Staff Reporter

Diesel Tumbles 9.6¢ to $3.922 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

The national average price for a gallon of diesel tumbled 9.6 cents — its largest drop of the year — to reach $3.922, according to Energy Information Administration data released May 8.

The last time the average was below $4 a gallon was in the week ending Feb. 7, 2022, EIA data shows.

The current price marks diesel’s steepest drop since Dec. 19, when it shed 15.8 cents a gallon to settle at $4.596, compared with $4.754 a week earlier. Trucking’s main fuel saw a 9.5-cent drop Feb. 13, declining to $4.444 from $4.539.

A gallon of diesel on average now costs $1.701 less than it did at this time in 2022. The $1.70 per gallon decrease year-over-year equates to roughly $22,500 in savings a truck, Dave Csontos, senior vice president logistics at Transervice Logistics, told Transport Topics. Lake Success, N.Y.-based Transervice Logistics ranks No. 95 on the Transport Topics Top 100 list of the largest for-hire carriers in North America.

U.S. average on-highway #diesel fuel price on May 8, 2023 was $3.922/gal, DOWN 9.6¢/gallon from 5/01/23, DOWN $1.701/gallon from year ago #truckers #shippers #fuelprices https://t.co/lPvRNZFztg pic.twitter.com/XKYLDblKpo — EIA (@EIAgov) May 9, 2023

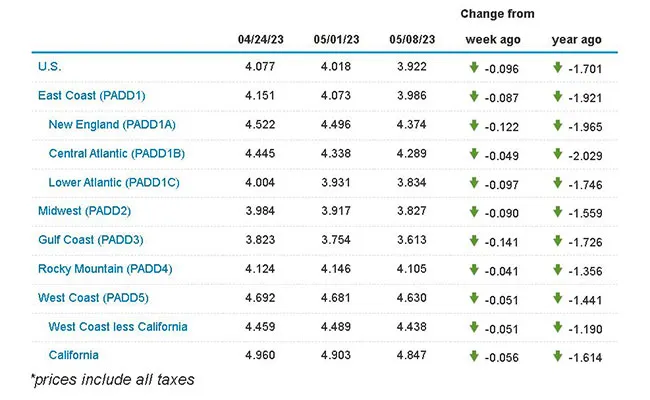

Diesel’s average price now is below $4 a gallon in four of the 10 regions in EIA’s weekly survey. The price fell in all regions, from a high of 14.1 cents in the Gulf Coast to a low of 4.1 cents in the Rocky Mountain region.

Further moves to the downside are expected, say analysts. Powerhouse Executive Vice President David Thompson said the outlook is massively bearish. GasBuddy Head of Petroleum Analysis Patrick De Haan said in an interview May 9 he expects the downtrend to continue, with at least 25 cents of more downside on the slate. If one looks at diesel consumption alone, it already looks like the U.S. is in a recession, he said.

Trucking executives are of a similar mind. Csontos said May 9 there is still likely to be more runway on the downside.

That’s even with U.S. stocks of distillates — which includes diesel — down 12% compared with the five-year average, said De Haan, but he noted they are up 5% compared with the same point in 2022.

Consumption is likely to soften, analysts say, with Wood Mackenzie Vice President of Refining, Chemicals & Oil Markets Alan Gelder telling Transport Topics the research group’s demand expectations had weakened since the start of 2023. U.S. growth will not be particularly strong in 2023, he said, adding that any growth would be service industry-led, tamping down any diesel demand benefit.

The question for the energy complex is whether the general economic cooling or geopolitical factors will win out, Csontos said. Over the last year, there has been a vicious circle related to cost increases, which impacts all consumers, said Leonard’s Express CEO Ken Johnson. Prices on everything but fuel are up, he said. A healthy consumer is good for the trucking industry, he added. Leonard’s Express is No. 88 in the TT 100 for-hire carrier rankings.

Refiners including Marathon and Valero are reporting a variety of viewpoints when it comes to diesel demand. S&P Global Commodity Insights Vice President, Americas Head of Refining and Marketing Debnil Chowdhury said regional focuses are one reason behind that, with booming oil and natural gas production in Texas boosting consumption, while storms and import decreases hurt California demand.

U.S. average price for regular-grade #gasoline on May 8, 2023 was $3.533/gal, DOWN 6.7¢/gallon from 5/01/23, DOWN 79.5¢ from year ago #gasprices https://t.co/jZphFa0hDF pic.twitter.com/ElV60hUY0c — EIA (@EIAgov) May 9, 2023

Globally, the picture is no brighter. Powerhouse’s Thompson said recent Chinese data had come in weaker than expected. A big part of the bulls’ case in energy had been for stronger data from China and the expectations of better growth prospects there.

One bright note, Rystad Energy Senior Downstream Analyst Janiv Shah said in an interview, is that crude prices have upside potential at the moment after finding a bottom, which for front-month NYMEX West Texas Intermediate is in the low $70s a barrel.

Refiners, meanwhile, are shifting their focus to gasoline rather than diesel due to low inventories, Chowdhury said, adding that further forward, diesel may also remain more in the background due to jet fuel claiming producers’ attention. How this will play out for diesel inventories will be worth keeping an eye on, he said.

On-highway U.S. gasoline fell 6.7 cents a gallon on average to $3.533. That marks a 79.5-cent decline from this time a year ago.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Want more news? Listen to today's daily briefing below or go here for more info: