Surging Corn Prices Put US Wheat Back in the Feed Trough

[Stay on top of transportation news: Get TTNews in your inbox.]

A looming shortfall in U.S. corn production after a historical spat of wet weather means wheat is back on the menu at cattle feedlots in the southern Plains.

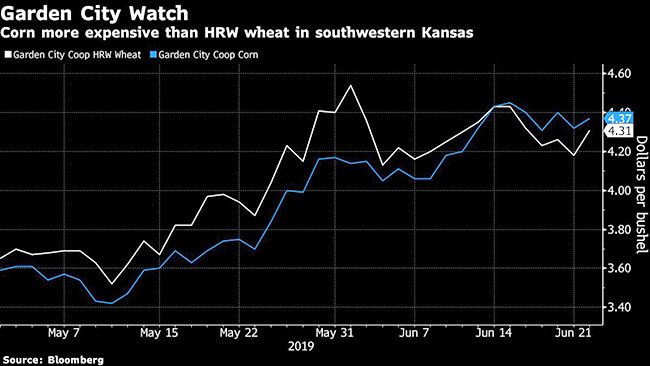

Surging prices for corn, the gold standard in fattening cattle, are making wheat that’s usually reserved for human food into a relative bargain for feeding livestock. Prices for both crops surged after record rainfall this spring saturated American fields. But corn’s gains have outpaced those of wheat, shrinking the latter’s traditional premium. In some parts of the U.S., the cash spread has even swung to a discount.

Hard red winter wheat, typically used to make flour for bread, was being sold as feed to cattle and hog operations for shipment in July, August and September, said Justin Gilpin, CEO of the Kansas Wheat Commission, a trade group.

“In southwestern Kansas, we’ve seen more wheat put on the books for feed than in quite a while,” Gilpin said in a telephone interview. “That’s in large part because feeders are concerned about corn prices and availability.”

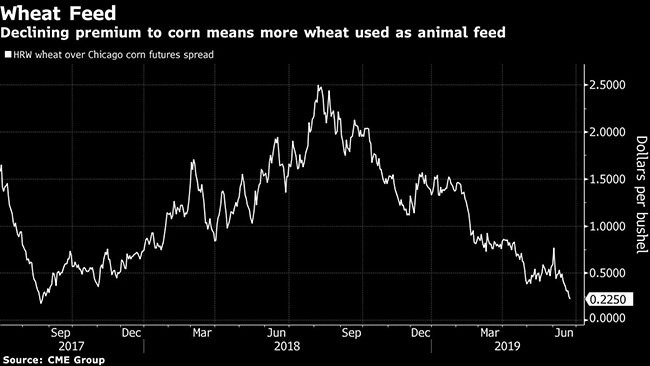

Declining premium to corn means more wheat used as animal feed

The U.S. Department of Agriculture earlier this month surprised traders by projecting smaller-than-expected wheat stockpiles, partly amid expectations for more use in livestock feed. The agency will issues figures on quarterly grain inventories in a report due June 28.

The USDA estimated about 140 million bushels of wheat will go to domestic feed and residual use in the season that started June 1. While that’s nearly triple last season’s amount, it still represents only about 4% of total supply, leaving room for more demand gains that could further erode reserves.

Also adding to the mix is expectation of lower wheat quality this year, which may leave more of the crop for feed instead of human consumption. Harvesting in key U.S. states is running behind and the average protein content in hard red winter grain is lower than last year, according to U.S. Wheat Associates.

Cattle ranchers in western Texas look at the grain as a feed option when wheat futures’ premium to corn gets close to about 60 cents per bushel, according to Charlie Sauerwein, a consultant at grain merchant WindRiver Grain LLC in Garden City, Kan.

The premium for September hard red winter wheat futures dropped to about 23 cents a bushel over corn for the same delivery month in Chicago on June 25. When the futures spread narrows this much, it usually means that in some cash markets, wheat can be found at a discount to corn. Also, wheat is already being harvested, giving some livestock producers an immediate cheaper option as corn fields won’t be cut for a few months.

“We are as narrow as we’ve been in history,” Sauerwein said of the spread. “It’s an incentive to look at wheat.”