A Year of Transition for 3PLs

[Stay on top of transportation news: Get TTNews in your inbox.]

Third-party logistics providers in the United States enjoyed another very good growth year in 2022. The two main growth drivers were the extraordinary inventory buildup from the COVID-19 supply chain disruptions, and 3PLs being able to efficiently decrease purchased transportation costs while staving off significant price concessions to shippers.

Carrier demand remained tight for the first half of the year and then shipper demand and rates started to trend down from the third quarter of 2022 into 2023. The 3PL market is beginning to normalize to pre-COVID conditions as we move into a potential Federal Reserve-induced economic recession as it tries to stave off inflation. Shippers are focused on drawing down on-hand inventories to reduce associated carrying costs for consumer and retail products, driving a “downshift” in international and domestic transportation demand and rates.

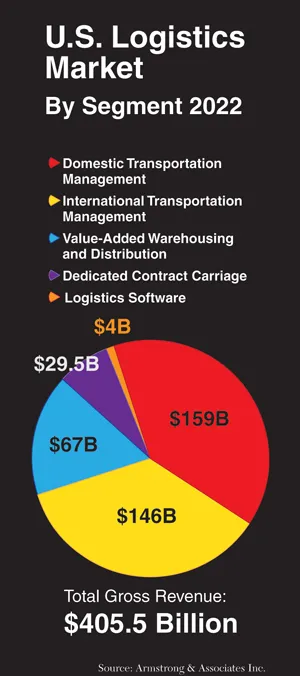

While many 3PLs are still providing us with 2022 financials, Armstrong & Associates’ current estimates show U.S. 3PL market net revenues (gross revenues less purchased transportation) grew 24% to $148 billion and overall gross revenues increased 18.3%, bringing the total U.S. 3PL market to $405.5 billion in 2022.

While year-over-year growth was significantly less than the 48.1% gross revenue growth registered in 2021, the 18.3% increase in 2022 was the fourth-best growth year on record since we began developing 3PL market estimates in 1995. The second-best year-over-year growth occurred in 2000 at 22.9% and the third best was 2010 at 19%.

Domestic Transportation Management

The non-asset-based domestic transportation management segment (DTM) led all other 3PL segments with net revenue growth of 33.8%, to $26.4 billion, while overall gross revenue increased a healthy 14.4%, to $159 billion. Of the $159 billion in DTM gross revenue, 84% was from freight brokerage and 16% was from managed transportation services.

DTM gross profit margins grew to 16.6%, reversing a downward margin trend from 16.6% in 2019 to 14.2% in 2021.

Armstrong

The increase in DTM gross margin can be attributed to shippers continuing to pay contracted or agreed to rates to 3PLs, while 3PLs in turn paid less for spot-market truckload carrier capacity.

The true leaders are those 3PLs with strong carrier management skills that have technologically innovated allowing them to efficiently tap long-standing carrier relationships to cover shipper demand versus being over-reliant on load boards to buy capacity at spot-market rates.

A cadre of DTM 3PLs realized significant gross margin increases as their net revenue growth more than tripled their gross revenue growth. These 3PLs include Allen Lund, Armstrong Transport Group, Bay & Bay Transportation Services, C.H. Robinson, Dupré Logistics, Edge Logistics, Integrity Express Logistics, Longship, M2 Logistics, Magellan Transport Logistics, Mode Global, NFI, RLS Logistics, Total Quality Logistics and Zipline Logistics, to name more than a few.

►2023 List Highlights Growth for 3PLs

►How 3PLs Are Building More Collaborative Supply Chains

►Map: Where the Top 100 Are

►Armstrong: A Year of Transition for 3PLs

►Shipment Visibility Is About Operational Excellence

►Sector Rankings Reflect Shifting Freight Market

Sector Rankings

Freight Brokerage | Dedicated

Dry Storage Warehousing

Refrigerated Warehousing

Ocean Freight | Airfreight

The ongoing digitalization of transactional truckload DTM/freight brokerage continues at a rapid pace as more 3PLs have built interfaces to large shippers’ transportation management systems (TMS) for truckload spot-market rate quoting and automated load tendering and booking. A couple of dozen 3PLs are using these TMS interfaces to provide shippers with instant spot-rate quotes and the ability to complete load tendering and booking systematically. This process automates part of the traditional spot-market freight brokerage account management function and is increasing shippers’ use of more spot versus contract pricing.

Account management automation of spot-market truckloads is happening in conjunction with the automation of carrier sales (procurement) functions within freight brokers using carrier capacity management systems to digitally match shippers’ loads to carriers based upon historical and real-time carrier capacity data analyzed via machine learning/artificial intelligence algorithms. This digital freight matching (DFM) capability has become a competitive differentiator within the DTM segment as DTM 3PLs look to increase the number of loads/shipments they manage per person per day and revenue per person per year. It can also build carrier loyalty by reutilizing high-performing core carriers at rates which are below the spot market rates offered via load boards.

C.H. Robinson, Total Quality Logistics (TQL), Worldwide Express/GlobalTranz, Echo Global Logistics and Mode Global are some of the 3PLs driving industry automation along with the newer tech-first digital freight brokers Convoy and Uber Freight. At this point, most of the top freight brokers are strategically digitalizing operations to add value through improved carrier management, and customer and carrier experiences.

As a continuation from March 2022, the Federal Reserve has made nine rate hikes to curb inflation. In addition, many high-tech companies have laid off employees and contractors. This has led some consumers to spend less and when coupled with shippers striving to draw down warehouse inventories, imports have declined, and truckload rates and demand are continuing to decline into 2023. This has prompted an increase in shipper procurement events/requests for proposal (RFPs) which should put pressure on DTM gross margins and lead to overall DTM margin compression in 2023. Some larger shippers have transitioned from annual RFP events to six- and three-month RFP cycles to capitalize on the downward trend in truckload rates. We anticipate that truckload pricing will bottom sometime in May or June as these events result in solidified lower contractual rates and as inventories begin to be replenished.

Last year Axle Logistics won the DTM “who’s that?” of 2021 designation with a stellar gross revenue increase of 194% to $520 million and a net revenue increase of 195.1% to $66.7 million. In 2021, Axle was one of very few 3PLs having faster net revenue growth versus gross revenue growth. Axle did even better in 2022 as its net revenue grew at over two times its gross revenue growth. Axle’s 2022 gross revenue grew 48.5% to $772 million and its net revenue jumped 81.9% to $121 million, generating a gross margin of 15.7% versus the 12.8% it realized in 2021. Founded in 2012 by University of Tennessee graduates Jon Clay and Drew Johnson, Knoxville, Tenn.-based Axle Logistics has over 400 employees managing dry van, flatbed, specialized truckloads, and LTL and intermodal shipments within North America.

Allen Lund is one of the largest freight brokerage operations in the U.S. It has more than 30 offices across the country and manages more than 450,000 loads annually. In 2022, its gross revenue grew 19.7% to $1.46 billion while its net revenue skyrocketed 75.8% to $252 million. Lund handles dry, refrigerated (mainly produce, which is 40% of the business) and flatbed shipments. Recent DTM acquisitions include its February 2020 purchase of food products and produce specialized freight broker Des Moines Truck Brokers. A year later, Allen Lund purchased Boise, Idaho-based Magic Valley Truck Brokers Inc. Founded in 1976, the family-owned-and-operated Magic Valley had good company processes and attention to detail.

Total Quality Logistics, the second-largest freight broker in the U.S., realized gross revenue growth of 12.2% to $8.7 billion and net revenue jumped 44% to $2 billion.

Employees working at the Total Quality Logistics office. (Total Quality Logistics via Facebook)

Founded in 1997, Cincinnati-based TQL today has 56 offices spread throughout 26 states. TQL manages more than 3 million dry van, reefer and flatbed truckloads per year. As one of the largest remaining privately owned, U.S.-based 3PLs, TQL is an ongoing acquisition target, but CEO Ken Oaks hasn’t found a reason to change its growth trajectory.

Dedicated Contract Carriage

The asset-heavy dedicated contract carriage (DCC) 3PL market segment delivered the second-largest year-over-year net revenue growth in 2022 with a 27.4% increase to $29.2 billion. Gross revenue increased 27.7% to $29.5 billion. DCC’s growth benefited from shippers wanting to lock in capacity after a turbulent 2021, an increased ability to attract drivers through wage increases and better recruiting, and having ample capital to invest in equipment. In addition, those 3PLs with freight brokerages which could handle “overflow” business from DCC operations as dedicated or spot truckload capacity tended to do well.

Traditional DCC contracts have one- to three-year terms with specific trucking assets being dedicated to customers. This makes DCC contracts much “stickier” than standard shipper/carrier trucking contracts and less susceptible to declines in the truckload spot market. So DCC has an advantage when truckload capacity is increasing from softer demand and rates are declining.

DCC trailer types are 80% dry vans, reefers account for 11%, flatbeds comprise 5% and tankers and other trailers tally 2% each. Sixty-four percent of the Top 25 DCC providers have both dry vans and reefers; 60% also have flatbeds. Over a third of the Top 25 have tankers. Other types of equipment include curtain sides, roller beds, end dumps, drop decks and dry van trailers with lift gates. Customer trailers/containers are often used especially for retail operations such as Walmart.

J.B. Hunt Dedicated Contract Solutions remains the largest DCC 3PL with 12,899 power units in 2022 and above average segment revenue growth of 31% over 2021.

Ryder, meanwhile, is the third-largest dedicated contract carriage provider based on power units but is not far behind longtime competitor and the second-largest DCC provider, Penske Logistics. Penske added an additional 464 power units in 2022 for 8,969 in total.

Ryder, one of the most recognizable 3PL brand names, is a lead logistics provider for most GM plants and services Chrysler/Fiat, Toyota and Honda plus a multitude of Tier 1 suppliers. Ryder runs inbound supply chain management, sequencing centers, just-in-time and dedicated contract carriage operations.

Ryder has dedicated contract trucking operations within both its DTS division and its Supply Chain Solutions (SCS) division. Within SCS, dedicated represents 32% of SCS’ total revenue with power units. Previously only Ryder’s dedicated assets from its DTS division were being considered for the top dedicated contract carriers list. This year, Ryder’s dedicated power unit count also includes its DCC operations within its SCS segment, which clarifies the large increase in its power unit count from 5,300 power units last year to 8,930 power units this year.

Schneider vehicles parked in a lot. (Schneider)

Schneider provides trucking, domestic transportation management/freight brokerage, port logistics (warehousing, transloading, distribution and drayage) and dedicated contract carriage services. Schneider’s dedicated operations are primarily dry van with some refrigerated, flatbed and lightweight trailers. It now has more than 5,900 power units in its dedicated operations helped by its January 2022 acquisition of Ohio-based truckload and dedicated carrier Midwest Logistics Systems, which added 1,000 drivers and 900 tractors across 30 central U.S. locations to Schneider’s roster of assets. In 2022, Schneider’s dedicated revenue grew 45.5% to $1.19 billion.

Value-Added Warehousing and Distribution

The value-added warehousing and distribution (VAWD) 3PL market segment did extremely well in 2022 and had the third-highest 3PL segment net revenue growth at 21.1%, to $49.8 billion. Gross revenue increased 22.7% to $67 billion. Most VAWD 3PLs had full warehouses in 2022 and were scrambling to find more; warehouse inventory space increased 10% to 2.6 billion square feet.

2022 marked the first year that multiclient warehouse space — at 54% of total warehouse space in the U.S. — exceeded that of dedicated space primarily due to strong growth in e-commerce fulfillment.

E-commerce fulfillment continues to be one of the fastest-growing domestic 3PL subsegments, having a compound annual growth rate of 28.5% from 2016 to 2022.

An ongoing headwind for VAWD 3PLs has been high warehouse labor demand, turnover and ongoing wage increases. This is driving significant interest from VAWD 3PLs to automate warehouses with autonomous robots from manufacturers such as Fetch, Locus and Six Rivers. Many 3PLs invested in robotics last year to improve efficiency, accuracy and speed of picking. By accessing real-time data and analytics from the cloud, robots can optimize their routes, reduce idle time, reduce human travel time and prioritize tasks based on demand. These autonomous mobile robots (AMRs) are robots that use sensors, cameras and mapping software to navigate the warehouse. Robots can be quickly deployed, in some cases as quick as two weeks. Leasing robots can also offer 3PLs greater flexibility in terms of scaling their operations up or down as demand fluctuates.

For 2023, the VAWD 3PL market segment has fared better than its transportation management brethren and even with shippers’ current inventory drawdowns, it will continue to do well given the general lack of warehousing space and growth in e-commerce fulfillment and last-mile delivery. Overall warehouse utilization should normalize with operations seeing increased efficiencies.

A lot of shippers we work with are examining their supply chain networks and providers to improve inventory management and on-time delivery performance. We anticipate continued focus on supply chain network flexibility and warehouse optimization throughout 2023.

GXO Logistics is the third-largest VAWD 3PL based on warehousing square footage within North America. It was recently spun off from LTL trucker XPO Logistics and was formed from XPO’s 2014 acquisition of New Breed Logistics and XPO’s subsequent 2015 acquisitions of Norbert Dentressangle and Con-way/Menlo Logistics.

A GXO employee oversees a robot sorting items in a warehouse. (GXO)

GXO provides value-added warehousing and distribution, order fulfillment, e-commerce logistics, reverse logistics and other supply chain services via its global network of 979 warehousing facilities. Of its warehousing operations, 294 are in the U.S., 316 are in the United Kingdom, 287 in Europe (excluding the U.K.), and the rest are primarily in Asia and Latin America.

GXO serves customers in the e-commerce, omnichannel retail, consumer technology, food and beverage, industrial and manufacturing, and consumer packaged goods industries with the vast majority of revenue generated in the U.K., U.S., France, Netherlands and Spain.

In the U.S., GXO’s gross revenue increased 16% year-over-year even as its warehousing footprint decreased 13% from 316 warehouses with 90 million square feet to 294 warehouses with 78 million square feet. It expanded operations in the U.K. and Europe with its May 2022 acquisition of London-based omnichannel retail logistics provider Clipper Logistics plc.

Last year Ryder overtook GXO as the second-largest VAWD 3PL based upon warehousing square footage within North America with 95 million square feet in 300 warehouses. Ryder’s growth was bolstered by its recent acquisitions of omnichannel fulfillment providers Whiplash (formerly Port Logistics Group) and Dotcom Distribution, as well as Midwest Warehouse & Distribution System. Based in Woodridge, Ill., Midwest provides warehousing, distribution and transportation management services primarily for food, beverage and consumer packaged goods companies.

International Transportation Management

Compared to 2021, when the international transportation management (ITM) 3PL market segment realized an unheard-of 74.9% gross revenue gain and 44.6% net revenue increase from COVID-driven demand from shippers focused on replenishing inventories to meet strong consumer demand, ITM’s 2022 gross revenue growth of 19.3% to $146 billion and net revenue growth of 19.7% to $42.6 billion seems underwhelming. ITM includes air and ocean freight forwarding, associated inland transportation, shipment consolidation and deconsolidation, customs house brokerage and related warehousing services.

The ITM environment has dramatically changed since mid-2022 with ocean freight rates from Asia to the U.S. trending down to pre-pandemic levels. In the third quarter of 2022, ocean shipping rates and domestic transportation rates began to deflate in the U.S. as consumer demand moderated and supply chain operations stabilized. China-to-U.S. and European ocean shipping rates have declined as much as 90% since the peak in early 2022.

In turn, 2023 has seen an increased willingness for ocean carriers to provide contracted capacity and good rates for targeted port-to-port pairs as import growth of furniture, consumer and retail products has waned. Generally, outside of current labor disputes, ports are less congested and drayage capacity is readily available.

Airfreight demand is off approximately 10% from 2022 while overall capacity has expanded with increases in passenger airline capacity globally. Airfreight capacity is generally available at lower rates. Midyear ITM demand should rebound from China once shippers need to replenish inventories. This should stabilize ocean rates from Asia to North America.

In a stark contrast to 2021, the two largest U.S.-based ITM competitors, Expeditors and C.H. Robinson Global Forwarding, saw minimal growth in 2022.

After its Global Forwarding division more than doubled in 2021 with gross revenue growth of 117.1% to $6.7 billion and a net revenue increase of 70.7% to $1.1 billion, C.H. Robinson’s ITM gross revenue in 2022 only grew 1.2% and net revenue increased only 0.9%. Its international freight forwarding volumes were down 5% on average.

Expeditors, which saw its gross revenue increase 67.7% to $16.5 billion and net revenue grow 39.7% to $4.5 billion in 2021, saw a much different picture in 2022. For 2022, Expeditors’ gross revenue only grew 3.3% to $17.1 billion and net revenue increased a minor 0.6%. Its international ocean and airfreight forwarding volumes dropped 10% and 17%, respectively.

On a smaller scale, AIT Worldwide Logistics grew its ITM gross revenue 12.9% to $2.5 billion with a net revenue increase of 27.8% to $540 million in 2022. Although AIT’s ocean TEUs fell 4.8% year-over-year, its airfreight metric tons grew 7.8%.

AIT Worldwide Logistics is an air and ocean freight forwarder and customs broker with associated warehousing operations. About 20% of its business is under contract and 80% is transactional. International revenues are two-thirds airfreight and one-third ocean freight. Its global network consists of 60 offices, with 41 in the U.S., three in Mexico, two in Canada, nine in Asia and five in Europe.

AIT’s acquisitions in recent years include its October 2018 purchase of Los Angeles-based cold chain specialist WorldFresh Express. Two months later, AIT acquired U.K.-based freight forwarder ConneXion World Cargo. In August 2019, AIT purchased Los Angeles-based freight forwarder Unitrans International Corp. In November 2020, AIT acquired Panther Logistics, a next-day delivery specialist, and a month later Germany-based Fiege Group’s international freight forwarding division, Fiege Forwarding, was purchased.

In March 2021, AIT was acquired by private equity firm The Jordan Company and has since continued its acquisition spree as well as expanding internationally with recent new offices added in India and South Korea.

Want more news? Listen to today's daily briefing below or go here for more info: