Staff Reporter

Class 8 Sales Drop for Third Straight Month During October

[Stay on top of transportation news: Get TTNews in your inbox.]

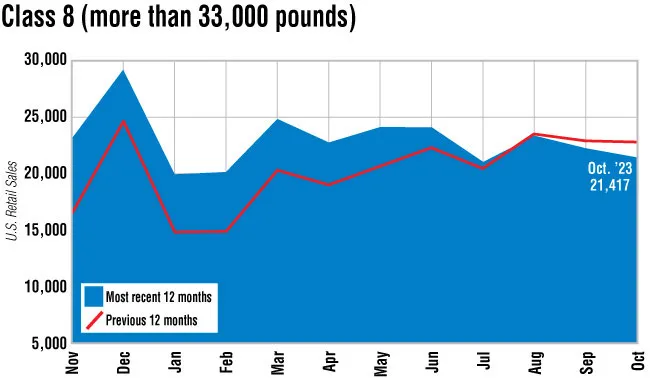

Class 8 retail sales in October declined from the year-ago period for a third consecutive month, Wards Intelligence data showed.

Sales declined 6.3% to 21,417 units from 22,863 in 2022 while also dropping 3.7% sequentially from 22,231 units sold in September.

Sales through the first 10 months of 2023 are up 10.7% to 223,751 from 202,088 at this time in 2022.

“We were a little bit disappointed,” said ACT Research Vice President Steve Tam. “We have yet another strong month of production in September and yet another soft month of sales in October. I’m scratching my head a little bit. We don’t seem to be keeping pace on the sales side, and I’m not really sure what the holdup is.”

Tam noted there should be a corresponding increase in inventory if sales are not keeping up with production, but he hasn’t seen that.

“Wards reported October sales came in above expectations by 3.5%,” FTR Chairman Eric Starks said. “This is a welcome sign that fleets are willing to take delivery of trucks at a slightly faster pace than forecasted. While it is above expectations, it generally is following the broader outlook for the equipment market.”

Starks warned sales exceeding expectations and inventories increasing will put downward pressure on production over the next six months.

“That information is a bit surprising to me, although I suppose the market segmentation shifts help support that data point,” said Kriete Truck Centers President David Kriete. “There is almost a 4% shift in purchasing from the longhaul segment YTD, and longhaul is by far the largest segment year-in and year-out. So, any drop in that area would have a significant impact.”

Kriete added that almost all other segments remain strong. But the ability to convert orders to sales has slowed since they require body upfitting.

“We continue to see a slowing market as contract and spot rates reflect the combination of nearly exhausted pent-up demand by large fleets, weak freight growth and multiyear low freight rates,” said Dan Clark, head of vehicle and equipment finance at BMO Commercial Bank. “I expect these conditions to endure throughout the first half of 2024.”

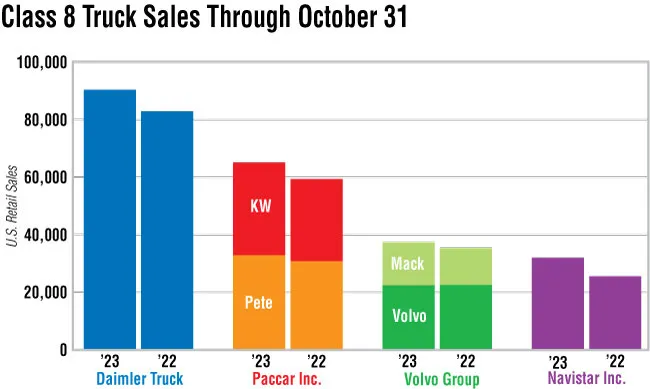

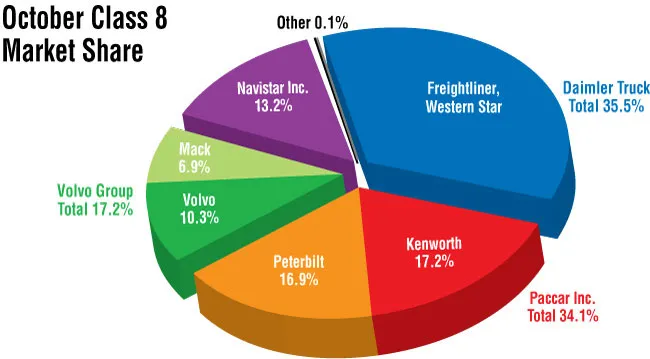

Wards found that sales declined year-over-year at three of the seven major truck makers. While Daimler Truck North America’s Freightliner brand claimed the largest market share at 31.1%, sales still declined 27% to 6,651 units from 9,056. Fellow DTNA brand Western Star posted the largest percentage increase with a 126% spike to 945 from 419.

“We can attribute the decline in retail sales to the soft freight market conditions that have persisted through 2023,” said Jonathan Randall, president of Mack Trucks North America. “Freight demand has declined from 2022 levels, and overcapacity among fleets has led to low freight pricing. As a result, some fleets have become more cautious about new and used truck purchases.”

Volvo Trucks North America’s sales declined 15.1% year-over-year to 2,212 units from 2,606, according to Wards. But Mack Trucks’ sales increased 10.6% to 1,469 from 1,328. Both are brands of Volvo Group.

“Typically, retails are lower in the first month of the quarter, which was the case for October,” said Magnus Koeck, vice president of strategy, marketing and brand management at VTNA. “We did expect the numbers to be a little stronger both in the U.S. and Canada, but this is an indicator that we are seeing the market slowdown now impact the retails.”

Koeck noted the largest fleets still have pent-up demand while smaller operations are being more restrictive due to the macroeconomic environment and tighter margins.

“When it comes to our own numbers, we declined in the U.S. during October and ended up at 10.3% for the month, but we recovered in Canada where we ended up at 11.3%,” Koeck said. “We still expect the market to be strong in 2024, but we will see a shift in the customer mix.”

Commercial Truck Trader can track buyer interest on its online marketplace by monitoring how actively people view listing specifics. It found new sleepers decline 8.3% in Vehicle Detail Page Views from the previous month, while new day cabs increased 22%.

“The overall commercial truck industry is rebounding,” said Charles Bowles, director strategic initiatives at Commercial Truck Trader. “There still exist some pockets of uncertainty, but the industry is adjusting to better inventory levels and more reasonable residual values.”

Over at Paccar Inc., Kenworth Truck Co.’s sales increased 21.6% to 3,682 from 3,028, while Peterbilt Motors Co. sales increased 6.7% to 3,612 from 3,384. Navistar’s International brand decreased 6.9% to 2,833 from 3,042.

“Access to credit was one factor in the reduction in Class 8 sales in October,” said Ann Brodette, senior vice president of sales for the eastern region at Mitsubishi HC Capital America. “Owner-operators are getting left behind or only approvable with significant amounts down and high interest rates. Our dealers are stating that traffic and application flow are down, and are not expected to increase in November and December. Usually, we see a spike in end-of-year sales.”

Want more news? Listen to today's daily briefing below or go here for more info: