Central States Woes Continue, Pension Value Falls $500 Million

This story appears in the Nov. 7 print edition of Transport Topics.

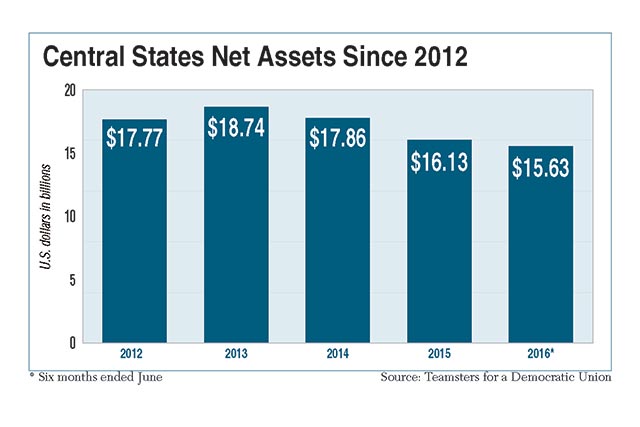

Central States Pension Fund lost $500 million during the first six months of this year, according to newly released financial documents, and continues to hemorrhage assets on the road towards eventual insolvency.

The total assets for the pension fund were $15.6 billion as of June 30, or 3% lower than Jan. 1 and nearly 10% down from June 2015.

Central States Pension Fund trustees project $754 million in contributions and withdrawal payments at the end of this year, but the fund will pay out $2.8 billion in benefits, according to internal financial documents obtained by the Teamsters for a Democratic Union. Withdrawal payments refer to the sum that an employer can pay the pension fund to leave altogether.

“The primary cause for Central States’ net asset loss in the first and second quarters of 2016 — and for its projected insolvency — is the imbalance between the number of active participants and the number of beneficiaries,” said Thomas Nyhan, executive director of the pension fund.

As of May 2016, there are 59,234 active participants versus 204,115 retirees, he said.

“The downward pressure on the fund’s assets is largely due to the fund’s current annual operating deficit of more than $2 billion per year — meaning that in recent years the fund has paid out more than $2 billion more each year in benefits than it has collected in contributions from employers,” said David Coar, who under a settlement agreement in a past case reviews the Central States Pension Fund for the U.S. District Court in Chicago.

To cover the annual benefits, the pension fund would have to generate $2 billion in profits from the $15.6 billion in total assets, or a 13% rate of return. Central States only generated 2.2% in profits during the second quarter, according to Coar. The median yearly return is about 7% to 7.5%, or about $1 billion for the pension fund, according to the Wilshire Trust Universe Comparison Service, a database that tracks performances.

“There’s not a citizen on Earth who can expect to make a 13% annual return. It’s like saying you expect your child to grow up to be 12 feet tall,” said Ken Paff, spokesman for Teamsters for a Democratic Union in Detroit.

Nyhan added that Central States can’t invest its way out of this problem. He added that without any intervention, the pension fund will slowly diminish each quarter until it becomes insolvent in less than 10 years. When the U.S. Department of Treasury rejected a plan from Central States to cut benefits in May, it left fund managers without any recourse.

“Unless Congress comes up with a different set of recommendations, or writes a check, which they’ve been unwilling to do, there are no options right now,” said Randy DeFrehn, executive director at the National Coordinating Committee for Multiemployer Plans.

“Reports like this that show the continued decline of the Central States Pension Fund should serve as a wake-up call that Congress needs to develop a real solution to this problem — one that doesn’t involve retiree pension cuts,” added Joellen Leavelle, spokeswoman for the Pension Rights Center.

YRC Worldwide and ArcBest’s ABF Freight unit, as well as some car haulers, still participate in the Fund. YRC and ArcBest rank Nos. 5 and 12, respectively, on theTransport Topics Top 100 list of the largest U.S. and Canadian for-hire carriers.

Coar wrote about another issue that could affect the pension. Kroger, the supermarket chain in 35 states, wants to pay a withdrawal penalty to leave Central States. Doris Campbell and other former Kroger employees sued the pension fund in April concerning the plans to leave.

“The Pension Fund’s staff reports that the action is being controlled and funded by Kroger pursuant to an agreement with the International Brotherhood of Teamsters [or its affiliates] in an effort to gain leverage in negotiations with the fund,” Coar said.

If Kroger left the fund, Central States would receive the withdrawal penalty rather than regular annual payments, but would still be responsible to pay benefits to vested retirees.

“Anytime that a pension fund is in a position where some of the major contributing employers are no longer available to make regular payments, it’s going to have an impact,” DeFrehn said.

Nyhan added, “The decision as to whether Kroger withdraws from the fund is decided at the bargaining table between Kroger and the International Brotherhood of Teamsters. The fund is not a party to the negotiations. The fund’s only involvement would be the assessment and collection of Kroger’s withdrawal liability should they in fact withdraw.”

The Kroger Co., the parent company of the supermarket chain, ranks No. 21 on the Transport Topics Top 100 list of the largest private carriers in North America, with more than 1,500 tractors and 5,800 trailers.