Staff Reporter

August Class 8 Sales Down 1%

[Stay on top of transportation news: Get TTNews in your inbox.]

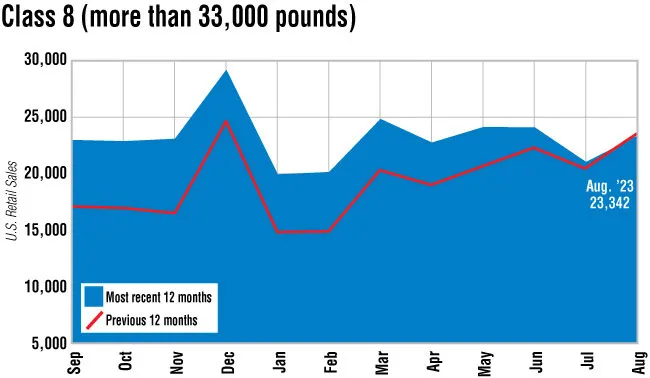

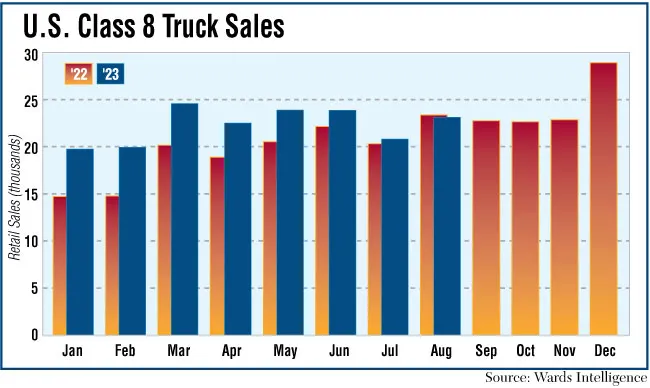

U.S. Class 8 retail sales in August stayed about the same from the year-ago period but increased from the prior month, Wards Intelligence reported.

Sales declined 1% to 23,342 units from 23,581 in 2022, but rose sequentially from 21,021 sold in July. It marked the first year-over-year drop this year. Year-to-date, Class 8 sales are up 15.2% to 180,106 units, compared with 156,275 at this time in 2022.

“The biggest thing with respect to the year-over-year decline is that August of last year was anomalously strong,” said Steve Tam, vice president at ACT Research. “We are expecting sales to continue to show improvement on a year-over-year basis throughout the remainder of this year. It goes back to some of the fundamentals that we’ve talked about. Even though the freight markets are a little bit squishy, they do seem to be firming up.”

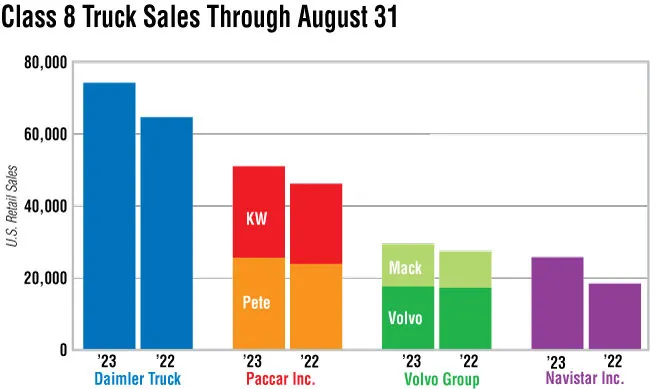

Wards found that five of the seven major truck makers saw sales rise year-over-year. Daimler Truck North America’s Freightliner brand took the largest market share with 8,158 trucks sold, accounting for 34.9% of all sales, compared with 9,783 last year. Western Star, another DTNA brand, reported that sales increased 19.5% to 722 from 604.

“The OEs have said that they don’t have any expectation that they’ll slow production,” said FTR Chairman Eric Starks. “They’re looking at starting to open up order books for the first quarter so we’ll see what that looks like. But our expectation is that we will start to see just a little bit of easing in the first quarter because you start to get back to more normalized levels. A lot of that pent-up demand will have been satisfied by the end of the year.”

Kenworth Truck Co.’s sales increased 11.5% to 3,689 units from 3,310, while Peterbilt Motors Co. saw sales rise 4.9% to 3,458 from 3,298. Both are brands of Paccar Inc. Navistar’s International brand posted the largest percentage increase in sales with a 30.5% jump to 3,587 units from 2,749.

“Class 8 (and medium-duty) truck sales for August remain strong,” David Kriete, president of Kriete Truck Centers, said in a statement. “I anticipate consistent, predictable sales through year-end. Low used truck values, ‘high’ interest rates, and supply hiccups remain the drivers for any uncertainty in demand.”

Mack Trucks’ sales edged up 0.3% to 1,598 from 1,594, but Volvo Trucks North America’s sales declined 5% year-over-year to 2,130 from 2,243, according to Wards. Mack and VTNA are brands of Volvo Group.

“The August Industry orders as per Wards came in at close to 16,400 units for U.S. and Canada, which is 4,000 less than in August 2022,” said Magnus Koeck, vice president of strategy, marketing and brand management at VTNA. “I believe there are two major reasons for this.”

Koeck first pointed out that manufacturers are still not fully opened for orders next year. He also noted that the market has been softening, which could cause some hesitation among smaller carriers.

“However, we still see an appetite for the larger fleets as their pent-up demand is still there,” Koeck said. “The next three months order statistics will be crucial for next year’s retails, and we will then get a strong indication of the total market in 2024. We will see an uptick of orders, but the question is: How big will that uptick be?”

Chris Brady, principal for Commercial Motor Vehicle Consulting, noted that the sales pace is unsustainable medium-term because it’s not supported by the freight environment. But he does expect carriers to continue their current truck investment spending plans for now.

“It’s not like there’s been a large cancellation where you’re going to see a sudden drop in sales in the next few months,” Brady said. “Inventories in relationship to the sales pace is slightly over two months now so there’s inventories to support sales. Production is still pretty good, and the backlog was in good shape.”

Commercial Truck Trader is an online marketplace for commercial vehicles that is able to track interest based on how actively customers look into specific listings.

“August 2023 was nearly a mirrored version of July,” Charles Bowles, director of strategic initiatives at CTT, said in a statement. “Class 8 buyer interest as expressed in Vehicle Detail Page views [clicking on a specific vehicle in search results in order to obtain detailed information regarding that vehicle] remained mostly flat for sleepers, day cabs and vocational units from July to August.”

Bowles added available truck inventories remain scarce since most units have already been ordered in advance instead of going to dealer lots.

“August proved to be a better than anticipated month,” said Ann Brodette, senior vice president of sales for the eastern region at Mitsubishi HC Capital America. “Yes, units were down 9% year-over-year, but this was the highest month in terms of net orders since February 2023. Plus, it was the third consecutive month of orders being upwards of 20,000.”

Want more news? Listen to today's daily briefing below or go here for more info: