Bloomberg News

US Consumer Confidence Falls as Virus Surge Dampens Expectations

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

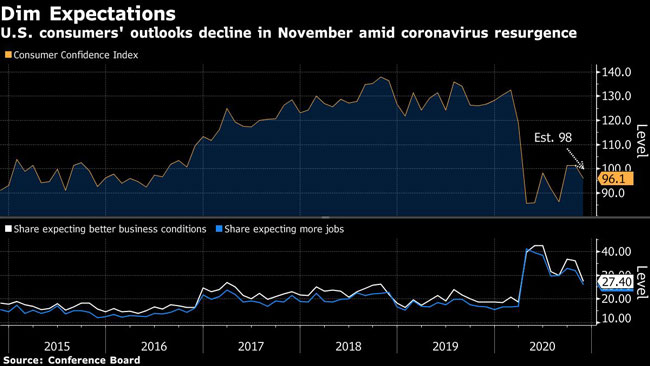

U.S. consumer confidence fell in November to a three-month low as the coronavirus resurgence prompted a slide in Americans’ expectations for the economy and job market.

The Conference Board’s index decreased to 96.1 from an upwardly revised 101.4 reading in October, according to a report Nov. 24. The median forecast in a Bloomberg survey of economists called for the measure to slip to 98.

The gauge of expectations dropped 8.7 points, the most since July, to 89.5 this month, while a measure of sentiment about current conditions eased 0.3 point to 105.9.

The figures coincide with the start of the holiday shopping season that will help shape estimates of consumer spending for the quarter. Less optimism, against a backdrop of surging infections that are sparking more government restrictions, suggests retail sales and hiring will slow.

The smallest shares of respondents since March said they expected better business conditions and more jobs in the next six months, the report showed.

“Heading into 2021, consumers do not foresee the economy, nor the labor market, gaining strength,” Lynn Franco, senior director of economic indicators at the Conference Board, said in a statement. “In addition, the resurgence of COVID-19 is further increasing uncertainty and exacerbating concerns about the outlook.”

At the same time, more consumers surveyed indicated they were likely to make big purchases in the months ahead. Greater shares in November said they plan to buy automobiles, homes or appliances. Buying plans for previously owned homes were the strongest since March 2019.

Also, the share of survey respondents who said they expected their incomes to increase crept up to 17.6%, the highest since March.

Consumers that said business conditions are currently favorable decreased to 17.6% from 18.6%. The percentage of consumers who said jobs are hard to come by was little changed.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More