Senior Reporter

Price of Diesel Soars 10.5¢ a Gallon to $3.951

[Stay on top of transportation news: Get TTNews in your inbox.]

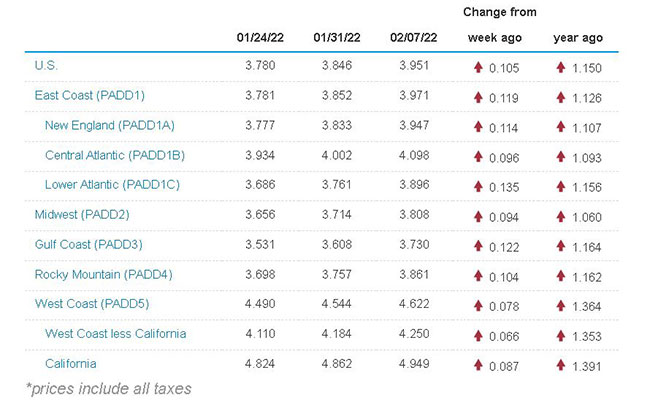

The national average price for diesel continued its rampage in the new year, surging 10.5 cents to $3.951 a gallon, according to Energy Information Administration data released Feb. 7.

Diesel has increased 33.8 cents a gallon over the past five weeks.

A gallon of trucking’s main fuel costs $1.15 more than at this time in 2021.

U.S. average on-highway #diesel fuel price on February 7, 2022 was $3.951/gal, UP 10.5¢/gallon from 1/31/22, UP $1.15/gallon from year ago https://t.co/o6ZihJz0xv #truckers #shippers #fuelprices pic.twitter.com/WLbPQ3lDOn — EIA (@EIAgov) February 8, 2022

The last time diesel cost at least as much as its current price was May 5, 2014, when it was $3.964.

Diesel rose in all 10 regions in EIA’s weekly survey, with the largest gain 13.5 cents in the Lower Atlantic. The Gulf Coast was next highest at 12.2 cents.

Gasoline increased by 7.6 cents to reach $3.444 a gallon for the national average. The price was flat in the Rocky Mountain region but rose everywhere else.

The high price of fuel is part of a larger petroleum wave that fleets must contend with, one motor carrier executive noted.

“So we’re still seeing increasing rates really on the average price per gallon. And as that increased through the year, the average in January was up about 39% versus January of last year, just for the national average there,” Adam Satterfield, chief financial officer at Old Dominion Freight Line Inc., said during the company’s latest earnings call.

“And certainly, there’s more than just the direct cost of diesel fuel that we use in our operations. As fuel prices go higher, that certainly works its way into tires and other components that we have to deal with. So anything that’s sort of fuel-related, we’ll see that same type of inflation on,” Satterfield said.

Old Dominion Freight Line ranks No. 10 on the Transport Topics Top 100 list of the largest for-hire carriers in North America. It ranks No. 4 on the TT list of the top less-than-truckload carriers.

Shell CEO Ben Van Beurden said during a recent earnings call that for the heavy-duty trucking sector, “what I would love to have [Shell’s] trucking business figuring out is how can I grow my business without just selling more diesel. So can we somehow find ways and means to sell bio-LNG (liquefied natural gas), hydrogen, biofuels in general? And how do I work together with my customers, and maybe with regulators, depending on which jurisdiction we are working in, to grow that business?”

U.S. average price for regular-grade #gasoline on February 7, 2022 was $3.444/gal, UP 7.6¢/gallon from 1/31/22, UP 98.3¢/gallon from year ago https://t.co/UQcrTUJCTj #gasprices pic.twitter.com/kNkwqh0iy3 — EIA (@EIAgov) February 8, 2022

He added: “So at this point in time, it is a shift from, well, if the opportunity is there, we may actually take advantage from it — to how do I make sure that this opportunity will come.”

West Texas Intermediate crude oil closed at $91.32 on Feb. 7, compared with $88.15 on Jan. 31. It has traded in a 52-week range of $52.50 to $93.17.

Oil prices going forward remain volatile.

“A lot of the geopolitical risk is priced in to crude currently so any progress, even small, could take a bit of that premium out of the price,” Rebecca Babin, senior energy trader at CIBC Private Wealth Management, told Bloomberg News. “It will not induce a massive sell-off unless something concrete happens but if things are not getting worse crude starts to fade off the highs.”

The possibility of more Iranian oil comes as global supply has increasingly been unable to keep up with surging demand from economies emerging from the pandemic, Bloomberg noted. OPEC+ is struggling to meet its pledged output increases, in part due to outages in Libya, while traders are looking to see how much the U.S. shale patch will lift output this year.

With prices hanging around their highest since 2014, some believe oil executives are showing all the signs of abandoning pledges to hold the line on drill budgets. U.S. shale explorers are poised to boost spending by almost 40% this year, based on comments and plans revealed during recent earnings presentations, Citigroup Inc. analyst Scott Gruber wrote in a note to investors Feb. 7.

Meanwhile, research firm Energy Aspects forecast planned refinery maintenance alone will take out more than 1.4 million barrels a day of U.S. crude capacity January through April. That’s about 200,000 barrels a day more than during the same period in 2015-19 that got taken offline for work, according to Bloomberg.

The market for refined products is robust if refiners can keep increasing run rates.

But refinery utilization on the Gulf Coast, the largest concentration of U.S. refining might, was only 86% as of the week ended Jan. 28, Bloomberg reported, citing the heavy maintenance season in progress as plants perform work that was pushed back in 2020 and 2021 to conserve cash during the height of the pandemic.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Want more news? Listen to today's daily briefing below or go here for more info: