Tight Capacity, ELD Mandate Send 3PL Rates Higher

The new year is bringing good news to third-party logistics firms as tight capacity sends the rates they charge shippers higher and their spot market business flourishes.

YOUR GUIDE TO THE MANDATE: Downloadable PDF.

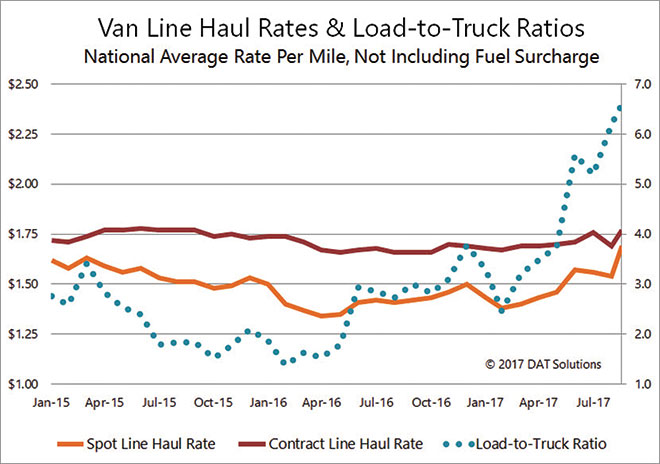

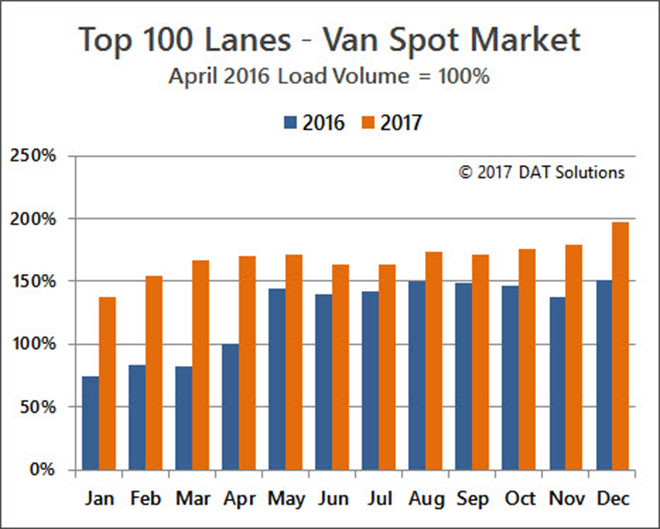

Capacity demand has been building since the spring of 2016 due to solid economic growth, said Mark Montague, an industry pricing analyst with DAT Solutions, operator of a truckload freight marketplace. DAT’s load-to-truck ratio is a measure of capacity that doubled at one point in 2016 and then nearly tripled in 2017. The industry research group FTR found that in December truckload capacity had hit 100%.

In addition to a bustling economy, capacity has been stretched by e-commerce growth and implementation of the electronic logging device mandate, which some fear will exacerbate the driver shortage. This whirlwind has sent more shippers to the spot market.

Abundant freight and surging rates have led some carriers to focus on the lanes that bring them their best return, “causing large segments of the business to migrate even further to 3PLs,” said Jason Beardall, president of England Logistics, which ranks No. 15 on Transport Topics list of the top freight brokerage firms in North America. “The waves in the marketplace over the last 24 to 36 months have caused even the large players to chase unusually high spot market rates.”

In response, some 3PLs have held off on signing yearlong rate contracts with shippers.

“We hesitate to lock in rates for 12 months. Capacity was sucked out of the system in October and November. Then the ELD mandate came in [on Dec. 18]. It’s crazy for any carrier to lock in rates,” said Aaron Keller, vice president of Keller Logistics in Defiance, Ohio. “We don’t always operate this way — where you don’t sign 12-month contracts unless you get the rates you desire. And even then do it with trepidation.”

Keller predicts 2018 will see contract rates up 8% to 10% and spot rates up 10%.

The hurricanes this summer kicked in so much demand that St. Charles, Ill.-based Simple Logistics conducted more business using spot rates.

“We used to lock in yearly rates but the markets have shifted in the last six to eight months,” said Scott Hadley, Simple Logistics’ director of operations. “Rates change on a weekly basis. We tell customers, ‘This is what we see now — rates around here.’ Sometimes they lock it down.”

Pete Emahiser, CEO at Toledo, Ohio-based Tadmore Transportation, sees a more modest rate increase of 2.7% to 3% in 2018 for refrigerated, flatbeds, dry vans and other categories. He predicted that some shippers will refuse to hire drivers that haven’t adopted ELD technology.

“I’m seeing more firms saying they won’t load a non-ELD truck, and those companies and drivers will have a harder time getting business,” Emahiser said.

Beardall said that some carriers will see reduced productivity during ELD implementation — leading some to leave the business — but those that remain will be rewarded with higher rates and increased miles.

“Rate surges for small carriers may just be enough to close the anticipated gap in revenue otherwise caused by ELD implementation,” he said.

"We expect quality capacity to be constrained and truckload rates to increase for the first half of 2018 as the market corrects itself," said Tim Tolari, executive vice president of sales at Arrive Logistics.

DAT’s Montague reported that shippers believe base rates will rise 2% to 4%, while carriers and brokers think the rise will range from 7% to 10%, according to his recent webinar, “Looking Ahead — Pricing and Capacity in 2018,” sponsored by Arrive.

However, the strain on capacity and the ELD mandate have given carriers and drivers the upper hand in negotiations, Montague said, and this will have a greater impact on rate increases.

Firms that he classified as “shipper of choice” — those that provide best practices and open communications with carriers — will see rates rise 3% to 4% from their current base rate, he said. These warehouse/distribution centers keep driver detention to a minimum, load and unload with an eye to the driver’s hours of service, and make efforts to communicate changes that might impact the drivers time at the warehouse.

The next level of shippers make efforts to reach these standards but occasionally fall short. They will see rates rise 5% to 6%, Montague predicted.

Shippers with poor practices towards 3PLs and drivers will see rates rise 7% to 10%. Poor practices include “paying the logistics firm in 90 days, long detention at the dock, poor communications,” Montague said.

The cross currents of change, capacity and market demand are making it hard to predict rates for 2018. What is clear is a need for 3PLs to be adaptable to a fast-moving market.