Rivian May Lose Nasdaq Spot After 90% Selloff

[Stay on top of transportation news: Get TTNews in your inbox.]

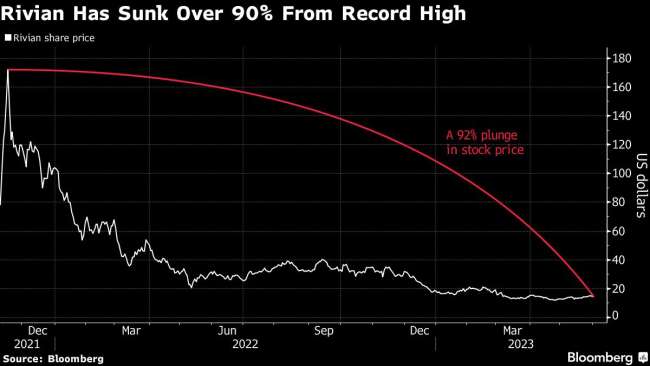

Shares of Rivian Automotive Inc., the money-losing electric vehicle startup, may get pushed out of the Nasdaq 100 Index as early as this month after plunging more than 90% from their record high, according to JP Morgan Securities.

The index typically removes the smallest members of the Nasdaq 100 if the company is weighted at less than 0.1% of the gauge for two consecutive months, JPMorgan analyst Min Moon writes in a note June 1. As Rivian was below 0.1% as of April 28 and May 31, Moon expects the carmaker to be excluded from the index on the third Friday of June.

ON Semiconductor is ranked at the top of the eligible companies to replace the EV maker, Moon added.

A removal from the index would deal another blow to a stock that has been pummeled since soon after its November 2021 initial public offering.

After briefly riding the frenzy for all things related to electric cars, Rivian’s shares started unraveling. Investors soured on risky growth names, correctly anticipating the Federal Reserve would raise rates to arrest inflation, in turn slowing the economy and making sales of an expensive electric pickup truck less likely.

Rivian did not reply to an email requesting comment on June 1. Representatives of Nasdaq have not provided a comment yet.

Rivian shares fell as much as 4.8% to $14.02 on Thursday in New York, but later pared most of the losses to trade down 0.1% by 1:54 p.m. EDT. That takes the stock down 20% just this year, compared to another EV startup Lucid Group Inc.’s 3.4% decline. Meanwhile, industry leader Tesla Inc.’s stock has risen 65% over the same period.

Want more news? Listen to today's daily briefing below or go here for more info: