U.S. Bank: Truck Freight Services Spending Grew 25% in 2017

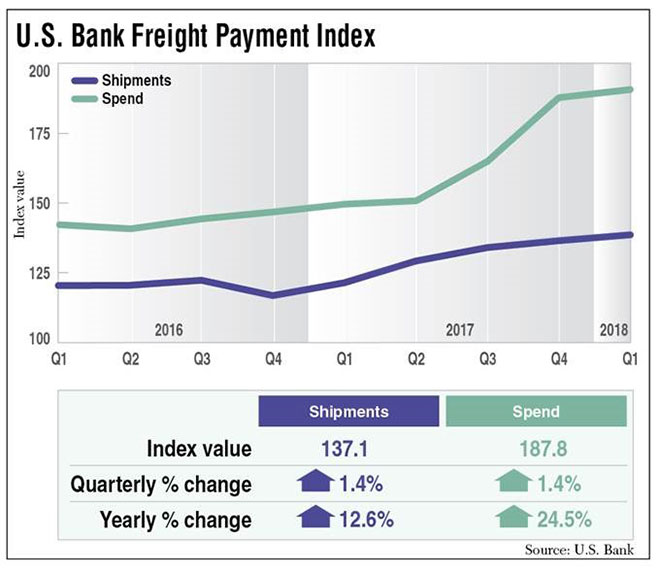

Spending on truck freight services surged nearly 25% and freight shipments grew 12.6% in 2017 as the economy expanded and the trucking industry paid more to obtain capacity and on driver compensation, according to the U.S. Bank Freight Payment Index.

The bank builds its quarterly freight index on data from the $24.5 billion in global freight payments it processes annually for corporate and federal government clients. Its broad payment index incorporates the National Shipment Index that covers freight shipping volumes, along with the National Spend Index covering spending on truckload and less-than-truckload shipping.

Costello

The National Spend Index grew 12.5% in the fourth quarter of 2017 and 24.5% for the full year as demand for trucking services outpaced the supply, the bank reported. Freight spending overall has increased for seven straight quarters, up a total of 31.4%.

The shortage of truck drivers is a major reason why spending for freight services nearly doubled that of shipments, as firms paid more to reserve trucks to move their goods, American Trucking Associations Chief Economist Bob Costello said.

“Motor carriers of all types are having extreme difficulty finding qualified drivers, which is constraining capacity and pushing driver pay higher,” he said. “The capacity situation will likely get even tighter throughout the year as economic growth accelerates and fleets have a difficult time adding trucks to meet the added demand.”

In the first quarter, both the spend index and the shipment index grew 1.4% from the fourth quarter of 2017.

On a regional basis, the Midwest was the strongest for shipping in the first quarter, growing 3.3%, followed by a rise of 1.6% in the Southwest and increases of 0.7% in the Southeast and 0.2% in the West.

The Northeast registered a 0.3% decline as bad weather slowed construction activity. For full-year 2017, however, the Northeast experienced a 6.5% rise in shipments and a nearly 26% increase in spending.

In the Southwest, shipments have been growing for two years with volume up more than 37%. In 2017 alone, shipments grew 20.2% in the region.

Spending was mixed in the first quarter with the Midwest and Southwest regions growing 5.2% while the West grew .5%, the Southeast fell 2.7% and the Northeast dropped 1.6%.

U.S. Bank reported the West region is looking positive with strong homebuilding numbers and West Coast port volumes sending freight volume and spending higher.

Shipments in the Southeast grew 5.8% during 2017 and 0.7% in the first quarter of 2018. Spending on truck freight services fell 2.7% in the first quarter, though it rose 13.5% during 2017.