Bloomberg News

Oil’s Recovery Capped by Stubborn US Crude Glut, Dour Demand

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

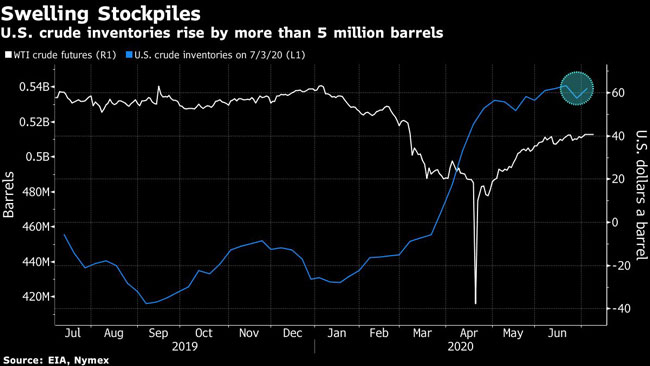

Oil’s recent rally has hit a ceiling, with U.S. crude inventories holding near a record high and gasoline demand still at the weakest seasonal level in more than 20 years.

Futures in New York have traded within a narrow range this month, struggling to top $41 a barrel after hitting a three-month high July 2. An Energy Information Administration report showing that domestic crude stockpiles rose by 5.7 million barrels last week only added to the malaise. While gasoline demand is improving — particularly on the East Coast, where virus cases are slowing — seasonal consumption remains at a two-decade low.

“It’s going to be tough to get prices to move much higher than $40,” said Bill O’Grady, executive vice president at Confluence Investment Management. “There’s still a ton of demand weakness. It’s getting better, but there’s still a lot of weakness.”

Economic uncertainty driven by the pandemic is locking oil into a holding pattern. Virus cases are spiking in gasoline-guzzling states including Texas and Florida, prompting leaders to re-impose travel restrictions that could dampen consumption further. Oil market volatility has tumbled, and trading volumes have fallen by about a third since the start of this month.

New virus cases topped 10,000 in Texas for the first time, reaching 210,585, while in Florida cases jumped 3.6% to 213,794. The U.S. total has now reached 3 million.

Oil demand next year will be only at 2017 levels, effectively meaning the coronavirus pandemic will have destroyed four years of growth, according to Standard Chartered.

The EIA report also showed U.S. distillate stockpiles reached the highest level since January 1983, signaling that trucking and other industrial activity remains far below normal. At the same time, gasoline inventories declined by the most since March, suggesting that more people are hitting the road.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More