Staff Reporter

April Class 8 Sales Up 19.4% Year-Over-Year

[Stay on top of transportation news: Get TTNews in your inbox.]

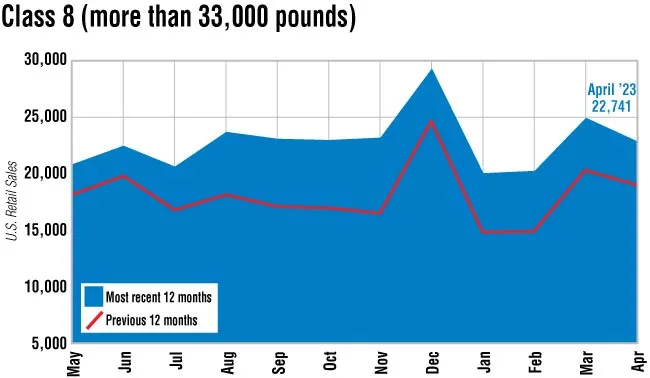

U.S. Class 8 retail sales in April increased 19.4% from a year ago but declined on a month-to-month basis, Wards Intelligence reported.

Class 8 sales for the month reached 22,741 units, up from 19,052 in April 2022 but down 8.4% from the 24,823 sold in March. Truck retail sales have experienced a year-over-year increase every month this year.

“We continue to see a little bit stronger sales than our full-year forecast would suggest,” ACT Research Vice President Steve Tam said. “The difference is, if you look at the trajectory of our forecast you can’t just take one month’s worth of data and seasonally adjust it to an annual rate because we’re expecting the second half of the year to fall off.”

Tam noted that when the data is seasonally adjusted it comes out at almost 285,000 units for the year, compared with a forecast of 260,000 units. But the numbers could end up falling more in line with expectations if sales do drop later.

“The sequential decline to me is not that big of a deal,” Tam said. “You had a couple extra days in March. So, on a per-day basis, sales were actually higher in April than they were in March. So that’s the biggest reason for that decline.”

Tam noted the bottom line is that truck sales have had a good couple of months as manufacturers make progress on supply chain issues. He has doubts over how much progress is actually being made but noted the latest sales figures show they can sell what they’re able to build.

“This came right in line with our basic expectations,” FTR Chairman Eric Starks said. “We definitely expected it to ease back from March. March had a little bit of additional things happening in there. Into February they started being able to get their red tag units out. Those units that were sitting with just a component or two waiting. Those started to be filled so they showed up in the March data.”

Starks doesn’t anticipate any noticeable slowdown in the sales environment for the next several quarters. Even indications that demand for trucks could be slowing won’t change that given how much it has outpaced production because of supply chain issues.

“At the dealership, demand was so high that they could not fulfill that at all,” Starks said. “That demand has eased back a little bit. And so, you’re starting to create more to an equilibrium where you are matching more closely to the demand level.”

Starks noted dealerships could see demand moderate going into the summer. But he doesn’t expect that to impact overall sales numbers. He noted demand is likely to remain strong among the larger fleets and they tend to order trucks directly from the original equipment manufacturers.

“The robust unit sales during April continue the well-above replacement pace over the past year and confirm that OEMs have made significant progress with their supply chains,” said Dan Clark, head of vehicle and equipment finance at BMO Commercial Bank. “From a demand standpoint, the pace shows that plenty of carriers have kept their appetite for refreshing their fleets, which in most cases, are behind schedule. That said, the market is in for a bumpy summer as new orders have fallen significantly over the past few months.”

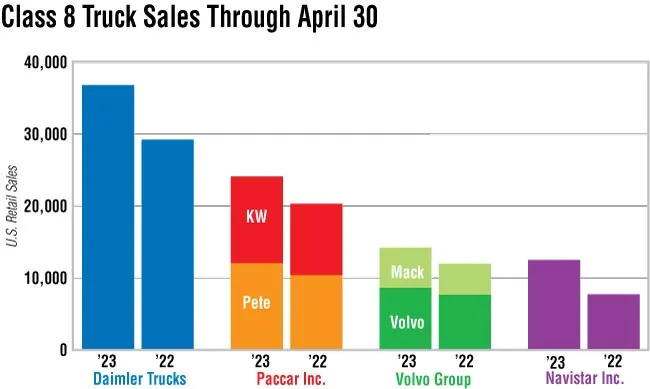

Freightliner, a brand of Daimler Truck North America, once again led sales with 8,580 trucks moved, good for a 37.7% market share. Navistar notched the largest year-over-year increase, as sales of its International brand trucks jumped 59.4% to 3,046 units from 1,911 last year.

Six of the seven major truck manufacturers posted gains over the prior year. Kenworth Truck Co.’s sales increased 23.3% to 3,191 from 2,588, while Peterbilt Motors Co. sales grew 4.6% to 3,318 from 3,173. Both are brands of Paccar Inc.

Want more news? Listen to today's daily briefing above or go here for more info

“The market in April came in as expected, and our performance in the U.S. was stronger than in the previous month,” Magnus Koeck, vice president of strategy, marketing and brand management at Volvo Trucks North America, said. “We’ve seen improvements in the supply chain but we’re still facing some challenges. Year-to-date we are not where we want to be, but we’ll continue to focus on posting a strong second quarter to get back on track.”

Mack Trucks’ sales grew 6.1% to 1,536 from 1,448, and Volvo Trucks North America’s increased 5.1% year-over-year to 2,549 from 2,425. Mack and VTNA are brands of Volvo Group. Western Star, a Daimler brand, saw a 26.7% decrease in sales to 491 from 670.

“Preliminary HD sales numbers in April show a 25.4% improvement YTD over the same period in 2022,” Mack Trucks North America President Jonathan Randall said. “We saw our overall market share improve and our YTD sales continues to be higher than the market’s growth rate. We remain confident in the level of demand we are seeing from our customers.”

In addition, Tesla sold 30 of its Class 8 Semi electric trucks.