Senior Reporter

Diesel Sheds 3.2¢ to $5.539 in Third Straight Decrease

[Stay on top of transportation news: Get TTNews in your inbox.]

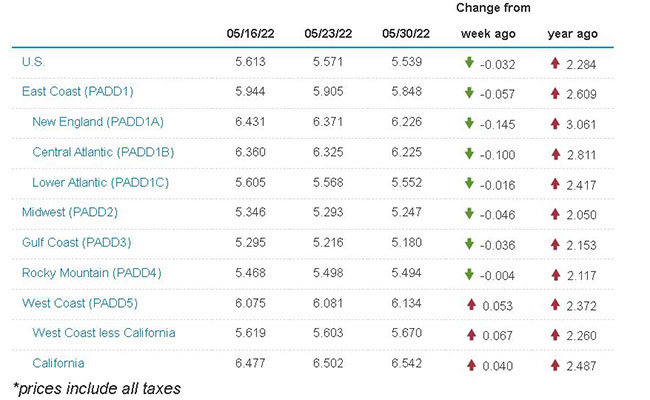

The national average price for diesel dropped 3.2 cents to $5.539 a gallon, according to Energy Information Administration data released May 30.

Trucking’s main fuel has shed 8.4 cents over three consecutive declines since an 11.3-cent spike May 9.

A gallon of diesel now costs $2.284 more than it did at this time in 2021.

Diesel’s price fell in seven of the 10 regions in EIA’s weekly survey.

New England and the Central Atlantic registered the biggest drops at 14.5 cents and 10 cents a gallon, respectively. The West Coast less California had the largest increase at 6.7 cents.

Gasoline moved in the opposite direction of diesel, rising an average of 3.1 cents to $4.624. A gallon now costs $1.597 more than it did at this time last year.

“Refinery profits [from gasoline] are still epic — rose nearly $7 bbl [42 gallon barrel] June 1 in the Northeast to $56.75 bbl. New normal is abnormal,” tweeted Tom Kloza, a fuel markets analyst and a founder of the Oil Price Information Service .

And the same day Kloza tweeted this: “Pop goes the diesel on CME (the former Chicago Mercantile Exchange) and physical markets. ULSD (ultra low-sulfur diesel) futures up 20.9cts gal and physical markets up 14-24cts gal across the country. The slippage in pump prices is over and we’ll see more $6 gal handles on the weekend. More freight surcharges ahead.”

Pop goes the diesel on CME and physical markets. ULSD futures up 20.9cts gal and physical markets up 14-24cts gal across the country. The slippage in pump prices is over and we'll see more $6 gal handles on the weekend. More freight surcharges ahead. — Tom Kloza (@TomKloza) June 1, 2022

EIA reported beginning June 13 it will conduct its On-Highway Diesel Fuel Price Survey using new statistical methodologies — some use EIA diesel prices to determine fuel surcharges.

“These changes include an updated sampling frame, new sampling and estimation methodologies, and a published history of standard errors for the prices from the new sample. The published geographical areas for retail diesel fuel prices will remain the same,” EIA reported.

Between June 9 and June 13, to gradually phase in prices from the new sample, it will revise prices that were published in some of the previous weeks.

American Trucking Associations noted some fleets have asked questions about how those revisions could impact fuel surcharges assessed in the past, if those revised weeks are recalculated at a lower rate than the pricing initially used.

If shippers raise such concerns, ATA said it recommends motor carriers consult their legal counsel for advice. “It’s our understanding that EIA will only be revising retroactively for a few weeks, and such revisions will be limited to this initial transition period.”

TravelCenters of America Inc. (TA) noted in its first-quarter earnings call there are many “primary” variables it takes into account in pricing fuel.

“The essence of it is buying at wholesale, we’re selling at retail, that’s where it starts, or discount to retail,” said CEO Jon Pertchik.

“Within that, we’re able to cancel loads. We can buy from certain places and not others, and there’s a whole lot of variables that go into those [decisions],” he said. “I don’t want to say exploiting, but taking advantage of, finding advantage in those regional differences as well as differences that change over time within a few days.”

He said TA expects to add more travel centers by the end of 2022, and is looking for potential opportunities to acquire other sites.

“We are particularly excited about the future impact that artificial intelligence and machine learning will have on diesel pricing, as well as our brand new small fleet program and its potential impact on both volume and fuel margin as we approach the back half of 2022,” Pertchik said.

Meanwhile, there are steps truckers can take now to increase fuel efficiency, another industry expert said.

“According to the U.S. Department of Energy, for every 1 PSI (pounds per square inch) drop in tire pressure, you lose 0.4% of your gas mileage. By keeping your tires properly inflated, you can improve gas mileage by more than 3%,” said Carson Krieg, head of last-mile industry solutions at Project44.

Another way to reduce costs is to use real-time visibility, he said. That allows carriers to track and reduce nonrevenue-generating miles as well as improve efficiency on the road.

“Also, minimizing driver dwell times at pickup and drop-off locations is a vital tactic to manage rising fuel costs. Providing distribution centers and manufacturing plants with more precise ETAs allow them to prepare receiving operations for a truck’s arrival,” Krieg said. “When a receiving company can plan ahead and schedule resources for unloading or loading, it leads to a faster turnaround at the dock and less fuel wasted.”

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Want more news? Listen to today's daily briefing below or go here for more info: