is starting to normalize as the coronavirus pandemic loses its grasp on the economy, a panel of experts said March 23.

“We really are moving toward an ‘endemic’ and getting away from the pandemic,” said Paul Bingham, supply chain transportation economics consultant at S&P Global Market Intelligence, during the inaugural Supply Chain Master Series hosted by Coyote Logistics. “We’ve come through omicron, and there’s no sign that the next wave is going to keep people at home and out of work.”

Bingham said the economy is showing some pre-pandemic characteristics, including rising labor force participation, more consumer spending on services and less spending on durable goods.

He noted that while his data indicates consumer spending in January rose 4.9%, by February that growth rate was at 0.3%. Bingham cited some factors that are likely adding to uncertainty.

“Obviously what’s also very different is what’s happened in Europe with the invasion of Ukraine by Russia,” Bingham said. “We’ve seen this spike in commodity prices and most significantly on the fuel side where we’ve had dramatic increases in fuel prices in the last six weeks.” Plus, the Federal Reserve plan to begin raising interest rates will affect interest expense and consumers’ ability to make purchases. This, he noted, while inflation is at a 40-year high.

(Coyote Logistics via Youtube)

“If you go back to a year ago, we were adding stimulus the economy,” said Jack Atkins, transportation research analyst at financial services firm Stephens. “Because of Fed actions, we’re really going to be taking stimulus out of the economy. And, broadly, the rate of change is slowing. You’re seeing economic growth slow a bit. It’s still up, the question is how much.”

Atkins noted truckload carriers are seeing employment capacity improving somewhat, an indication that the supply chain is beginning to stabilize.

“You’re starting to see some fluidity return,” Atkins said. “That’s going to be adding capacity at the margin. Employment is getting better. Truckers are in a better position to hire today than they were a year ago. You put all of it together, it certainly feels like supply chain tightness maybe peaked in the second half of last year, maybe in January of this year.”

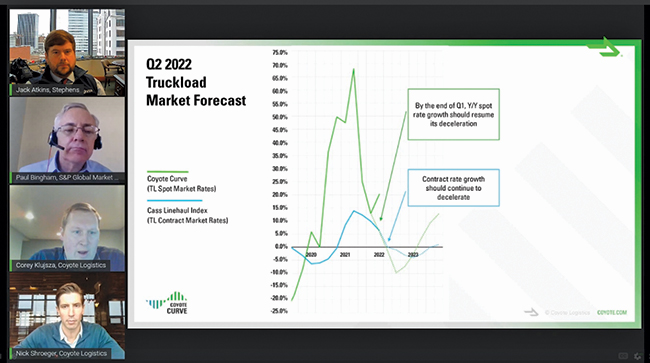

Coyote Logistics’ spot market data shows rates increased through much of the pandemic as freight capacity struggled to meet strong demand. Spot rates ended the year 14% above year-ago levels, but trailed the 50% year-over-year rise from the end of 2020.

Host Michael Freeze speaks with TMC Chairman Randy Obermeyer and Brenda Neville of the Iowa Motor Truck Association about how to recruit young drivers and technicians. Hear a snippet above, and get the full program by going to RoadSigns.TTNews.com.

“We’re all well aware that the spot market ended the year in 2021 at all-time highs,” said Corey Klujsza, vice president of procurement strategy at Coyote Logistics. Klujsza noted while the spot market is an inflationary market, it appears to have entered a disinflation period.

“We’ve seen tender rejection rates broadly across the market trend down over the course of four weeks,” Atkins said. “Which is indicating to us that capacity is beginning to come back into the market, or the balance of supply and demand is beginning to shift a little bit back towards equilibrium.”

Atkins added that while truckload carriers are having some success hiring drivers, they’re facing problems maintaining their trucks with the parts shortage. They’re also having trouble getting new tractors and trailers, a trend he believes could extend into next year.

“It will be interesting to see how the Russia and Ukraine war maybe plays into that to some degree,” Atkins said. “It does feel like we’re beginning to enter this period of deflation within the transportation sector and truckload market in general. We’re hearing that pretty consistently both from our public and private contacts.”

Coyote Logistics is a UPS Inc. company; UPS ranks No. 1 on the Transport Topics Top 100 list of the largest for-hire carriers in North America.

Want more news? Listen to today's daily briefing below or go here for more info: