Technology Helps Manage Spot Market

[Stay on top of transportation news: Get TTNews in your inbox.]

Despite a positive outlook in the short term, freight markets will continue to experience tight capacity that will be exacerbated by a labor shortage, logistics experts said. As these issues persist, technological solutions are increasingly helping shippers and carriers manage a boisterous business climate in which spot freight plays a prominent role.

“The top-line transportation cost has gone up dramatically for shipping companies, and the cost for trucking companies to operate has gone up as well,” said Kenny Lund, executive vice president of Allen Lund Co., based out of La Cañada, Calif.

“There’s been a return to more spot pricing and it’s been simply necessity because companies have not been able to honor contracts or there’s been more freight than what is anticipated in the contracts,” said Lund, who noted shippers often have to turn to the spot market to get their freight moved.

Logistics technicians take calls at one of C.H Robinson's offices. (C.H. Robinson)

Lund’s company brokers many types of freight — about 41,000 loads per month — and specializes in fresh produce and grocery. During the pandemic some shippers in perishables and grocery have seen truckload volumes increase, while food service volumes decreased.

“Long story short: For groceries — people were shopping in stores,” said Anne Reinke, CEO of the Transportation Intermediaries Association. “Restaurants? People weren’t going to.” She added that some brokers “shifted their mix so that they could do more grocery and less food service.”

Transportation management systems (TMS) and related technology offerings are designed to provide up-to-the-moment information about shippers’ loads, available carrier capacity and rates. TMS providers are emphasizing how they can bring shippers, carriers and brokers together on their platforms to collaborate, to enhance efficiency of freight movement in the midst of a supply chain subject to disruptions.

Dan Graham, an owner-operator based in Albia, Iowa, has used C.H. Robinson’s Navisphere Carrier platform for about five years.

C.H. Robinson

“I see everything I need to see and can book my freight from it,” Graham said while his temperature-controlled trailer was being loaded at a cold storage facility in Mount Pleasant, Iowa. “I don’t hardly use anything else but that. It’s just for the convenience and the easy.”

During the pandemic, some shipper and receiver facilities have been short-staffed, Graham said. “It takes a little longer sometimes to load and unload at places,” but he said enough time is built into his bookings that it has not been an issue for him.

Contractual or planned procurement in the truckload business is usually “somewhere between 80 and 85% of all procurement,” said Tim Gagnon, vice president of analytics and data science for logistics services provider C.H. Robinson. He said that COVID and the disruption has put a lot of pressure on planned or contract freight. “The spot market has become the catch-all for the universe of freight that is unplanned,” he said.

Gagnon

Gagnon added that shippers often tender freight that’s actually not well-suited for a contractual commitment. Carriers are bidding on freight that is not a good candidate. For instance, Gagnon noted, the volume of the freight might fluctuate sharply.

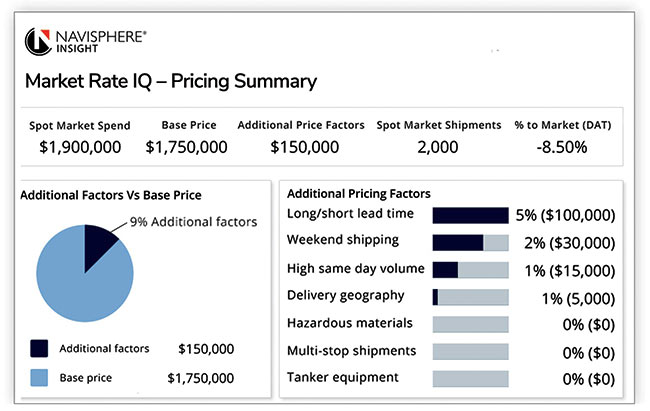

C.H. Robinson has introduced a procurement tool for shippers called Procure IQ, which analyzes each shipping lane and recommends which freight should be sent out to bid and which is better suited to the spot market.

Among technology providers working to support the search for capacity is PCS Software, which recently introduced Carrier Address Book, a tool that features information on carriers in a searchable directory, for use by on-platform shippers.

“In some cases for the shippers we’re working with, the spot market has replaced their contracted rates,” said Chris Noble, director-level product manager for PCS Software. “We are seeing a much higher percentage going through spot because carriers won’t pick the loads. They won’t cover it.”

However, Noble noted, shippers will participate in the spot market for the same lane.

Ken Adamo, chief of analytics for DAT Freight & Analytics, said that transportation management systems are becoming more versatile and effective through integration with complementary technology solutions.

“For most TMS providers, it’s faster and less costly to integrate data and features developed by a third party,” Adamo said. “It also makes for a better experience for users because they can do more work without having to leave the TMS.”

Adamo added that fleets can help shippers eliminate or manage “ghost lanes” in the routing guide, which connects a shipper’s annual bid with load tendering in a TMS. “Ghost lanes” — lanes that are rarely or never have any volume to tender — denotes lanes where there is a low primary-carrier acceptance ratio and high reliance on the spot market.

A forklift driver loads cargo onto a trailer at a loading dock. (Carrier Logistics)

“For most shippers, the routing guide handles 80% to 90% of all shipments — essentially, all contracted moves,” Adamo said. “Unfortunately, it also includes lanes with intermittent, nonconsistent and low volumes of freight, which creates problems for carriers.”

He added that for the 100-plus shippers using DAT, lanes with fewer than 12 loads per year account for 50% to 80% of all lanes in a shipper’s routing guide; but those lanes make up only 3% to 7% of total volume. Low-volume lanes account for 20% to 40% of the shippers’ total spot truckload volume. Lanes with more than 100 annual loads average 2% to 4% spot, Adamo said adding that most shippers include low-volume lanes as separate point-to-point lanes within their annual bid, resulting in the “ghost lanes.”

Some technology companies that don’t bill themselves as TMS are highlighting how they can boost coordination among the players in trucking. For instance, Transflo introduced an enhancement to its Unite platform, designed to speed up documentation of a shipment from shipper to driver, “whether they are a current Transflo carrier or not,” said Andrew Fulton, vice president of product management.

Transflo provides a platform to which a freight broker can connect their TMS directly, Parker McCrary, Transflo’s vice president of supply chain solutions, pointed out.

“It doesn’t cost the carrier anything,” he said, qualifying that “Transflo does have solutions that carriers pay for but in this case … the broker pays for it. The carrier has free access to a portal where they can manage their shipments, assign them to drivers,” and drivers have access to the mobile platform.

In this episode, host Michael Freeze asks, how are companies saving money by leasing trucks rather than owning? For answers, we speak with Jim Lager of Penske Truck Leasing and Al Barner of strategic fleet solutions at Fleet Advantage. Hear a snippet above, and get the full program by going to RoadSigns.TTNews.com.

Looking ahead, technology and logistics service providers said they expect to be addressing similar challenges, or variations of the current challenges.

“The carriers are the most advantaged and have the most leverage compared to the intermediaries and the shippers,” said Reinke, of TIA. “They can kind of pick and choose what they want to carry, which means they can choose the best spot rate that they see.”

If demand decelerates in upcoming months, diesel prices and a labor shortage could still be disruptive, said Reinke. “I don’t think the spot market gets less volatile for a while,” she added.

Noble said carriers may take a load anticipating they’re going to see something else that pays better. “They know that their truck has value and the closer it gets to the time when that shipment’s got to go, the higher the value is of that truck,” he said.

Meanwhile, shippers are coming up with contracts that are increasingly creative, Lund said.

“Now we’re seeing contracts that may be for a year, but the price adjusts every month,” he said. Or a contract might be for one month, or for one quarter. Some are “for very specific lanes, but not your whole mix of freight,” he said. “Shippers don’t really want to do new contracts right now because they would be locking in the highest prices that we’ve ever seen.”

Want more news? Listen to today's daily briefing below or go here for more info: