TIA Says Loads, Revenue Up on Truckload, Intermodal Strength

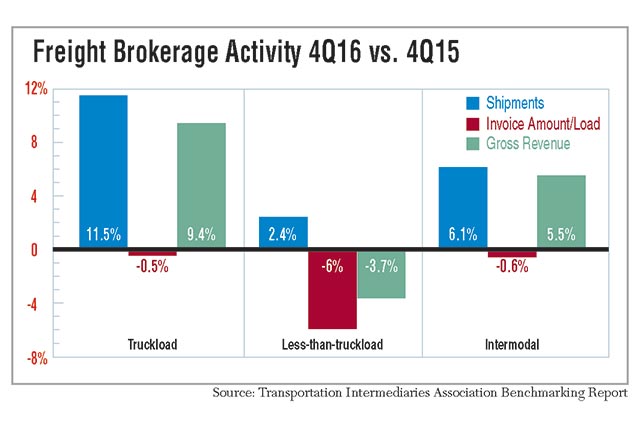

Freight shipments increased 9.2% in the fourth quarter year-over-year, and 3.7% sequentially, as truckload capacity tightened, intermodal activity picked up and less-than-truckload business remained flat, according to the Transportation Intermediaries Association and industry executives.

Results of the group’s quarterly report were based on data from third-party logistics providers that connect shippers to carriers. Truckload, less-than-truckload and intermodal rail freight account for 98% of the activity in the report. Truckload is the largest contributor at 69%, intermodal was 20% and LTL 9%.

Across all modes, shipments increased to 1.34 million loads from 1.29 million, and revenue rose 8.5% to $2.4 billion versus the same period in 2015. Sequentially, shipments increased 3.7% and revenue rose 8.3%.

Truckload shipments rose 11.5% year-over-year, and 6% sequentially, to 924,538 loads in the fourth quarter. However, profit margin per load (the difference between what the shipper paid the broker and what the broker paid in transportation costs) dropped 13.2% year-over-year and 4.8% sequentially.

Nathan Chew, president of supply chain solutions at Range Logistics, told Transport Topics that the results were consistent with his data. The St. Louis-based 3PL is a small company with less than $30 million in revenue.

“Shipments grew 8% in truckload for us year-over-year, but margins and revenue have been compressed,” Chew said. “We’re susceptible to what the market will pay. A lot of shippers knew the pendulum was in their corner in the fourth quarter.”

Jason Beardall, president of England Logistics, agreed there was strong holiday volume in the fourth quarter, but pricing hurt his bottom line. England Logistics ranks No. 16 on the Transport Topics sector list of top freight brokers in North America.

“Volumes strengthened [from the third quarter] at a pace that had carrier rates inflating quickly for the season in the spot market. Third-party logistics providers and brokers absorbed much of this inflation, which had a heavy impact on Q4 margins when compared to Q3. In other words, 3PL contracted revenue per transaction remained relatively flat while our cost per transaction seasonally rose,” Beardall said.

GlobalTranz Enterprises CEO Bob Farrell told TT that his truckload profit margins remained flat sequentially. The company ranks No. 12 on the freight broker sector list.

Less-than-truckload shipments rose 2.4% year-over-year, but dropped 5.3% sequentially, to 114,700 loads. Profit margin per load was down 5.6% from one year ago and virtually unchanged from the third quarter.

“I would say the LTL marketplace was mixed and spotty. There are folks that had success and others that felt blasé,” said report author Mark Christos, vice president at Matson Logistics Services, No. 27 on the freight sector list.

Farrell added that his margins fell about 2.5% on a year-over-year basis in the LTL business.

“More shippers looked at truckload as a great solution. We had customers who went to truckload when they previously had used LTL, based on the price points,” he said.

Intermodal shipments rose 6.1% year-over-year but were virtually unchanged sequentially at 265,690 loads. The invoice amount per load dropped 9.9% year-over-year but rose 2.2% sequentially. Profit margins were down less than 100 basis points.

Executives told TT that their 3PL business reflected the same quarterly trend that the Class I railroads presented to analysts: worse than 2015 but better than previous quarters.

“As we saw tightening in truckload and pricing increase in Q4, we experienced a better pricing opportunity for intermodal and more customers converted a percentage of their loads to intermodal to save money,” said Cosmo Alberico, chief financial officer at Odyssey Logistics & Technology, No. 50 on the Transport Topics Top 50 list of the largest logistics companies in North America.

“The improvement moved us out of the red and into the black for the full year in our intermodal business. Had it not been for the fourth quarter, we would’ve seen shipments down 2% and revenues down 4% in 2016,” Chew said.

As for 2017, executives said that the first quarter is shaping up to be better than last year. They’re crediting a post-election “Trump Bump,” but they’re also uncertain about whether there is underlying economic strength to sustain the trend.

“We’re up so far in the first quarter on gross revenue, net revenue and [earnings before interest, taxes, depreciation and amortization], so our operating metrics are looking good sequentially and year-over-year,” Farrell said.

At Range Logistics, shipments jumped 12% in truckload, 5% in LTL and 6% in intermodal.

“It’s like a golf game. You’ll have birdies and you’ll have pars, but you’ll also hit bogeys in certain months. You just hope at the end of the year that you come out with a nice score. Fortunately, we’ve begun this year with a couple birdies,” Chew said.