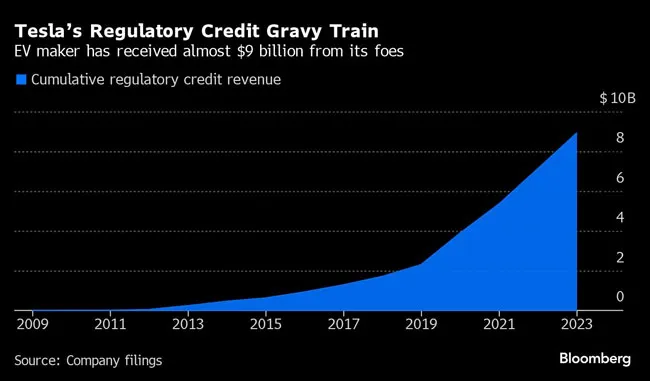

Tesla Rakes In Billions From Selling Regulatory Credits

[Stay on top of transportation news: Get TTNews in your inbox.]

Tesla Inc. continues to cash in on other carmakers needing help to meet emissions standards, keeping up a lucrative business the company thought would fade away.

The Elon Musk-led manufacturer generated $1.79 billion in regulatory credit revenue last year, an annual filing showed this month. That brought the cumulative total Tesla has raked in since 2009 to almost $9 billion.

Selling regulatory credits is a tidy business for Tesla. It earns them by making and selling electric vehicles, then sells the credits to manufacturers whose new-vehicle fleets exceed emissions limits set by various authorities, including in China, the European Union and state of California.

Tesla bears little to no incremental cost earning the credits, so the sales are virtually pure profit.

Three and a half years ago, Tesla’s chief financial officer said he expected the revenue to gradually dissipate.

“We don’t manage the business with the assumption that regulatory credits will contribute in a significant way to the future,” then-CFO Zachary Kirkhorn said during a July 2020 earnings call. “It will continue for some period of time, but eventually this stream of regulatory credits will reduce.”

Tesla made $1.58 billion selling regulatory credits that year. While the company generated about 7% less credit revenue in 2021, it’s brought in more than $1.7 billion each of the past two years.

It’s no secret that auto executives rue the fact they’ve had to kick money Tesla’s way for this purpose.

“It really makes them mad that Tesla got so much of a boost out of being the only purely electric car manufacturer out there,” Mary Nichols, the former chair of the California Air Resources Board, told Bloomberg News in 2017. “In effect, they helped to finance this upstart company which now has all the glamor.”

Want more news? Listen to today's daily briefing above or go here for more info

While more EV makers have emerged since then, Tesla’s regulatory credit business may still have room to run.

Automakers including Volkswagen AG and General Motors Co. have fallen short of their EV goals and delayed or canceled electric vehicle manufacturing investments. VW and GM both have needed help meeting emissions standards in recent years, as has Honda Motor Co. and Jaguar Land Rover.

Meanwhile, emissions rules aren’t getting any easier. Europe has set stricter car emissions targets starting next year and from 2030 onward, while the U.K. adopted a zero-emission vehicle mandate beginning this year.