Bloomberg News

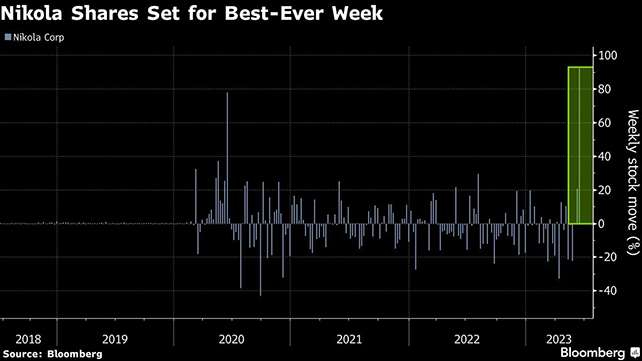

Nikola Short Sellers Take a Hit on EV Maker’s Recent Rally

[Stay on top of transportation news: Get TTNews in your inbox.]

Nikola Corp. shares surged this week in a rally that’s eating into paper profits for traders betting against the electric vehicle maker and setting them up for a short squeeze.

Short sellers lost more than $80 million in paper profits this week, according to data from S3 Partners LLC. Traders betting against Nikola are now up only $55 million in 2023.

Even though shares retreated June 16, falling 15%, short sellers could still get burned. Earlier gains in the trading session followed the electric truck-maker’s ousted founder Trevor Milton call for leadership change, a statement that Nikola said was in “direct violation of the agreements” he made when he left. The stock is still down 99% from its 2020 peak.

The stock popped as much as 8% in after-hours trading June 16 when the company said it would eliminate about 10% of its workforce in an effort to cut costs.

“We are seeing the start of a short covering squeeze and expect more shorts to trim their short exposure in NKLA and realize some of the profits they earned earlier in the year,” Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners, said. Nikola earned S3’s highest short squeeze score of 100 on June 15.

Shorting Nikola has become increasingly expensive as shares left to borrow dwindle, setting traders up for a squeeze, an event that occurs when traders rush to exit their contrarian positions by buying back the stock they’ve shorted. The phenomenon often drives stock prices up, putting more pressure on short sellers looking to cut their losses.

Options traders have also shifted from bearish to bullish, trading calls for Nikola at a record pace this week. Implied volatility on three-month options jumped to the highest level since July 2020 and the skew — which measures the relative value of calls versus puts — flipped from 14 points in favor of puts at the end of May to around even on June 16, signaling greater demand for bets on that shares will rise.

Retail trading appears to have juiced most of Nikola’s gains this week. On June 15 alone, net retail buying in Nikola reached $4 million, a record inflow after about two years of negligible trading, according to data from Vanda Research.

The rally indicates that “speculation is running rampant again,” according to Matthew Maley, chief market strategist at Miller Tabak + Co. “It shows that the stock market is getting frothy again on a short-term basis,” he said.

The gains also have helped drive Nikola shares above the key $1 level, which allows the stock to comply with a Nasdaq rule requiring listed securities to maintain a minimum closing price of $1 per share.

A flurry of recent news has boosted electric vehicle and technology stocks this month. Coherent Corp., which recently unveiled its new laser processing heads for EV manufacturing, is also rallying and on track to rise for a fifth consecutive session. The stock jumped as much as 12% on June 16 to extend its weekly gains to 47% this week — setting it up for its best week in 23 years.

Electric vehicle maker Tesla Inc. meanwhile snapped its record 13 straight sessions of gains earlier this week, amid the hawkish stance taken by the Federal Reserve and market technicals. The winning streak had added more than $240 billion to its market valuation.

Nikola also announced that it is cutting 270 jobs to reduce costs and preserve cash.

The move will affect 150 employees supporting European operations and another 120 workers based mostly at sites in Arizona and California, the company said June 16 in a statement. Nikola expects to save $50 million annually through the staff reduction, while the broader effort will result in as much as $400 million in lower annual cash usage by next year.

Want more news? Listen to today's daily briefing below or go here for more info: