California’s Port Dominance Is Slipping as Cargo Shifts East

[Stay on top of transportation news: Get TTNews in your inbox.]

California has suffered a series of economic blows this year, from torrential rains that inundated farmland to the failure of three regional banks. Now the state’s $2.8 trillion freight industry is under threat.

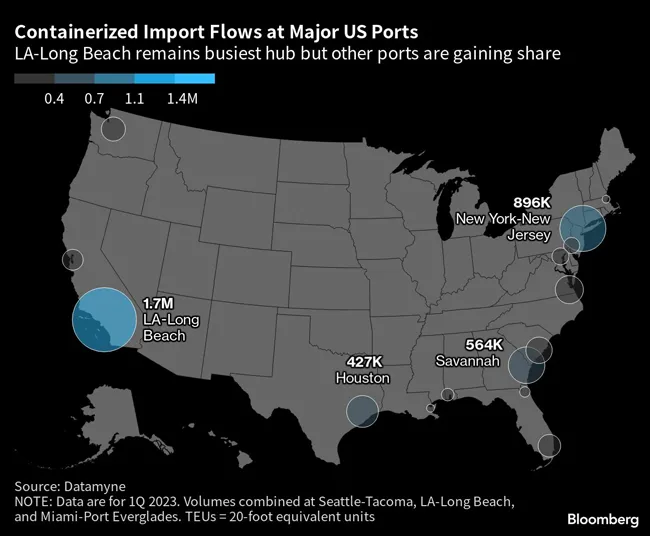

Southern California’s ports have grown up alongside China’s rise as a global trading power, moving almost 40% of containerized imports into the U.S. from Asia for the past two decades. But the pendulum is swinging east as the pandemic’s cargo crush pushed the Los Angeles and Long Beach complex close to the breaking point, allowing ports from New York-New Jersey to Houston to grow their market share.

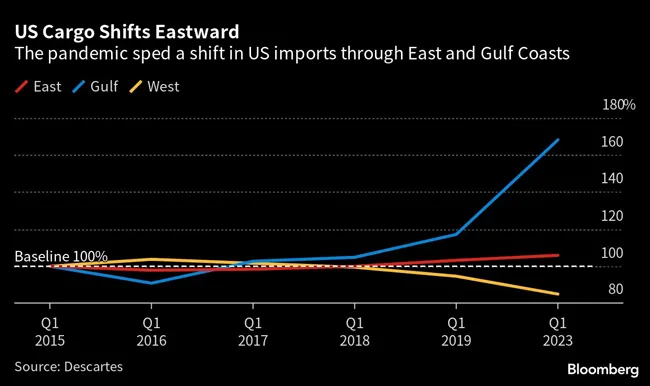

A gradual shift was already underway. But it’s getting supercharged by simmering West Coast port labor talks, the near-shoring of factory production amid rising tensions with China, and U.S. population growth shifting to the Sunbelt states.

Some observers worry that the L.A.-Long Beach docks will struggle to stay the No. 1 U.S. ocean gateway over the long run.

“Now that pandemic cargo volumes have leveled off, the decline in market share has accelerated,” said Pacific Merchant Shipping Association President John McLaurin in his April trade report.

With negotiations between nearly 22,000 West Coast dockworkers and employers approaching the one-year mark this week, skittish logistics managers are taking action to avoid potential strikes and lockouts by realigning supply routes away from L.A.’s San Pedro Bay. Burned by pandemic-era bottlenecks, businesses are placing more of a premium on reliability.

Many recall contract talks in 2014 that dragged on for nine months and caused vessel backups and shortages for some consumer goods. Those talks finally ended when the U.S. government intervened, but it took most of 2015 for the shipping industry to return to normal.

This time around, operations at the 29 West Coast ports have been largely smooth since the International Longshore and Warehouse Union and Pacific Maritime Association’s contract expired on July 1, though recent disruptions at L.A.-Long Beach have renewed calls for the White House to get involved.

The standoff “could amount to an entirely avoidable, self-inflicted obstacle to the U.S. economy,” said Jessica Dankert, vice president of supply chain at the Retail Industry Leaders Association. “Retailers will continue working to insulate consumers from the impact.”

Several importers have made the costlier move to divert some, or all, of their cargo away from the West Coast and will stay away until an agreement is ratified, according to RILA, whose members include Home Depot Inc., Target Corp. and Best Buy Co.

This special "Inside the List" episode features the Transport Topics 2023 Top 100 largest logistics companies. Hear the program above and at RoadSigns.TTNews.com.

The U.S.’s shifting demographics are also a factor — California’s population has shrunk by about 500,000 since 2020, while places like Texas and Florida are growing faster than ever.

The big winner? Gulf Coast ports. An April Descartes report showed West Coast container volumes were down 10% in the first quarter of 2023 compared with the same period in 2019. But Gulf ports saw a 43% increase in goods over the same period, and much of the cargo arriving includes electronics, furniture and machinery — products usually imported from Asia.

L.A. and Long Beach sit at the nexus of a logistics system largely geared to deliver freight to both major population centers locally and to cities halfway across the country on trains and trucks — often through warehouses, distribution centers and store shelves stretching 2,000 miles to Chicago.

Able to take larger ships that ply the Panama and Suez canals, ports like those in Texas, Alabama, Georgia and New York have spent years and billions of dollars expanding capacity — deepening channels, adding warehousing, expanding rail links and even raising a major bridge — so cargo flows more efficiently to the Midwest and across the South.

Consider what the Georgia Ports Authority just announced: the opening of the Mason Mega Rail Terminal, a five-year, $220 million investment project billed as the largest port-based intermodal facility on the continent. It’s promising delivery to places as far away as Dallas or Chicago within three days — the average amount of time containers currently dwell on the docks at L.A.-Long Beach.

The Southern California ports still have major advantages: They offer the most direct route from Asia-Pacific and have twice the capacity of their closest rival, New York-New Jersey.

They also offer intermodal rail and a vast network of truckers who ferry cargo to the nation’s largest distribution hub in the Inland Empire. At $1.1 trillion, Los Angeles-Long Beach-Anaheim had the second-highest GDP of any U.S. city in 2021.

But a third of the San Pedro Bay’s containers are increasingly “up for grabs,” and the twin ports risk becoming more of a regional hub, according to maritime economist John Martin. This so-called discretionary cargo generated $19.3 billion in 2021, according to a Martin Associates report commissioned by the PMA.

The supply chain industry drives nearly a third of the state’s economy and supports one in five jobs in California. Even a small dip in cargo volume over the longer term could lead to a cascading loss of employment starting on the docks and spreading through tech, consulting, transportation, warehousing and retail.

“Anytime we see a slowdown in volumes this significant, every segment of the supply chain feels it,” according to Port of Long Beach Chief Operating Officer Noel Hacegaba.

Terminal operators at the L.A. and Long Beach ports paid out about 400,000 shifts to dockworkers in the first quarter of 2023, a drop of about 25% from the same quarter in 2019, according to data from the PMA.

On a recent trip to Washington, Port of L.A. Executive Director Gene Seroka lobbied for a share of the $17 billion in federal dollars designated to ports and waterways. He is seeking funds for digitalization measures “to make that cargo flow smoother,” cleaner equipment to help reach its zero-emission goals and support for a new workforce training facility.

Some port customers will return their goods to Southern California once contract talks have settled, which will be crucial for the region to remain a vibrant hub for supply chains. “Shippers aren’t contemplating a shift back yet, but are not saying never,” said Anne Reinke, CEO of the Transportation Intermediaries Association.

— With assistance from Ana Monteiro.

Want more news? Listen to today's daily briefing below or go here for more info: