Staff Reporter

Trailer Orders Surge 82% in October

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. trailer orders in October jumped 82% from the prior month to reach 46,750 units, ACT Research reported Nov. 16.

The ACT Research preliminary net trailer orders report also noted that the latest numbers represent a 168% increase from the same time last year. The market data and industry analysis firm attributed the rise to trailer manufacturers being more comfortable accepting orders amid an easing of supply chain constraints.

“With more 2023 order boards opening, October net orders continued their upward trend,” said Jennifer McNealy, ACT’s director of commercial vehicles market research. “With the supply chain constraints improving for trailer manufacturers, as well as their increasing nimbleness in meeting and mitigating those challenges, OEMs are more comfortable accepting orders, and this month’s preliminary data demonstrates that.”

Preliminary October Net Trailer Orders Jump as 2023 Orderboards Open More Fully

Read the release now https://t.co/sTql8mvbuk#Trailers, #Transportation, #truck, #trucking, #ACT, #ACTResearch pic.twitter.com/u7ph9Zh0W9 — ACT Research (@actresearch) November 18, 2022

McNealy added that demand for trailers remains strong with a backlog-to-build ratio above the seven-month mark on average. She noted fleets that need trailers are getting in queue and staying there.

“I think there’s still plenty of pent-up demand in the trailer industry,” said David Giesen, vice president of sales at Stoughton Trailers. “So, what’s happening here now is we’re all being held back by the components and supplies we can get and the labor. All of those things are still an issue. We’re all cautiously plugging into our backlog. We could overfill our backlog easily next year, so we’re consciously not doing that.”

Giesen

Giesen noted that September is a big month in terms of filling orders in the first quarter and into second quarter. By getting those in, it provides visibility into next year. He noted there is plenty of demand for next year at this point, and it’s mostly from the larger and midsize fleets.

“It is still supply chain issues; component availability is still an ongoing thing that doesn’t seem to be going away for quite some time,” Giesen said. “Any given week we might run out of certain components because they’re not here. And that makes it interesting to operate. Because you hear things in the world about it’s all getting better. Well, it doesn’t seem to be getting better in this industry yet. Not significantly.”

Wabash reported record quarterly revenue of $655.2 million in its third quarter earnings report Oct. 26. During those three months, the manufacturer reported that new trailer shipments increased 7.3% year-over-year to 13,365. The company said shipment activity remained strong relative to ongoing supply chain unevenness.

“When you layer in the structural changes and demand coming from digital brokers, power-only solutions and the growth of trailer pools more generally, we continue to feel very confident in our longer-term financial targets into 2025,” Wabash CEO Brent Yeagy said during a call with investors Oct. 26. “Our backlog remains very strong at $2.3 billion, especially considering our strong record revenue coming out of the backlog during Q3.”

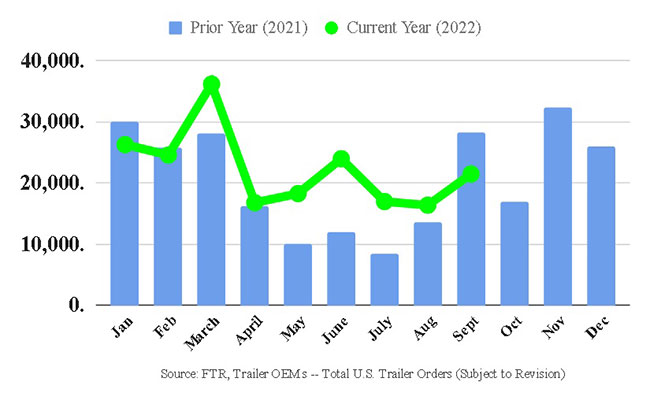

FTR Transportation Intelligence found in its most recent preliminary report that trailer orders increased 29% month-over-month to 21,500 units in September. The report noted trailer orders still were down 24% from the prior year but have totaled 280,000 units for the trailing 12 months.

“In the retail market, dealerships still can’t keep enough stock to meet demand,” Charles Roth, commercial vehicles analyst at FTR, said at the time. “At the same time, large carriers haven’t been able to keep up with replacement cycles, which has driven the level of pent-up demand for new replacement units to above-average levels. While net orders have historically followed a seasonal pattern, the past two years have fundamentally changed how OEMs manage their build slots.”

Want more news? Listen to today's daily briefing above or go here for more info

Uber Freight highlighted industry perceptions of trailers in its third-quarter freight market update report Oct. 10. It found equipment cost pressures on carriers remain at an all-time high but are easing as the supply chain loosens. The report noted that a subset of carriers increasingly pushing for accessorial changes included updated fuel schedules and trailer utilization.

There also has been significant investment in new tractors, trailers and real estate.

ACT Research expects to release its final order numbers later this month. The preliminary market estimate should be within plus or minus 5% of the final order tally.