Consumer Spending Misses Forecasts as Inflation Eases

U.S. consumer spending in January was short of projections while inflation eased, an early read on the economy in the first quarter that may add to concerns about the outlook.

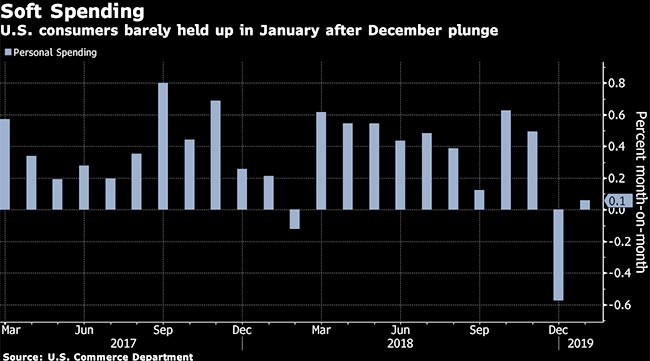

Purchases, which account for about 70% of the economy, rose 0.1% from the prior month after a downwardly revised 0.6% drop, according to a Commerce Department report March 29. Personal income rose 0.2% in February, also less than forecast.

The spending figures, which reflected weaker sales of new autos, signals first-quarter growth faces additional headwinds, though surveys show consumers remain generally upbeat despite projections for slower expansion. At the same time, tame inflation reinforces Fed projections for no interest-rate hikes this year.

The Fed’s preferred price gauge — tied to consumption — fell 0.1% in January from the previous month and was up 1.4% from a year earlier, matching the annual projection with the slowest reading since late 2016.

Excluding food and energy, so-called core prices rose 0.1%, less than estimated. The index was up 1.8% from January 2018, also below forecasts, after an upwardly revised 2% gain.

A report March 28 showed the expansion decelerated to a 2.2% pace in the fourth quarter, and economists surveyed by Bloomberg project 1.5% this quarter, the slowest in two years.

The spending data add to signs of weakness just ahead of the February retail sales report April 1. The update will be closely watched after December transactions plunged 1.6%, the most since 2009, before rebounding in January.

The median forecasts in Bloomberg survey called for spending to advance 0.3%in January and incomes to increase 0.3% in February.

The data did not include February figures on spending or PCE inflation because of delays related to the five-week shutdown that ended Jan. 25. The next report on April 29 will combine personal spending and PCE price data for February and March with income figures for March, according to the Commerce Department.

Adjusted for inflation, January spending on goods dropped 0.2% on a monthly basis while purchases of services increased, driven by financial services and insurance.

The saving rate fell to a still-elevated 7.5% in January from 7.7% the prior month.

#economy Personal income rose 0.2% in February, following a 0.1% decline in January. Personal spending increased 0.1% in January after a 0.6% decline in December. Consumer spending had a slow start to the quarter but should see some bounce back in coming months. — FTR (@FTRintel) March 29, 2019

The slower-than-forecast core inflation gives Fed officials time to wait for signs of a pickup before considering resuming their hikes. Chairman Jerome Powell said this month rates could be on hold for “some time” as inflation remains muted and global risks cloud the outlook.

While the central bank targets 2% inflation including all items, it looks to the core gauge as a better indicator of underlying price trends.

The Fed noted in its last policy statement that overall inflation has declined “largely as a result of lower energy prices.”

Minneapolis Fed President Neel Kashkari said March 29 that he expects economic growth in 2019 and 2020, though it’s always possible there will be a recession. Wage growth is ticking up but isn’t fueling higher inflation, he said in a Fox Business Network interview, adding that it’s “way too soon” to make judgment on rate moves next year.