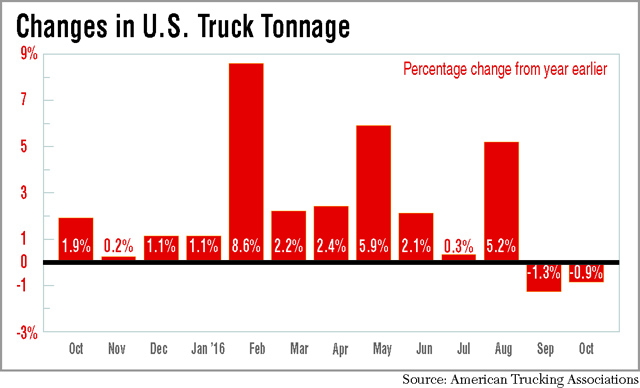

October Tonnage Dips 0.9% From 2015

This story appears in the Nov. 28 print edition of Transport Topics.

Truck tonnage sagged 0.9% in October versus a year ago, the second consecutive decline in American Trucking Associations’ monthly index, despite other positive economic numbers in the retail, manufacturing and industrial sectors.

Sequentially, seasonally adjusted U.S. tonnage fell just 0.3% from September, much better than the 6.3% drop last month.

The preliminary index number for October was 131.6, the lowest reading since May 2015. As recently as August, the figure was 140.8. It fell to 131.9 last month, down from the record high of 144 in February.

The index uses a base level of 100 for freight activity in the year 2000.

On a positive note, tonnage was up 2.5% year-to-date through October, compared with the same 10-month period in 2015. February and August have been this year’s two strongest months.

“Retail sales, housing starts, and even factory output, all improved in October, which is a good sign,” ATA Chief Economist Bob Costello said. “Most importantly, there has been considerable progress made in clearing out excess stocks throughout the supply chain. While that correction is still ongoing, there has been enough improvement that the negative [inventory] drag on tonnage shouldn’t be as large going forward.”

The federal government reported retail sales in October rose 0.8% sequentially and increased 4.3% year-over-year. The inventory-to-sales ratio fell to 1.38, which is the lowest level since August 2015.

Housing starts surged more than 25% in October, and factory output rose 0.2% for the second straight month.

However, Costello told Transport Topics that tonnage numbers don’t always match up to these other economic indicators because trucks haul raw materials, intermediate goods and finished goods throughout the economy. Higher factory production or more retail activity doesn’t always match up perfectly to truck movements, he said.

The raw numbers, or unadjusted index, which represents the tonnage actually hauled by the fleets, equaled 138.2 in October, up 1.9% from September.

“While seasonally adjusted tonnage fell, meaning the not seasonally adjusted gain wasn’t as large as expected, the bottom of the current tonnage cycle should be near,” Costello added.

Jon Starks, chief operating officer at consultant FTR, said he finds it difficult to get a good read on ATA tonnage figures. He predicted the number would slightly increase for October.

“Overall, the freight environment seems to be relatively stable with a little bit of positive news being generated, but you’re not likely to see any significant uptick in the tonnage numbers in the near term,” he said.

The ACT Research Co. For-Hire Trucking Index rose sequentially and year-over-year in terms of pricing, volume, capacity and productivity. All four indexes were higher than 50 in October, which is the dividing line between expanding and contracting economic conditions. Two of the four were lower than 50 one year ago.

The pricing index was 52.7 in October, up from the range of 44 to 49 from July through September. The pricing segment was 51.3 in October 2015.

“In terms of pricing, October is the strongest out of the latest six months and one of only two positive months,” said Jim Meil, an economist with ACT. “It was a soft pricing environment in the first half of the year, but October might be a hint, and it’s real tentative, of a slightly stronger environment. But I wouldn’t bet the ranch on it.”

ACT’s freight volume index rose to 58.1 from 56.1 sequentially and 46.3 year-over-year. Capacity increased to 53.4 from 52.3 in September and 52.5 in October 2015. The productivity number was 54.1 for October, up from 53 sequentially and 47.5 year-over-year.

“This is not a smoking-gun, sure-fire indication that happy days are here again or that we’ve reached a break point,” Meil said, “but it always has to start somewhere, and there are hints that we might be nearing the end of the yearlong correction.”

The DAT North American Freight Index, which measures spot market activity, rose 1.8% sequentially to 347 in October. It marked a 27% increase from last October and was the third consecutive month the index beat its 2015 comparison. DAT Solutions uses spot market activity from 2000 at a baseline of 100.

DAT analyst Mark Montague said the strong October numbers should continue through the end of the year.

“We used to see a down tail for November and December, but in the last few years, we’ve seen upward movement on pricing. I think that’s very much going to be the case this year,” he said. “I’m seeing spot market volumes holding for van and reefer freight and pressure building for higher rates. I see good things coming ahead in the spot market.”