Tesla Q4 Earnings Fall Short of Analyst Estimates

[Stay on top of transportation news: Get TTNews in your inbox.]

DETROIT — Tesla’s net income more than doubled last quarter thanks to a one-time tax benefit, but it warned of “notably lower” sales growth this year.

The Austin, Texas, vehicle, solar panel and battery maker said its net income was $7.93 billion from October through December, compared with $3.69 billion a year earlier.

But excluding one-time items, such as the $5.9 billion noncash tax benefit for deferred tax assets, the company made $2.49 billion, or 71 cents per share. That was down 39% from a year ago and short of analyst estimates. Data provider FactSet said analysts expected earnings of 73 cents per share.

Tesla reported quarterly revenue of $25.17 billion, up 3% from a year earlier but also below analyst estimates of $25.64 billion.

Profits were off because Tesla lowered prices worldwide through the year in an effort to boost its sales and market share.

Earlier this month, Tesla reported that fourth-quarter sales rose by almost 20%, boosted by steep price cuts in the U.S. and worldwide through the year. Some cuts amounted to $20,000 on higher-priced models.

Shares of Tesla Inc. fell 4.4% in trading after the markets closed Jan. 24.

Tesla’s sales growth rate was slower than previous quarters. For the full year, its sales rose 37.7%, short of the 50% growth rate that CEO Elon Musk predicted in most years. The company reported deliveries of 484,507 for the quarter. As usual, the bulk of Tesla’s sales were its lower-priced Models 3 and Y.

Fast-growing Chinese powerhouse BYD passed Tesla in the fourth quarter as the world’s top-selling electric vehicle company.

In its letter to shareholders released after the Jan. 24 closing bell, Tesla cautioned that sales growth this year may be “notably lower” than the 2023 growth rate, as it works to launch a next-generation vehicle at a factory near Austin.

The company, the letter said, is between two big growth waves, one from global expansion of the Models 3 and Y, and a second coming from the next-generation vehicle.

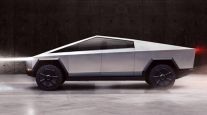

Tesla said Cybertruck deliveries will ramp up through this year. Also this year, revenue growth from energy storage should outpace the automotive business, the company said.

“We expect the ramp of Cybertruck to be longer than other models given its manufacturing complexity,” the company said.

Ben Gardiner, a cybersecurity expert at the National Motor Freight Traffic Association, shares practical, effective strategies to shield your business. He offers insights into operating systems and a comprehensive guide to cyber resilience. Tune in above or by going to RoadSigns.ttnews.com.

Tesla’s gross profit margin fell to 17.6% for the quarter, down 3.8 percentage points from a year ago as price cuts chewed into profits.

For the full year, Tesla reported net income of almost $15 billion, including the one-time tax benefit. Excluding it, the company made $10.88 billion, down 23% from 2022. Gross profit margin was 25.6% in 2022, but that dropped to 18.2% last year.

Tesla said that during the fourth quarter, it released the latest version of its “Full Self-Driving” software to employees and then selected customers who will test it. The new version uses artificial intelligence to help control steering and pedals instead of “hard coding” all driving behaviors. But the system still can’t drive itself, and Tesla says owners must be ready to intervene at all times.

Want more news? Listen to today's daily briefing below or go here for more info: