US Retail Sales Drop, Hinting at Shift to Spending on Services

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

U.S. retail sales declined in May, after a stimulus-related splurge in the prior two months, suggesting consumers are starting to shift more of their spending to services as the economy reopens.

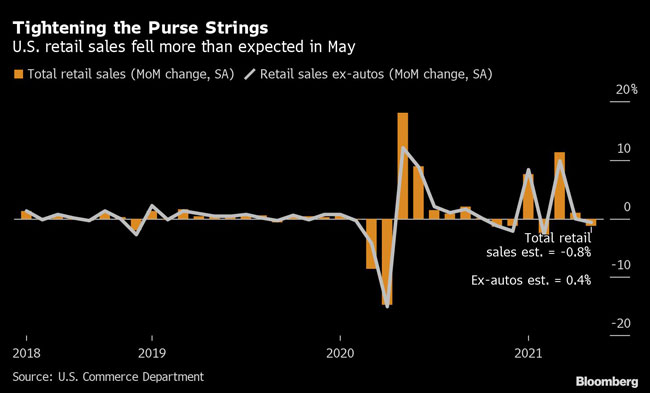

The total value of retail purchases fell 1.3% in May following an upwardly revised 0.9% gain in April, Commerce Department figures showed June 15. The median estimate in a Bloomberg survey of economists called for a 0.8% decrease.

For the last year, demand for goods has been propped up by elevated savings supported by fiscal stimulus, bringing total retail sales well above pre-pandemic levels. The May decline in retail sales suggests that as travel picks up and entertainment venues reopen, spending on goods is starting to moderate.

Stock-index futures were little changed after the figures, while the yield on the 10-year Treasury note edged higher.

The total value of retail sales was $620.2 billion in May, well above the almost $526 billion in February 2020, before the pandemic.

The sales data precedes the June 16 conclusion of the Federal Reserve’s two-day policy meeting. Investors and economists will be watching to see whether the Fed adjusts its outlook for scaling back monetary support as price pressures build and areas of the economy — like spending — improve quicker than expected.

While consumer spending is expected to continue strengthening, the pace will probably moderate as enhanced unemployment benefits expire and stimulus checks are spent. A sustained pickup in inflation may also cause consumers to limit discretionary expenditures.

A separate report last week showed that prices paid by consumers rose in May by more than forecast. Growth in producer prices also exceeded projections, according to Labor Department data on June 15.

Economists estimate a robust pace of overall household outlays in the second quarter before a moderation in the second half, according to Bloomberg survey data. Retail sales in the three months through May have increased at a 57% annualized rate.

Eight of the 13 major retail categories posted declines in sales receipts last month.

Excluding vehicle sales, retail sales decreased 0.7% in May. Motor vehicle and parts dealer sales fell 3.7% in the month. Furniture stores, electronics outlets and building materials merchants also posted declines in receipts.

Restaurant sales rose 1.8% in May, underscoring consumers’ shift toward services spending as social distancing restrictions ease and health concerns decline. The retail sales data don’t include figures on other services categories like travel and accommodation.

Sales at clothing stores rebounded 3% in May, reflecting the reopening of many offices and the pickup in social activity.

So-called control group sales, which exclude more volatile categories including food services, car dealers and gasoline stations, fell 0.7% in May after a revised 0.4% decrease in April.

Want more news? Listen to today's daily briefing below or go here for more info: