Amazon Scraps Planned Merchant Fee

[Stay on top of transportation news: Get TTNews in your inbox.]

Amazon.com Inc. is scrapping a planned fee on merchants that don’t use its shipping services, according to documents reviewed by Bloomberg.

The abrupt reversal suggests the company is being more cautious about how much money it tries to extract from online sellers amid an escalating antitrust investigation.

Amazon announced the 2% fee on merchants in August, and it was set to take effect on Oct. 1. The levy was interpreted by Amazon merchants and consultants as a brazen move since the U.S. government is poised to file an antitrust lawsuit against the e-commerce giant. The federal case is expected to focus in part on Amazon’s alleged efforts to coerce merchants into using its logistics services.

Amazon didn’t immediately comment on the fee reversal.

Amazon has been accused of having too much power over the some 2 million merchants who use its platform, which captures almost 38% of all U.S. online spending, according to Insider Intelligence. The Federal Trade Commission is expected to file an antitrust case against Amazon this month.

The fee would have applied to thousands of third-party merchants who ship products via Amazon’s Seller Fulfilled Prime program, which guarantees speedy delivery even though the company isn’t handling shipping itself. The levy would have been added to the commission — usually 15% — that merchants already pay Amazon to sell products on the popular web store.

Amazon didn’t explain to merchants why the fee was needed when it was announced in August. The company told Bloomberg the fee would help cover the costs of running a separate infrastructure and measuring its effectiveness. Amazon this week began notifying merchant partners the proposed fee was being canceled, attributing the decision to merchant feedback, according to the documents.

Gragg Wilson of UPS won grand champion honors at the National Truck Driving Championships. Wilson takes us through the competition's course, successful driving practices and how to attract new drivers. Tune in above or by going to RoadSigns.ttnews.com.

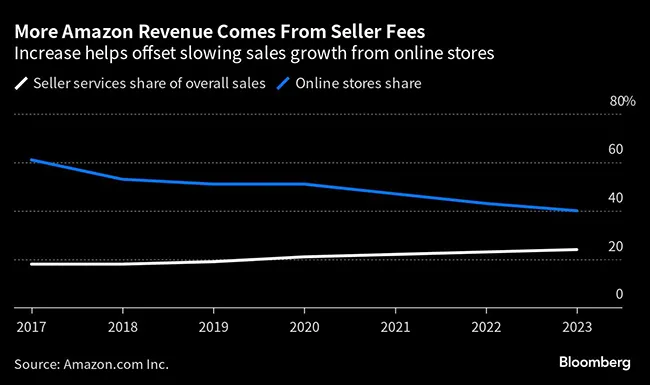

In recent years, Amazon has been ratcheting up fees on merchants, who typically pay for advertising and logistics to help maximize their sales. The business has become increasingly important to the company as sales growth in the core online operation slows. Seller services generated $32.3 billion in revenue in the second quarter, up 18% from the same period a year earlier and more than the profitable cloud services business. Last year, for the first time, seller fees began gobbling up about half the cost of each sale, making it harder for merchants to make a profit.

Amazon launched Seller Fulfilled Prime in 2015 as a way to expand inventory without overloading its fulfillment centers.

Amazon’s seller fees have been a focus of regulators and lawmakers since at least 2019, when a merchant accused Amazon of using its dominance in e-commerce to force sellers to use its logistics services. The allegation, since echoed by multiple sellers, has emerged as a focus of the FTC’s antitrust case against Amazon, according to people familiar with the situation.

Amazon.com Inc. ranks No. 9 on the Transport Topics Top 100 list of the largest private carriers in North America.

Want more news? Listen to today's daily briefing below or go here for more info: