Texas Instruments’ Forecast Signals Chip Demand Slump Is Spreading

[Stay on top of transportation news: Get TTNews in your inbox.]

Texas Instruments Inc., whose chips go into everything from home appliances to missiles, gave a weak sales forecast for the current quarter, indicating that the falloff in semiconductor demand is spreading beyond computing and phones.

Fourth-quarter revenue will be $4.4 billion to $4.8 billion, the company said in a statement Oct. 25. That compares with the $4.93 billion average estimate from analysts. Profit will be $1.83 to $2.11 a share, also missing projections. The stock fell more than 5% in the wake of the results.

While Texas Instruments has the largest customer list in the semiconductor industry — making its projections an indicator of demand across the economy — producers of cars and industrial machinery are its two biggest sources of revenue. Those customers may now be slowing orders, joining makers of computers and phones in cutting back.

Many of the largest companies in the industry — Samsung Electronics Co., Intel Corp. and Nvidia Corp. among them — have warned that demand is dropping steeply. Now investors are looking for indications of when the orders will reach their low point.

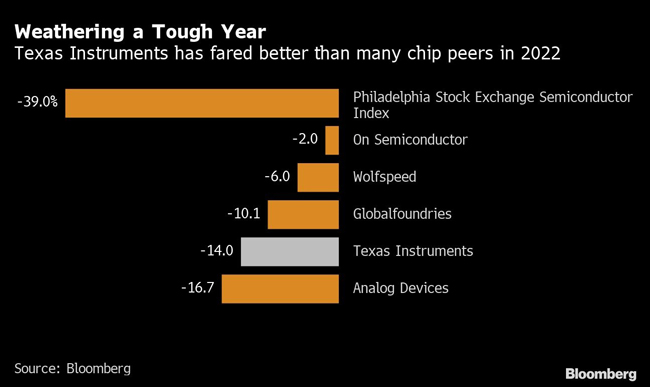

The Philadelphia Stock Exchange Semiconductor Index, a key benchmark, has lost 39% of its value in 2022, but it has now climbed seven days in a row, suggesting that investors think the industry has bottomed out.

Texas Instruments shares have fallen this year as well, though they’ve performed better than most of its peers. They’re down 14% in 2022, making Texas Instruments the fourth best stock in the index this year.

Third-quarter net income rose to $2.47 a share, Texas Instruments said. Revenue climbed 13% to $5.24 billion. The company had posted double-digit percentage increases for six straight quarters coming in to Oct. 25’s results.

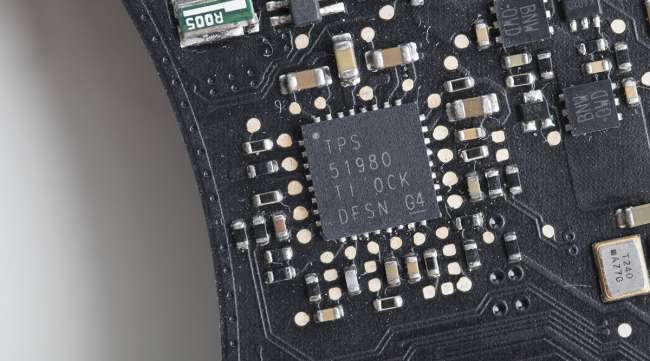

One of the pioneers of the chip industry, Texas Instruments is the largest maker of analog and embedded processing chips, which go into products as varied as factory equipment and space hardware. Such chips generally require less advanced production than Intel Corp. processors or other digital products. That focus has allowed Texas Instruments to become one of the most profitable companies in the industry and to devote its cash to dividends and share buybacks.

Texas Instruments’ management typically refuses to give predictions about future demand for electronics, outside of its basic forecasts.

Executives have argued that, while there will always be fluctuations in the semiconductor industry, its chips have lasting value. Unlike digital semiconductors such as microprocessors, Texas Instruments’ products take years to become obsolete, meaning that accumulating inventory in times of weaker demand isn’t the danger sign that it is for other chipmakers.

Texas Instruments manufactures about 80% of its chips in its own factories, and the company is expanding that footprint. It has said that will result in higher levels of capital spending over the next couple of years, causing some analysts to express concern that the expenditures will crimp its budget for buybacks.

Want more news? Listen to today's daily briefing below or go here for more info: