Senior Reporter

Class 8 Sales Weaken in November

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. Class 8 retail sales in November were 16,539, or 7.1% lower compared with a year earlier, as results were mixed among the truck makers, WardsAuto.com reported.

It was the year’s second-lowest volume, trailing all but February’s 15,369, according to Wards.

Sales were 17,803 a year earlier.

Tam

“My overarching comment is sales is the tail of the dog when it comes to value creation chain,” said Steve Tam, vice president of ACT Research. “If we look back at production, in October it was a soft month. The year-over-year sales drop is just the way we rocketed out of the pandemic last year.”

Don Ake, FTR vice president of commercial vehicles, agreed.

Ake

“So retail sales aren’t moving because production isn’t moving,” he said. “Inventory has been flat for four months; it’s stagnated.”

Investment firm Cowen Inc. reported the driver shortage has led to unseated truck counts rising two to three times more year-over-year.

“In other words, even if carriers could get their hands on new tractors, it is even more difficult to find a driver to fill the seat. These factors lead us to forecast a likelihood of an elongated trucking cycle with a strong rate environment,” the company wrote in a recent report.

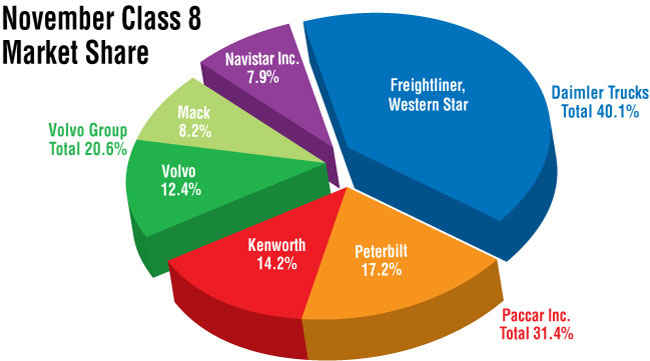

In November, only four truck makers posted higher sales compared with the 2020 period, and two of those were slim gains.

Leading the way were Volvo Trucks North America and Mack Trucks, both units of Volvo Group.

VTNA notched sales of 2,048 for a leading 43.2% gain, good for a 12.4% share.

Koeck

“The industry continues to see supply chain constraints as well as labor shortages, and we believe this will continue well into 2022,” VTNA Vice President of Strategy Magnus Koeck told Transport Topics. “It will take several months before the industry will see significant improvements in the monthly market numbers as the demand will continue to outpace the supply.”

He added that the company was pleased with its November numbers.

“We are now coming back strong after the challenges [a strike at its assembly plant in Virginia] we had this past summer,” Koeck said.

Mack saw sales climb 28.3% to 1,356 and an 8.2% share.

Randall

“Economic recovery, including increased consumer spending, contributed to the year-over-year improvement for Mack Trucks, while more and more operators realize the benefits associated with running our trucks, leading to increased share,” said Jonathan Randall, senior vice president of sales at Mack. “We will continue delivering as many trucks as possible as we navigate ongoing supply chain constraints.”

Peterbilt Motors Co., a Paccar Inc. brand, increased sales 6.1% to 2,842 — the second-highest total for the month and good for a 17.2% share, also the second highest.

Daimler Trucks North America remained the market leader.

Its Freightliner brand posted a 20.4% decline in sales to 6,134 compared with a year earlier and earned a 37.1% share.

DTNA’s Western Star brand saw sales rise 2.2% to 503, good for a 3% share.

Paccar’s Kenworth Truck Co. brand posted a decline in sales of 9.5% to 2,342 for a 14.2% share.

International, a brand of Traton Group’s Navistar unit, saw sales fall 28.9% to 1,314 in the steepest decline. It earned a 7.9% share.

Results were stronger for the 11-month period; all truck makers increased sales compared with the 2020 period.

Sales rose 15.7% to 197,224 compared with 170,498 a year ago.

Mack led the way with a 28% year-to-date increase to 15,742 sales, which lifted its 11-month share to 8% from 7.2% in 2020.

Other truck makers either declined or did not respond to a request for comment.

Looking to future sales, Sysco Corp. announced it will electrify 35% of the company’s U.S. tractor fleet by 2030, equivalent to adding nearly 2,500 electric trucks to its fleet.

Sysco Corp. ranks No. 2 on the Transport Topics Top 100 list of the largest private carriers in North America.

Host Mike Freeze talks to the 2021 Transport Topics Trucking's Frontline Heroes, Gene Woolsey and Cully Frisard. Hear a snippet above, and get the full program by going to RoadSigns.TTNews.com.

In its latest corporate social responsibility report, Sysco wrote, “We are gearing up to deploy our first group of EVs at our Riverside, Calif., operating site in FY2023 as part of our commitment to replace diesel vehicles with various zero-emission vehicles.”

For Sysco, fiscal 2023 runs July 2022 to June 2023.

Sysco also completed a successful pilot with Freightliner, a brand of DTNA, earlier this year. It previously placed a deposit for 50 electric trucks with Tesla.

“Sysco presents an interesting use case for electrification in the heavy-duty market because they’re pulling a 28-foot refrigerated trailer, primarily for maneuverability purposes,” Tam said.

“Weight for them is not so much of a concern, and they don’t need huge batteries because they aren’t traveling over the road. Plus, they have return-to-base charging,” he said. “Clean fuel [and the subsequent elimination of particulate matter] for trucks in food service, and bringing other consumer goods like that, is getting a lot of traction.”

Want more news? Listen to today's daily briefing below or go here for more info: