Staff Reporter

May Class 8 Sales Up 16.4% Year-Over-Year

[Stay on top of transportation news: Get TTNews in your inbox.]

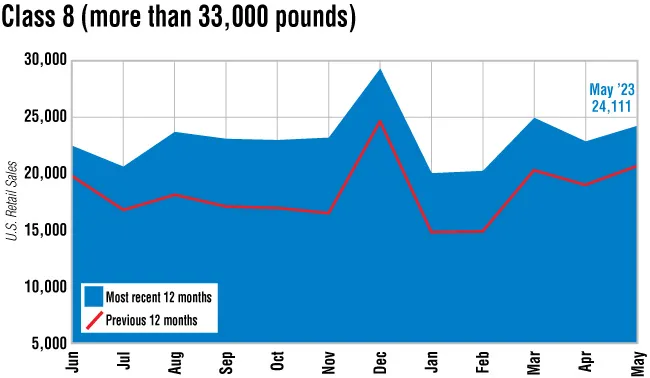

U.S. Class 8 retail sales in May rose 16.4% from a year ago and also saw a month-to-month gain, Wards Intelligence reported.

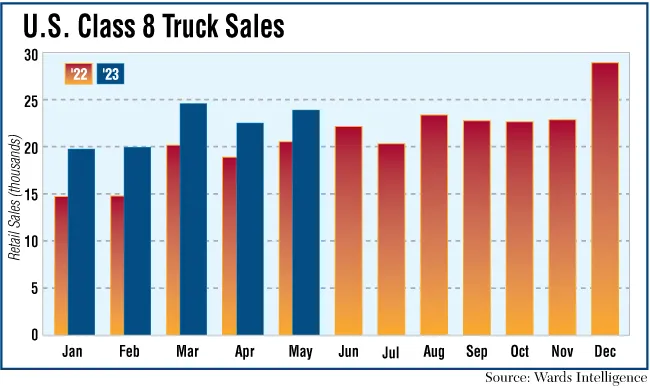

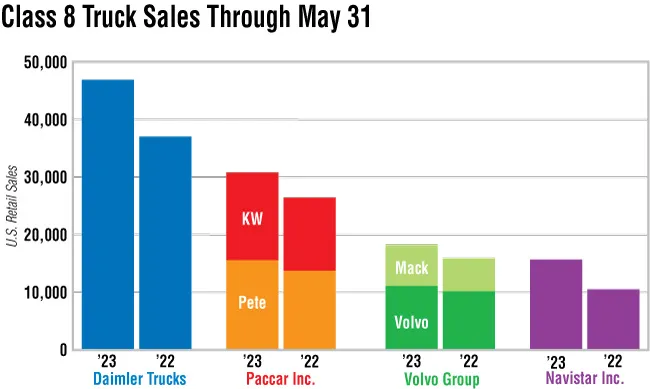

Class 8 sales for the month reached 24,111 units, up from 20,713 in May 2022 and up 6% from the 22,741 sold in April. Retail sales have experienced a year-over-year increase every month this year. Year-to-date, Class 8 sales are up 24.3% to 111,723, compared with 89,897 at this time in 2022.

“It’s encouraging to see a strong number like that,” said ACT Research Vice President Steve Tam. “The fact that we’ve had some luck, I guess, in increasing production rates and actually getting some units out there to be delivered to customers is certainly a positive, or an encouraging development in the industry after the year that we had last year.”

Tam is still concerned about the parts shortage, however. He noted that manufacturers typically run with 10 days of parts inventory, but he recently visited a plant that had fallen to two days. He also warned that truckers have started to exhibit a decreased appetite for equipment.

“What happened last year was there were supply chain issues, so the truck makers couldn’t produce enough trucks,” said Chris Brady, principal for Commercial Motor Vehicle Consulting. He noted that those constraints led fleets to extend the trade cycles of some of their trucks, resulting in pent-up demand this year. He cautioned that current demand levels likely aren’t sustainable as monthly numbers are well above normal seasonally adjusted annual rates. “I think what’s driving it is pent-up replacement demand,” he said.

“We’re seeing inventory on the new side up significantly over this period last year,” added Charles Bowles, director of strategic initiatives for Commercial Truck Trader. “That’s what we would expect to see, but it hasn’t quite rebounded to pre-pandemic levels. It’s still short of that, but it’s significantly higher from 2022 and 2021.”

Bowles noted that issues remain when it comes to getting equipment. That is particularly true for owner-operators, as manufacturers are generally prioritizing large orders.

“Year-to-date retail sales through May are running well ahead of full-year expectations, but we expect the pace will slow through the remainder of the year,” said Dan Clark, head of vehicle and equipment finance at BMO Commercial Bank. “We continue to see the larger fleets catching up on a COVID-induced, elongated refresh cycle, or continuing their normal trade cycle. Smaller fleets are being more conservative.”

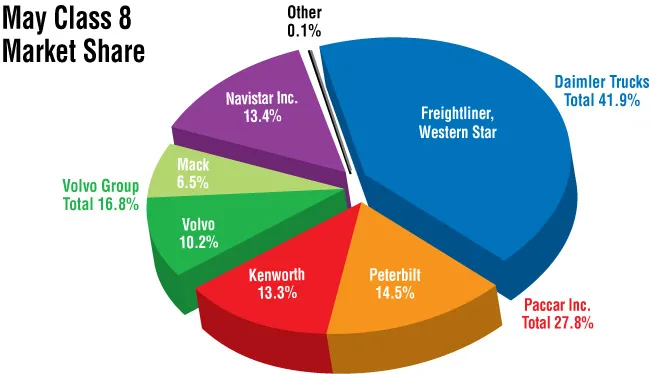

Freightliner, a brand of Daimler Truck North America, claimed the largest market share with 9,368 trucks sold, accounting for 38.9% of all sales for the month. Western Star, also a Daimler brand, experienced the largest year-over-year increase in sales with a 44.2% gain to 737 units from 511 a year ago.

“Sales of Freightliner and Western Star trucks continue to be very strong, driven by robust market demand and an improving supply chain for necessary components,” said David Carson, senior vice president of sales and marketing at DTNA. “We remain laser-focused on ensuring the timely supply of trucks and providing leading service and support.”

Wards data showed that six of the seven major truck brands posted an annual gain for the month. Kenworth Truck Co.’s sales increased 14.2% year-over-year to 3,200 from 2,803 while Peterbilt Motors Co. saw sales rise 3.7% to 3,501 from 3,375. Both are brands of Paccar Inc.

“May’s preliminary sales number for [heavy-duty] trucks indicate that sales in the segment grew 16% over the same time frame in 2022,” said Jonathan Randall, vice president of North America at Mack. “Mack’s sales growth rate of 20% YTD continues to outpace the HD market as a whole, and we are regaining market share. Orders remain strong despite some market headwinds and we foresee consistent sales for the remainder of the year.”

Mack Trucks’ sales increased 14.6% to 1,572 from 1,372, but Volvo Trucks North America’s sales slipped 2.9% year-over-year to 2,471 from 2,546, according to Wards. Mack and VTNA are brands of Volvo Group.

“The market in May was a little stronger than expected and we’re now pacing towards a 300,000-market in U.S. and Canada for 2023,” said Magnus Koeck, vice president of strategy, marketing and brand management at VTNA. “We’ve seen improvements in the supply chain but we’re still facing some challenges. Year-to-date we are not where we want to be, but we remain focused to finish strong in June and get back on track for the second half of the year.”

Navistar, the parent of International Trucks, experienced a 15.5% increase in sales to 3,232 from 2,799.

One analyst foresees a stable market in the months ahead.

“With fuel prices dropping and hopefully spot rates bottoming out, we are hopeful sales will remain steady as we move into the summer months,” observed Ann Brodette, senior vice president of sales for the eastern region at Mitsubishi HC Capital America.

Want more news? Listen to today's daily briefing below or go here for more info: