XPO to Purchase Con-way

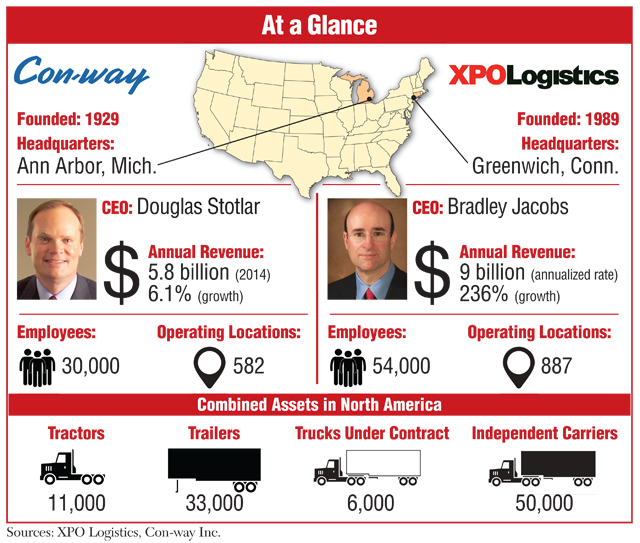

XPO Logistics Inc. last week agreed to buy Con-way Inc. for $3 billion — the highest price ever paid for a U.S. trucking company — to broaden its service offerings and leap into the less-than-truckload market.

The purchase of the company that ranks No. 4 on the Transport Topics Top 100 list of U.S. and Canadian for-hire carriers is being made at a premium of 32% to the $36.18 closing price of Con-way shares Sept. 8.

If the deal, announced Sept. 9,is completed, XPO would jump to No. 3 on the for-hire TT100.

Brad Jacobs, CEO of XPO, told TT on Sept. 9 that “the acquisition will make our platform more powerful and flexible” by offering a broader array of services.

“This is an opportunistic acquisition,” Jacobs said, making XPO “much more appealing to the customer.”

“This landmark transaction provides immediate cash value for our shareholders,” Con-way CEO Douglas Stotlar said. “The combination will mean more services for our customers, more miles for our drivers and more career opportunities for our employees.”

Prior to Con-way, the most ever paid for a less-than-truckload carrier, based on Transport Topics records, was the $1.5 billion UPS spent to buy Overnite Corp. a decade ago. Adding Con-way, with its $5.8 billion in annual revenue, would transform XPO, created four years ago with $177 million in annual revenue, into a $15 billion business.

“XPO is taking another giant step in its quest for external growth,” said a report from Cowen and Co. analyst Jason Seidl, whose comments were among many from trucking experts.

“Con-way has historically been an excellent LTL operator, but in recent years, the company’s execution has been choppy at best,” Seidl said. “XPO’s proprietary technology platform and focused management team can help optimize [Con-way’s] operations over time.”

For the first time, XPO set an annual savings goal from an acquisition, targeting $170 million to $210 million annually. At the higher end, that amount would raise Con-way’s profit, excluding interest and taxes, by about 80%.

It will be accomplished by changes in technology, sales, shifting highway freight to intermodal and other steps throughout every Con-way unit, Jacobs said.

“We will run the LTL business with a fresh set of eyes,” Jacobs said, as a “non-commoditized, high value-added business.”

Buying Con-way is about more than LTL, however.Jacobs called Con-way’s Menlo Logistics unit a “crown jewel,” which matches up favorably with his company’s current offerings.

In the Menlo portion of Con-way, the complementary businesses include contract logistics, transportation management and brokerage.

XPO expects that buying Con-way will nearly double earnings before interest taxes depreciation and amortization, or EBITDA, to $1.1 billion.

Jacobs said on a conference call he expects to boost that by “several hundred million dollars” in the next few years by wringing costs out of the business.

Four months ago, XPO offered $3.5 billion paid for Norbert Dentressangle, a Lyon, France-based company that offers a blend of asset and non-asset services.

XPO’s strategic evolution happened after buying Norbert.

Jacobs explained that it became clear from meeting with customers that larger shippers wanted their service providers to have asset-based capability.

Without assets, Jacobs said, “by and large you are not sitting at the adult table.” Putting that another way, he said Con-way’s size, with about 40,000 pieces of equipment in North America alone, gives XPO “street cred” with shippers.

Last week’s announcement also was the latest evolution in transport-related acquisitions, not just at XPO, that are progressing into faster and larger deals.

Memphis, Tennessee-based FedEx Corp. in April offered $4.8 billion for Hoofddorp, Netherlands-based package and freight operator TNT Express. Globally, this year’s biggest deal was the $5.1 billion spent by Japan Post to buy Australia’s Toll Holdings.

Ann Arbor, Michigan-based Con-way, whose corporate ancestors date to 1929, will be rebranded as XPO Logistics, according to the announcement from XPO, which is based in Greenwich, Connecticut.

Con-way’s LTL management will be changing.

Asked who will run that business after the acquisition, Jacobs answered “me,” while a search for a new LTL leader proceeds. Stotlar will remain as an adviser through the first quarter of next year.

No other Con-way management changes were announced.

Jacobs, whose corporate strategy focuses on establishing large market positions, listed several milestones post-acquisition, including the second-largest contract logistics provider and No. 2 freight brokerage firm worldwide, and an annual spend of $3.6 billion on purchased transportation.

Terms of the deal include cash offering $47.60. The sale price, which isn’t conditioned on financing, includes about $290 million in Con-way debt.

The purchase price was 5.7 times last year’s EBITDA, based on XPO’s calculation. That amount was far below other XPO acquisitions that have been about 10 times EBITDA.

A final advantage he noted in an interview with TT was that over the long term, capacity is expected to get tighter — along the lines of what happened last year.

“Controlling capacity in that scenario will be extremely beneficial to customers,” he believes.

XPO will maintain its long-term emphasis on non-asset acquisitions, Jacobs said.