Senior Reporter

Seasonally Strong Trailer Orders in June Up 51% Year-Over-Year, Top 20,000

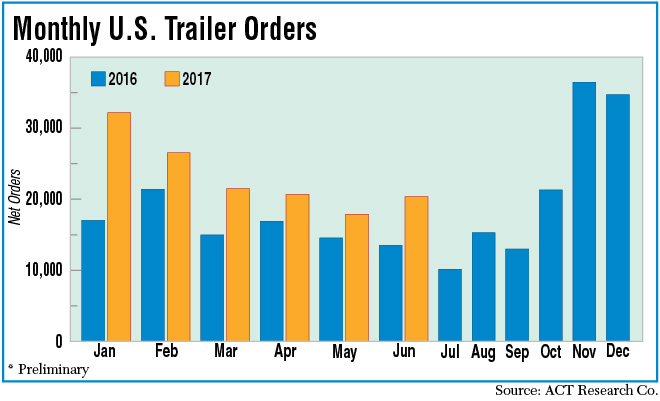

U.S. trailer orders shot up 51% in June and notched the seventh consecutive month of year-over-year gains. They topped 20,000 orders amid strong spot rates, burgeoning e-commerce and drop-and-hook opportunities as well as a pre-buy in flatbeds, analysts said.

Orders reached 20,375, compared with 13,532 in the 2016 period, said ACT Research Co., which cited preliminary net order data it soon would adjust as needed.

Year-to-date, orders reached 139,150, up 41% compared with 98,400 in the 2016 period, according to ACT. “It was pretty dramatic, and a really big number on dry vans,” Frank Maly, ACT’s director of commercial vehicle transportation analysis and research, told Transport Topics, speaking of the year-over-year gain in June.

Dry van orders were up nearly 125% compared with last year, according to ACT.

Maly said large carriers, ordering against typical seasonal patterns, were active.

“It was pretty evident that there was some larger-fleet activity that also hit the books in June [in addition to small and medium-size carriers],” Maly said.

However, June orders for dry vans were less than 50% of what ACT saw booked for dry vans in January. “It’s the kind of thing — what time of year is it happening? This order season started later, and it continues to kind of dribble out as we move into the summer,” he said.

Flatbeds and refrigerated trailers notched the best month-over-month improvement, ACT said.

Flatbed demand has been steadily rising in 2017, compared with 2016, but there was a “pretty good spike in June,” said Alan Briley, president of Fontaine Trailer’s commercial platform business. Fontaine is a unit of the Marmon Highway Technologies, in turn part of Berkshire Hathaway Co.

“We view the projected overall flatbed build for 2017 as at or ever so slightly above historical averages. So this is not a bad year; it is an average year,” Briley said.

At the same time, there is a pre-buy ahead of greenhouse gas regulations that will affect certain models of flatbed trailers beginning in January, he said, citing a spike in orders from the oil field services sector and rental and leasing companies.

“I have not quantified it, but it is an impactful number for our business,” Briley said. “That may have driven some of that summer spike. We’ll see if it continues in July.”

The research firm FTR pegged June orders at 18,900, calling it a final net number.

Trailer demand “continues to surprise me,” said Don Ake, vice president commercial vehicles at FTR. “I have had to increase my forecast almost every month because I did not expect the dry van market to continue at this pace, and the flatbed market looks like it is back now.”

Trailer maker Wabash National Corp. reported on July 25 that it shipped 13,600 trailers in the quarter ended June 30, compared with 15,350 in the 2016 second quarter. The 2017 period, however, was its second-best second quarter ever for net income and revenue, trailing only the same quarter a year earlier.

Its backlog was $762 million as of June 30 and remains “seasonally and historically strong, supporting our long-standing belief that trailer fleet age, regulatory compliance requirements and customer profitability support a continued favorable demand environment,” Wabash CEO Richard Giromini said in a statement.

Wabash also raised its guidance for the year slightly to between 53,000 and 56,000 trailers shipped, compared with guidance of between 52,000 and 56,000 trailers in the first quarter.

The spot freight market remains hot, prompting small and medium fleets to order trailers, FTR’s Ake said.

Freight volumes and prices moved lower in mid-July, according to load board operator DAT Solutions, as is typical. “Still, we’re coming off some of the highest prices we’ve seen in years,” it said.

Rates for flatbed loads were the highest throughout the first three weeks of July, compared with refrigerated and dry vans, according to DAT.

E-commerce also is a key factor in the ongoing demand this year, experts said.

It is “definitely” spurring orders to accommodate related drop-and-hook procedures, said Glenn Harney, chief sale officer for Hyundai Translead.

“Drop-and-hook benefits driver utilization. This trend has been growing to better utilize the precious driver resources,” said David Giesen, vice president of sales at Stoughton Trailers.

Charles Willmott, chief sales officer for Strick Group, also agreed on the demand driven by e-commerce.

“A primary reason for that is that trailers remain the ‘stupidest’ links in the freight logistics chain,” Willmott said. “When trailers start to be equipped with more ‘intelligence,’ they will be used more efficiently, reducing the need for more trailers and improving a carrier’s return on investment.”