Senior Reporter

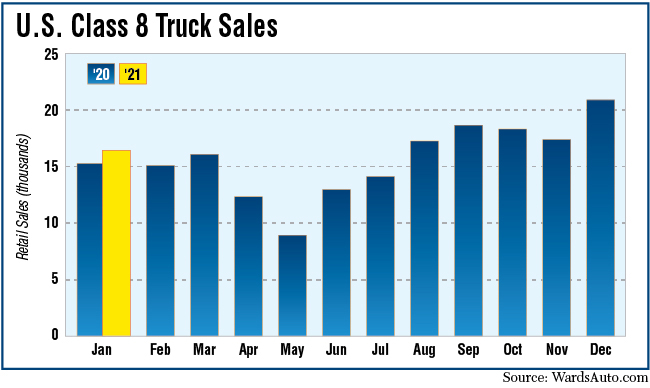

Class 8 Retail Sales Rise 7.7% in January

[Stay on top of transportation news: Get TTNews in your inbox.]

Class 8 U.S. retail sales in January gained 7.7% compared with a year earlier, reaching 16,844 compared with 15,645 in 2020, WardsAuto.com reported.

Four truck makers posted improved sales, while three others had lower sales compared with the year-ago period.

January’s number was “a little lower than those from the last few months of 2020, but that is typical,” said Steve Tam, vice president at ACT Research.

He expects the industry’s monthly sales to increase as the year progresses. ACT forecast U.S. Class 8 retail sales for the full year would be about 250,000, or 30% more than the 2020 total of 191,100.

Tam also pointed to what some in the industry see as the increasing likelihood of interruptions in truck production, like automakers already have experienced, from the ripple effect of the fire that destroyed a key Asian microchip manufacturing plant in November.

“We still haven’t seen production shut down anywhere because of material shortages. But I think the likelihood is increasing that we will see that put a wrinkle in the industry. The hand-wringing seems to be intensifying a little bit,” Tam said.

About 145,000 North American Class 8 orders have poured in since November.

He added: “Right now, I think we are living off of parts-and-pieces inventory.”

Likewise, Don Ake, vice president of commercial vehicles at FTR, said he expected “retail sales to show significant improvement in February” then keep rising into the second half of the year.

Daimler Trucks North America got its year off to a strong start, surging into the lead with a combined 45.7% market share for its two heavy-duty brands, Freightliner and Western Star.

Freightliner sold 7,285 trucks, good for a leading 43.2% share. Its January sales rose a leading 20.2% compared with a year earlier.

Germany-based Daimler Truck recently announced it would spin off from parent company Daimler AG to become a separate publicly traded company called Daimler Truck AG.

In an exclusive interview with Transport Topics on Feb. 5, Daimler Truck CEO Martin Daum said the realignment would mean truck customers in the United States would find the independent company focused on becoming faster to market and even more successful.

Western Star 49X Logger. (Daimler Trucks North America)

“I would say in North America, we always invested a huge amount of money there,” Daum said. “We have a great product lineup. With the launch of our new Western Star 49X truck introduced last fall, we have proven we can have industry-leading technology in the heavy-duty vocational segment, as well. Where I would like to speed up things is on the CO2 emissions [reduction] powertrain,” for Freightliner’s eCascadia and eM2 battery-electric vehicles, he said.

“We have to reduce emissions,” he added. “But I mean, if the times are changing, everyone involved needs to adapt and invest or the winds of the times pass by them.”

Volvo Trucks North America had the next-highest year-over-year increase at 18.9%, and sold 1,746 trucks, good for a 10.4% share.

Mack was next, climbing 10.7% on sales of 1,082 trucks. That was good for a 6.4% share.

VTNA and Mack are brands of Volvo Group.

Peterbilt 579 (Peterbilt Motors Co.)

Peterbilt Motors Co., a brand of Paccar Inc., increased sales 3.1% to 2,753, and earned a 16.3% share with the month’s second-highest sales total.

Peterbilt in February announced a redesigned 579 model to replace the current version launched in 2012.

Peterbilt General Manager Jason Skoog told TT the 2012 version of the 579 opened new doors for the truck maker, brought in new customers, especially fleets, and boosted its market share.

“My expectation for our market share, as I look in the 2020s, is we plan to grow it by continuing to sell in segments we are very strong in like vocational and traditional, and then transition all of our existing 579 customers into this new truck,” Skoog said. “They are going to see a 7% gain in fuel economy compared with the current version of the 579, more driver comforts and amenities and new technology like a digital dash — and that is going to open more doors than even the current 579 did.”

The new model is scheduled to begin production in April and hit full production in July.

As for any supply chain disruptions, Skoog said the industry is adept at recovering from them. “But they tend to come up quickly.”

Meanwhile, the remaining truck brands posted sales declines.

International, a brand of Navistar Inc., saw sales fall the most compared with a year earlier, tumbling 12.8% to 1,691, which was good for a 10% share of the market.

Kenworth Truck Co., also a Paccar brand, saw sales fall 10.1% compared with a year earlier, to 1,868, and earned an 11.1% share.

Kenworth was scheduled to unveil the next generation of its T680 truck as TT went to press.

Western Star saw sales fall 5.2% to 418 trucks, good for a 2.5% share.

Want more news? Listen to today's daily briefing below or go here for more info: