Special to Transport Topics

Advances in Analytics Help Fleets Translate Information Into Action

[Find the latest in trucking technology: Explore this quarter's issue of iTECH]

Technology adoption in the trucking industry has given freight transportation companies access to an abundance of data. The question now is how best to use it.

In a business where onboard and back-office technologies such as electronic logging devices, trailer tracking and transportation management systems have become mainstream if not ubiquitous, the focus is shifting from gathering information to actively harnessing it in ways that truly improve business operations.

Technology vendors and trucking companies are increasingly prioritizing data utilization and quality over sheer quantity.

“The more data you have, the better. The problem is you have to use the data,” said Matt Cartwright, CEO and founder of software provider Magnus Technologies.

Vast amounts of data flow through modern fleets’ information technology systems, but the challenge lies in interpreting and finding the right uses for that information.

In addition to tracking their trailers, some fleets are now using sensors and video to monitor cargo status. (SkyBitz)

“Over time, you get bloated with this data and it gets more and more unwieldy, and then people aren’t using it,” Cartwright said. “The data has to be used before it is meaningful — it’s not meaningful by itself. A lot of carriers don’t have the tools to use it yet.”

That’s where data science enters the equation. Data analytics and business intelligence software can help fleet managers make better business decisions.

And that evolution has only begun.

“I think we’re just at the beginning of learning how to use this data to truly drive productivity,” said Siamak Azmoudeh, vice president of product life cycle management and business development at SkyBitz, a supplier of trailer and asset monitoring technology.

In the Cloud and at the Edge

Some older, legacy systems inefficiently parse data due to factors such as siloed operations and a reliance on on-premises databases and software rather than cloud-based technology. The move to cloud computing — or on-demand access to data storage and computing capabilities over a distributed network — has improved the efficiency and speed of data analytics.

Information gathering and processing is timelier now than it was even six years ago, said Jason Palmer, vice president of product operations and strategy at Solera.

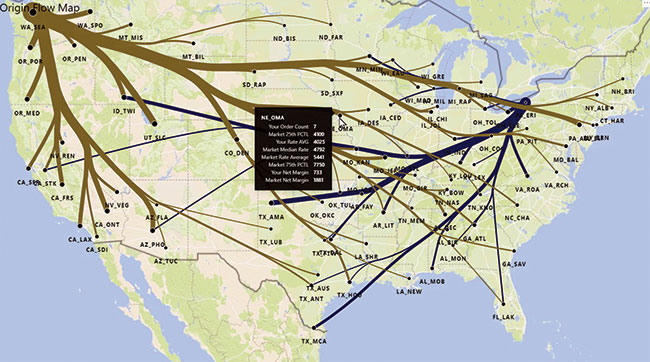

Market analysis tools such as McLeod’s MPact product can help carriers and brokers monitor rate trends and find ways to improve profitability. (McLeod Software)

At that time, “a lot of the processing and intelligence was being run in batches, once a day,” he said. “Now information is much more readily available and we’ve got real-time information … and the system can make much more intelligent decisions.”

Solera is the parent of several fleet technology providers, including Omnitracs, SmartDrive and Spireon.

Edge computing — a distributed framework for processing data closer to where it’s generated — also is changing the analytics game. It saves bandwidth and reduces latency in information transfer, which is a boon for time-sensitive tasks, including routing, navigation and sending safety alerts.

Together, cloud and edge computing are pushing trucking technologies further and expanding their capabilities, Palmer said.

“We are doing a lot of processing on the edge so we can communicate back and forth to the truck … much more quickly,” he said. “Also, a lot of our partner [application programming interfaces] that we make available … are being shared on the edge so that, again, it gets to where it needs to be in milliseconds instead of having to go to a server somewhere.”

Progressing Toward Prescriptive Analytics

Data-driven trucking technologies first achieved descriptive analytics, which refers to analyzing historical data to understand a business’s past performance and establish performance metrics. The capability goes hand-in-hand with diagnostic analytics, or determining why something happened in the past.

Q3 iTECH

►Advances in Analytics Help Fleets Translate Information Into Action

►Connected Workflows Can Lead to a Higher Level of Operational Fitness

►Dysart: Personalizing Communications With Customer Data Platforms

►Clevenger: Mapping the Journey to Cloud Computing

Explore the Issue!

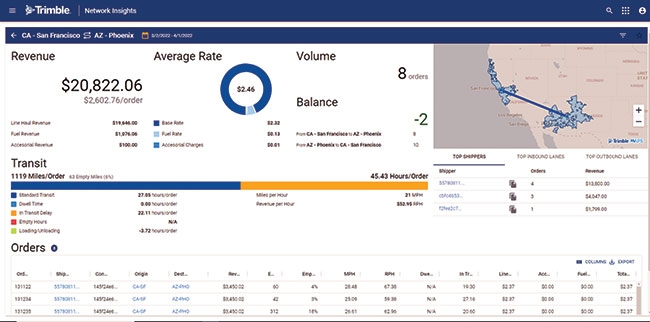

Modern trucking technologies are adept at descriptive analytics’ simple fact reporting, but “what we really need to get is the predictive, prescriptive and then machine learning-driven solutions to the operational problems we face,” said Chris Orban, vice president of data science for Trimble Transportation.

Predictive analytics forecasts outcomes that are most likely to happen in the future, while prescriptive analytics suggests actions to take that would affect the predicted outcomes.

Progressing from descriptive to prescriptive analytics increases the value of technology investments by decreasing the time, effort and cost needed to obtain actionable information. This move toward prescriptive analytics is transforming trucking, vendors said.

“Our industry is very reactive,” SkyBitz’s Azmoudeh said. “To be able to get more predictive and be able to look ahead and plan ahead is a key part of what we’re trying to develop and deliver.”

The use of artificial intelligence and machine learning promises to take data analytics to new levels.

Systems can use machine learning to sift through historical data and pinpoint patterns, which in turn enables the system to learn for itself. As the system learns, it can take in new data and predict outcomes.

Increasingly, transportation technologies such as TMS software are applying machine learning techniques. The concept is especially promising for tasks such as tracking maintenance, reducing vehicle downtime and improving asset visibility.

However, the application of AI and machine learning in trucking is still in its early days, vendors said.

Putting Data to Use

Tech vendors spend a lot of time building and enhancing benchmarking functions because “you have to be able to measure where you are before you can see improvement,” Azmoudeh said. That helps with establishing key performance indicators and developing best business practices.

The systems process fleets’ internal data in addition to that of competitors and partners across the industry. Data is anonymized in the systems to preserve businesses’ privacy while still providing an accurate view of overall industry baselines.

Cargo Transporters Chairman John Pope has noticed an expansion in use cases during the four years since his trucking firm adopted SkyBitz’s trailer monitoring technology. Initially, the truckload carrier relied on the system’s basic tracking functions that provide trailer history data, in addition to its heavy load sensor capabilities. This year, the company upgraded to the latest technology and paired it with in-trailer cameras, which uncover insights on trailer and load status and the amount of remaining cubic space.

“We use that data extensively in our TMS … and we’ve really added to how we were using some of the data we get back from the trailer,” Pope said. “We use it to determine whether we’ve got our committed trailer pools, are serving customers at the agreed upon levels and to provide drivers with places where they can go and retrieve empty trailers.”

Analytics is valuable to a variety of internal departments, including operations, planning, payroll and customer service. It can identify under- or over-utilized trailers, opportunities to reduce dwell time, opportunities for adding freight, the best location for a new terminal and where to hire new drivers.

Streamlining operations through prescriptive analytics can benefit drivers by reducing communication time, improving productivity and even enabling more home time, thereby increasing driver satisfaction and retention.

Incorporating external information from industries adjacent to transportation, such as construction, retail and agriculture, can help optimize the entire ecosystem, vendors said. When analyzing target regions for recruiting drivers, for example, integrating data about new e-commerce warehouses or distribution centers nearby could signal areas with recruiting challenges, considering the talent pools sometimes overlap.

Technology suppliers such as Trimble are offering software features designed to help fleets better utilize company and industry data. (Trimble Transportation)

“Pulling in some of these data sources … and thinking outside the transportation sector, I think is really the next step,” Trimble’s Orban said. “We can remove some of these friction points from the network that are really causing problems now.”

This year, fleets have become more interested in applying prescriptive analytics to better understand supply chains and fuel prices, Orban said. Vendors consider these and other outside conditions that affect the carrier network when updating their system capabilities and finding new business cases.

Looking beyond profitability and efficiency, leveraging data analytics enhances relationships with shippers and other clients. This information can smooth relationships on touchy topics including dwell time and pricing on the spot market. Tech-produced insights might not always “have specific meaning to how we would handle a load, but maybe it’s something that adds value to the customer,” thus improving the relationship, Cargo Transporters’ Pope said.

While acknowledging the many existing and upcoming applications and machine learning functions, vendors cautioned that data analytics cannot do it all. Systems still require human attention and configurations to maximize performance and provide continued return on investment.

“We are not yet at the point where you can just kind of ‘fire and forget’ and assume you’re going to get value forever from the investment,” Orban said.

Keeping Data Clean and Safe

The performance of an analytics model is only as good as the data it ingests. System reports don’t hold value and can’t bring about change if carriers don’t trust their data or its security. Focusing on accurate data inputs and guarding that data once it’s in the system are growing priorities among vendors and fleets.

Business intelligence software can help trucking companies extract insights from their data and ultimately make better business decisions. (Magnus Technologies)

“Part of the evolution is realizing how important clean data is,” said Barry Brookins, director of data science at McLeod Software.

Users should expect that data entry errors result in “garbage in, garbage out,” he said. “You wouldn’t want your drivers to put bad fuel into your tractors, so why would you let your office folks — dispatchers, billing clerks — put bad data into your system?”

He said more trucking companies now take a hard stance on collecting and inputting accurate data.

Eliminating offline or manual record-keeping and data transfer can streamline workflows. It maintains data integrity by reducing the human error associated with obsolete techniques involving spreadsheets, paperwork or whiteboards. Integrating multiple Internet of Things technologies across a business allows systems to communicate directly with each other about the data each component accurately gathered. For instance, integrating cameras or trailer sensors into a telematics system allows for direct, accurate information transfer.

Enhanced cybersecurity practices also inspire trust in data. Tech vendors reinforce the importance of staying on top of the cybersecurity game as bad actors become more sophisticated. While vendors beef up protections on their systems and software, they also highlight the customer’s role, such as updating virus detection products and using system backups.

“Back in the old days — the old days being 10 years ago — cybersecurity often was an afterthought,” Brookins said. “We encourage our customers to protect their data. It’s their most valuable asset.”

Trucking firms sometimes hesitate to share their data because of concerns about cybersecurity and data theft. But technology vendors said data sharing bolsters analytics systems by giving them even richer datasets to support machine learning. Over time, they see fleets coming around to the idea.

“One of the key things that is going to drive success across operational efficiencies is the openness of partners to share data,” Solera’s Palmer said.

Unfinished Business

Vendors and fleets agree that trucking is just beginning to unlock data analytics capabilities and applications. Reaching the next frontier relies on strengthening and expanding machine learning and true artificial intelligence.

In this special edition of RoadSigns, hosts Seth Clevenger and Mike Freeze provide an inside look at Transport Topics' 2022 Top 100 Private Carriers list. Tune in above or by going to RoadSigns.ttnews.com.

“The AI capabilities and machine learning capabilities have barely happened yet, and I think we’ll see a lot of that in the next few years,” Palmer said.

Cargo Transporters made the strategic move to upgrade its system and add cameras to extend the technology’s life span and ensure it holds future value and growth potential, Pope said. He anticipates that the most recent products will be able to perform functions that might still be in development.

“What we’re trying to do … is set ourselves up for some of the future capabilities — and potential AI capabilities — that will come down the road,” Pope said. “I think we’ve probably barely scratched the surface of some of the things that will be doable.”

He cites time-saving tools for drivers as desirable future functions. For example, automated pre-trip checks could inform the driver of any issues — tire pressure, lighting or mechanical problems — before they even get to the truck.

In the meantime, vendors report that they are working to improve their data science methods and collaboration with carriers to foster greater understanding of the powerful punch these technologies pack in improving businesses.

“All the different solutions out there generally have some way of using data … some are easy and some are super difficult,” Magnus’ Cartwright said. “It’s all change, and change management can be difficult.”

Want more news? Listen to today's daily briefing below or go here for more info: