Senior Reporter

Truck Sales Dip in January

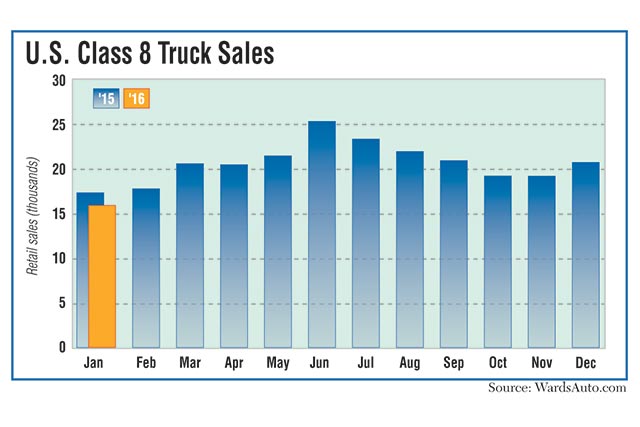

U.S. retail sales of Class 8 vehicles nearly reached 16,000 in January, but analysts said the anticipated softening in demand has taken hold.

WardsAuto.com reported heavy-duty truck sales of 15,949 marked the second-highest January in nine years. That was an 8% drop, however, from 17,373 a year earlier.

“It’s one of those cases where it has been better than it should have for longer than it should have,” ACT Research analyst Steve Tam told Transport Topics.

ACT has forecast U.S. Class 8 retail sales in 2016 to be 220,000. That would fall well under the 248,804 units sold last year, according to Ward’s, and essentially would be flat with 2014’s total `but about 19% higher than in 2013.

Analyst Jon Larkin with Stifel, Nicolaus & Co. wrote in an investor note: “Most carriers have suspended growth initiatives. A few are taking advantage of their strong balance sheets and leverage with needy manufacturers to modestly increase the size of their fleets in preparation for the coming of more favorable freight conditions.”

Daimler Trucks North America’s dominant Freightliner brand saw sales fall 10.8% to 6,915 trucks. That was good for a 43.4% market share.

Earlier this month, DTNA announced another round of layoffs, involving 500 workers at its Class 8 plant in Cleveland, North Carolina, which makes the Freightliner and Western Star brands. This follows layoffs at the plant in January affecting about 936 employees.

The latest round is “due to a sustained reduction in orders and a diminished build rate and it is considered temporary,” DTNA spokesman David Giroux said in a statement.

The company also laid off 700 workers from its medium-duty plant in Mount Holly, North Carolina, he said (story, p. 14).

“It’s not that the sky is falling . . . but we see a moderate decline from very, very, very high levels that we’ve seen last year,” Daimler Trucks’ global chief Wolfgang Bernhard said during an earnings conference call earlier this month.

Sales at DTNA’s niche nameplate, Western Star, hit 353 trucks, up from 325 a year ago. That gave it a 2.2% market share.

Tam said DTNA has been bullish for a long time.

“When forecasters were cutting their forecasts, when the analysts were cutting their forecasts, the corporate line was stay the course,” he said.

Tam suggested that what is occurring at DTNA is a reassessment of production or sales that is more consistent with what the market is experiencing. “So I guess, maybe, they are late in acting on the realization that the market is softer than what they were expecting,” he said.

Ann Duignan, an analyst with J.P. Morgan, wrote in an investor note the cancellation rate in January increased to 18.2% of gross [Class 8] orders from December’s 11%.

Meanwhile, sales at Navistar International Corp. shot up 20.6% to 2,605 and a 16.3% market share.

“Our success in January was partially due to timing, but we’re very pleased that customer confidence continues to increase as they experience the outstanding performance and reliability of our products,” said Jeff Sass, senior vice president of sales.

The only other truck maker to see positive results in January was Mack Trucks, where sales jumped 18.8% to 1,181, leading to a 7.4% market share.

John Walsh, Mack’s vice president of marketing, said the figures confirm “we are off to a very solid start.”

Walsh said Mack was working to make gains in the longhaul sector — though he’s pleased that construction continues to show signs of rebounding, and the company still was doing well in the refuse and day cab markets.

Mack and Volvo Trucks North America are brands of Volvo Group.

VTNA’s sales fell 37.2% to 1,085 trucks, or a 6.8% market share.

Magnus Koeck, VTNA’s vice president of marketing, said, “January’s industry decline in overall Class 8 retail sales indicates a continued shift from 2015’s sales, which finished as the fourth-best of all time. Class 8 sales are also being impacted by high product inventory levels that continue to affect manufacturing and freight volumes.”

Koeck said January’s decline followed two strong months for the company.

Paccar Inc. declined to comment on behalf of its two brands, Kenworth Truck Co. and Peterbilt Motors Co.

Kenworth fell 22.5% to 1,682, good for a 10.5% market share.

Peterbilt’s sales fell 5.1% to 2,124, or a 13.3% market share.

“Overall, with respect to the equipment market, the Class 8 truck market remains under pressure given a soft freight and challenging rate environment,” BB&T Capital Market analyst Rheem Wood wrote in an investor note. “Specifically, we believe the 2016 and 2017 Class 8 forecasts remain too high.”

Editorial Director Neil Abt contributed to this story.