Bloomberg News

Stocks Rally, Crude Oil Jumps on Election Day

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. stocks rose as a gust of optimism swept through global equity markets as millions of Americans headed to vote. The dollar weakened and crude oil increased by the most in a month.

The S&P 500 jumped for a second consecutive day amid growing bets that banks and oil companies are among sectors poised for gains after the election. The benchmark index has swung more than 1% in six of the past seven trading sessions. Meanwhile, Alibaba Group Holding Ltd.’s U.S.-traded shares tumbled as much as 9.7% after Ant Group Co. said its listings in both Shanghai and Hong Kong have been suspended.

Treasuries fell and a gauge of the dollar dropped the most in three weeks as a risk-on mood prevailed. Oil extended gains after jumping Nov. 2 on increasing signs OPEC+ will delay a planned easing of output cuts.

“That suggests investors are much more focused on the election and anticipating more of a decisive result tonight,” said Mike Bailey, director of research at FBB Capital Partners. “If we continue to see markets up 1-2%, it perhaps suggests they are going with the betting odds, either a blue wave or a decisive presidential election and are trading on that.”

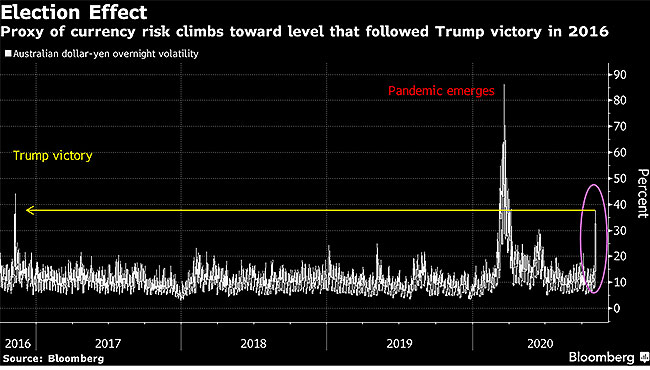

While trades reflecting a Democratic sweep held firm, betting markets aren’t convinced. One gauge slipped to just over 50% odds of the so-called blue wave — that Democrats oust President Donald Trump and take congressional majorities. Traders hedged prospects of post-vote volatility, driving a measure of expected swings in China’s yuan to its highest level in more than nine years.

“The election outcome will drive all markets over the next day or two,” Torsten Slok, chief economist at Apollo Global Management, said in an interview. “How they move depends on the extent to which we have clarity about the results.”

Markets are reflecting more optimism following weeks of speculation that a contested election outcome may produce no clear winner for some time and roil markets. Polls continue to indicate that Democratic nominee Joe Biden is ahead, though the race looks tight in some battleground states, some of which are seeing virus cases soar.

In Europe, mining shares climbed, helped by the slumping dollar. Banks rallied after BNP Paribas SA joined its European peers in posting lower-than-expected bad-loan provisions from the pandemic.

Elsewhere, China suspended Ant Group’s $35 billion offering, derailing the world’s biggest initial public offering, because of “supervisory interviews” by related agencies.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More