UTi Worldwide Agrees to Buyout by DSV Group for $1.35 Billion

UTi Worldwide, a U.S.-based air and ocean freight forwarder that has been struggling to reverse a downward trend in revenue and profits, has agreed to a buyout by Danish freight forwarder and transportation firm DSV Group for $1.35 billion.

DSV said it will pay $7.10 a share for all of the outstanding stock in UTi, a premium of 50% over the closing price Oct. 8, the last trading day before the deal was announced. That still is well below the price of the company’s 52-week high of $14.75.

The companies, in fact, had discussed a deal in late December but were unable to come to terms, according to several industry analysts.

The addition of UTi is expected to boost DSV’s market share among global freight forwarders and greatly expand the company’s business in North America for contract logistics, distribution and warehousing services.

UTi has lost money in each of the past three years as the company has tried to complete an internal restructuring and IT integration program. Annual gross revenue has fallen nearly 15% from $4.9 billion in 2012 to $4.2 billion in the fiscal year ended Jan. 31, 2015.

“We are very excited to be joining forces with DSV, which we believe will strengthen our value proposition to our clients while providing a meaningful cash premium to the holders of our ordinary shares relative to the recent trading prices,” Ed Feitzinger, the CEO of UTi, said in an Oct. 9 statement.

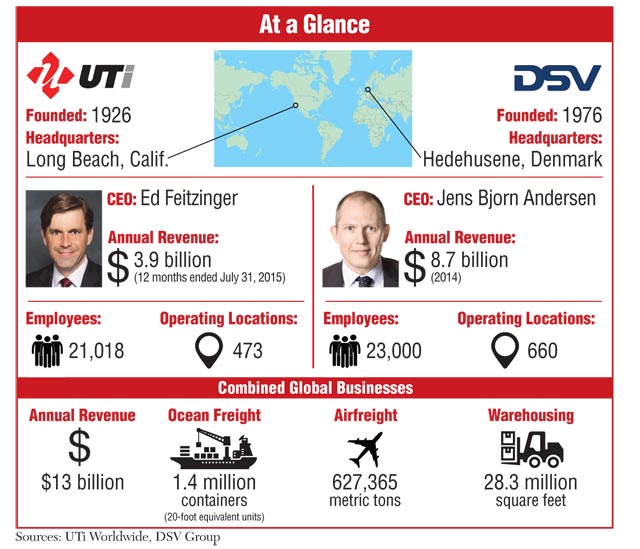

Kurt Larsen, chairman of Hedehusene, Denmark-based DSV’s board, said “the combined business will reach new levels together” with the combined gross revenue of about $13 billion a year and a workforce of about 44,000 people in 84 countries.

UTi Worldwide ranks No. 9 on the Transport Topics Top 50 list of the largest logistics companies in North America. It also ranks No. 18 on the list of largest global ocean freight forwarders and No. 14 on the list of largest global airfreight forwarders.

DSV Air & Sea ranks No. 13 on the ocean freight forwarders list and No. 17 on the airfreight forwarders list.

Officials from both companies said they expect the deal to be completed in the first quarter of 2016, after approval by UTi shareholders.

Founded in Germany in 1926, UTi is legally registered in the British Virgin Islands and maintains its operational headquarters in Long Beach, California.

Industry analysts had generally good things to say about the transaction.

“We believe the deal is compelling,” said Kevin Sterling of BB&T Capital Markets. “In addition to multiple business synergies, a seemingly good cultural fit and complementary customer base and service offerings, the combined companies will have a vastly expanded geographical footprint.”

DSV will gain a significant presence in the Americas and Africa, while for UTi the combination provides an increase in European road freight, Sterling said in a report.

While DSV operates principally as a broker for over-the-road transportation in 32 countries in Europe, UTi uses a combination of its own trucks and brokered capacity to haul freight in the United States.

UTi’s trucking holdings include Market Transport Ltd., a truckload and intermodal carrier based in Portland, Oregon, and Sammons Trucking, a flatbed and heavy/specialized carrier based in Missoula, Montana. UTi also provides transportation management services through a company called Concentrek.

Satish Jindel, owner of SJ Consulting Group, said he expects DSV to be cautious about keeping UTi’s trucking operations, in part, because other European firms have had difficulty adjusting to market conditions in North America. DB Schenker’s purchase of BAX Global and Deutsche Post DHL’s acquisition of Airborne Inc. are two examples, he said.

“My view is that they will find a buyer for the domestic portion of UTi’s business,” Jindel said.

Benjamin Hartford, a transportation and logistics industry analyst for Baird Capital in Chicago, said the purchase of UTi is a “good deal” for DSV. He also said the Danish firm is “one of the few transport models with a successful, proven track record of acquiring and integrating companies into its network.”

DSV’s purchase of ABX Logistics in 2008 doubled the size of its global network and the company has since acquired Swift Freight Group of Cos. with operations in Africa, the Middle East and Asia. In 2013, the company acquired Seatainers Group in Denmark, SBS Worldwide Holdings in the United Kingdom, Airmar Cargo in Colombia and Ontime Logistics in Scandinavia.