Bloomberg News

Oil Rallies With Strong Jobs Data Adding to OPEC+ Cut Optimism

[Stay on top of transportation news: Get TTNews in your inbox.]

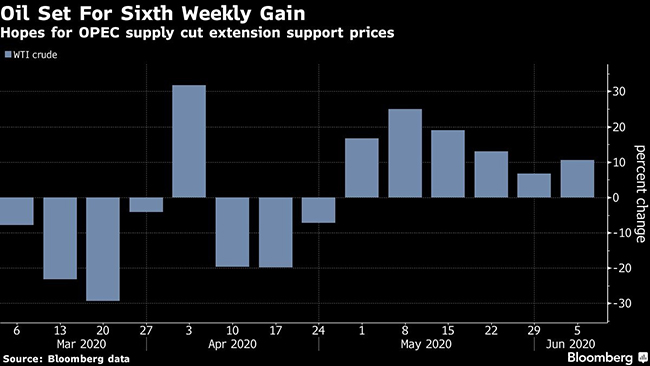

Oil headed for a sixth weekly gain after OPEC+ reached a tentative agreement to prolong its record production cuts and U.S. jobs data was better than expected.

Brent crude rose above $42 a barrel, while futures in New York gained 5%. All OPEC+ nations have agreed to comply with their output quotas and those that didn’t meet them will compensate in the coming months, a delegate said. The cartel and its allies will hold a round of meetings June 6 to extend record cutbacks by at least a month.

In the U.S., the unexpected jump in employment buoyed risk assets across the board.

How can trucking companies adjust to ensure that essential freight keeps moving while protecting their workers from coronavirus? Host Seth Clevenger speaks with Lilli Chiu of Hub International and Dave Cox of Polaris Transportation. Hear a snippet, above, and get the full program by going to RoadSigns.TTNews.com.

While oil has recovered rapidly from its plunge below zero in mid-April, the pace has slowed in the past couple of weeks. Demand is quickly returning in China, but questions remain for many other nations, especially for consumption of diesel. That complicates the task for OPEC+ as it tries to balance the market.

“It seems that the pre-OPEC meeting shenanigans have been resolved,” said Callum MacPherson, head of commodities at Investec. “It will be interesting to see whether OPEC+ varies the previously announced declining schedule for the future. For example, if they cut hard for longer now, might cuts planned for the future be reduced?”

OPEC+ will review later in June if more extensions are required, a delegate said. Iraq — the main laggard in adhering to the cuts — said June 5 that it supports all oil agreements that would lead to the market’s return to stability, despite financial strains the country is facing.

The producer group still needs to walk a tight line. A continuation of crude’s price rally could also encourage more American shale producers to bring wells back. WTI for 2021 was trading above $40 a barrel on June 5, the highest level since March. A $45 price could be enough to see renewed production growth in the Permian Basin, Citigroup analysts wrote in a report.

“It will be interesting to watch U.S. shale now,” said Helge Andre Martinsen, senior oil market analyst at DNB Bank ASA. The market could see a “quick rebound from curtailed production,” he added.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More