Oil Reaches 5-Week High on Biggest Drop in Stockpiles Since 2016

[Stay on top of transportation news: Get TTNews in your inbox.]

Oil rose to a five-week high as a huge drop in U.S. crude inventories bolstered the outlook for demand.

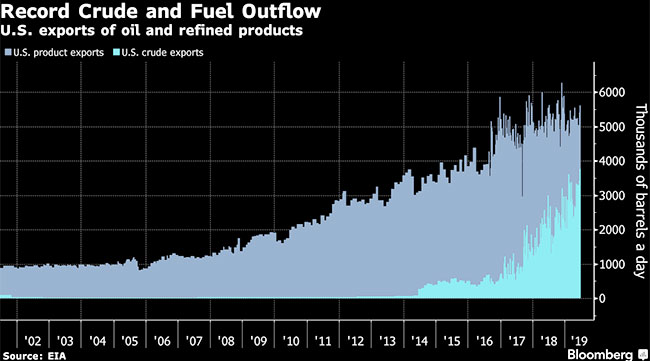

Futures in New York climbed 2.7% Wednesday after the U.S. Energy Information Administration said domestic stockpiles fell by 12.8 million barrels last week. The biggest decline in American supplies since September 2016 was accompanied by record exports of crude and refined products and gasoline demand that remained near an all-time high.

“U.S. exports are going to continue to grow, and that’s a positive for long-term crude balances here,” said Nick Holmes, who helps oversee $16 billion in energy investments for Kansas-based money manager Tortoise. “It’s our expectation that we continue to see draws into the second half of the year.”

While the summer driving season typically boosts demand, it was the second week in a row that inventories fell far beyond expectations, countering worries about the economy that have dogged oil prices. With added momentum from the U.S.-Iran standoff in the Persian Gulf, futures have jumped about 10% in the past week.

West Texas Intermediate for August delivery rose $1.55 to $59.38 a barrel on the New York Mercantile Exchange. It was the highest closing price for the contract since May 22.

Brent for August settlement added $1.44, or 2.2%, to $66.49 a barrel on London’s ICE Futures Europe Exchange. The global benchmark crude traded at a premium of $7.11 to WTI.

“This is the market’s reaction to the unexpectedly pronounced fall in U.S. crude-oil stocks,” said Carsten Fritsch, an analyst at Commerzbank AG in Frankfurt. “Apart from crude-oil stock trends, the focus here is also likely to be on gasoline demand” as the northern hemisphere moves into the peak driving season.

Plans for a meeting between the U.S. and Chinese presidents at the G-20 summit this weekend have added some optimism that trade talks between the two may be revived. Early next week, the Organization of Petroleum Exporting Countries and its allies are widely expected to extend output cuts at a meeting in Vienna.

With imports also down last week, the U.S. was a net exporter of crude and petroleum products for only the third time in records dating back to 1990, the EIA found. Gasoline inventories fell by 1 million barrels, in part due to an explosion and fire at Philadelphia Energy Solutions, the East Coast’s biggest refinery.

Philadelphia Mayor Jim Kenney said Wednesday that the 153-year old complex will close within the next month. Gasoline futures closed up 5%, their biggest one-day gain since March 1.