Slow-Rising Driver Pay Set to Jump in 2018

Driver pay and other incentives are on the rise, spurred by a growing economy, tight capacity, driver turnover and a persistent shortage of drivers, leaders from the National Transportation Institute recently told investors from Stifel, Nicholas & Co.

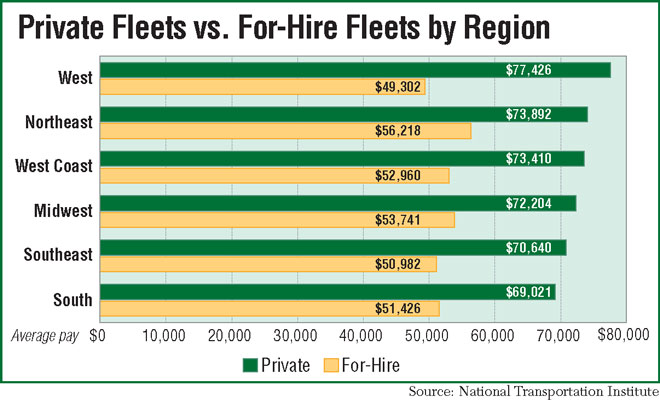

Drivers with private fleets are earning as much as 36% more than their for-hire counterparts and receiving predictable routes that get them home at night, said Leah Shaver, chief operating officer of the institute, a provider of benchmarking surveys and analysis of driver compensation for the transportation industry.

Rates per mile in the third quarter rose a penny to 2 cents, but some outlier carriers took them up 4 cents to 7 cents, and those higher jumps will become more widespread in 2018, said Gordon Klemp, president of the institute.

Shaver was featured during a “What Makes Driver Pay Move” conference and analyzed pay by region and by fleet driver versus for-hire driver. Klemp discussed the current pay landscape and predictions for 2018.

Shaver said demand for drivers is so strong in the Midwest and Northeast that “you see pay gaps of up to a few cents a mile, sometimes even a little bit more.”

This regional approach to pay that has become pervasive in the industry, coupled with the shortage of 50,000 drivers as calculated by American Trucking Associations, suggests “that there are just not enough drivers to sustain the longhaul model,” Shaver said.

Private fleets are the place to be for drivers, Shaver said. The pay per year is often $20,000 higher compared with a driver at a for-hire fleet and in the West pay can be 36%, or $28,000, higher.

Klemp

Along with offering favorable routes to their drivers, more than a third of private fleets offer hourly pay while about 20% add component pay for such tasks as a delivery, Shaver said.

This was seen in November when Oklahoma City, Okla.-based refrigerated carrier Freymiller implemented a “guaranteed detention” program that pays its drivers for their time while detained at shipper and receiver facilities.

The up-front communication on pay and schedule by private fleets allows the driver to know exactly what to expect every week. “So, not only do they have consistent paychecks at extremely higher levels but they know exactly when they are going to be home,” Shaver said.

Fleets can cherry-pick the drivers they want, and that’s one reason their turnover rate averages 30% in contrast with 90% at for-hire fleets.

The tortoise-like rise in hourly pay rates today will likely become a fast-moving hare in 2018, said Klemp, who recapped during the call the major reasons for the shortage — drivers on average are 52 years old, GDP is growing at a 3% clip, unemployment is near 4%, for-hire driver pay has risen an anemic 6.3% since 2006 and many prospective drivers are opting for a gig-economy job like Uber driver.

Klemp said some carriers are offering their drivers referral bonuses for bringing in solid drivers and sign-on bonuses in busy traffic areas like Chicago, Fort Wayne, Ind., and Allentown, Pa. For instance, drivers with at least a year of experience are seeing such recruiting incentives as a $10,000 sign-on bonus that pays out 40% in the first four months.

One example is the $15,000 sign-on bonus for drivers with at least six months experience who join New Ulm, Minn.-based carrier J&R Schugel Trucking before the end of the year. Drivers can receive $250 for 7,500 to 9,999 dispatched miles driven in a month, or $500 for 10,000-plus dispatched miles driven.

Klemp said conditions are similar to those in 2004-2005, when turnover jumped as high as 121%, the GDP hit 3% and freight rates rose. “Pay increased 21% and drivers were happy, but they were almost impossible to recruit. This is our pay model now,” Klemp said.

That indicates the 4-cent to 7-cent increase in rates per mile implemented by the outliers could well become the norm by this time next year, he said.