Natural Gas Nears $2 Amid Work on Largest US Export Terminal

[Stay on top of transportation news: Get TTNews in your inbox.]

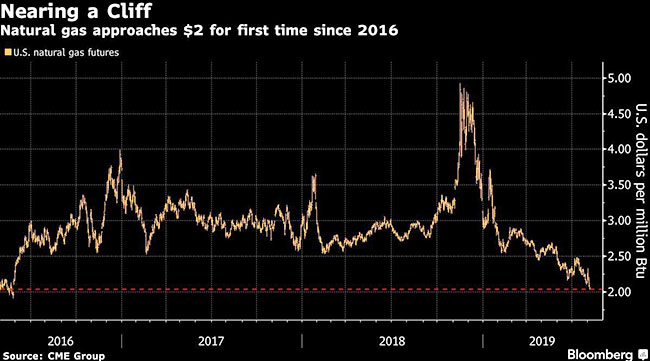

Natural gas futures slid toward $2 per million British thermal units, a level that hasn’t been breached in three years, as fading summer heat and maintenance on the largest U.S. export terminal leave the market struggling to absorb a barrage of supply from shale basins.

Temperatures may be mostly normal in the lower 48 through the middle of August, according to Commodity Weather Group. Planned work on Cheniere Energy Inc.’s Sabine Pass liquefied natural gas export terminal in Louisiana, meanwhile, is limiting a key outlet for gas producers. Flows to the facility dropped 36% from Aug. 2.

Though U.S. gas exports have climbed to a record and power plants are burning more of the fuel than ever, the demand boost has been no match for soaring output from shale basins. Underground gas storage is filling up at a faster pace as the weather cools, erasing concern that a supply crunch will emerge during the winter heating season. Hedge funds’ bearish bets on gas have climbed to the highest in three years.

”We haven’t had any kind of sustainable hot weather this summer to give the market some backbone,” said Thomas Saal, senior vice president of energy trading at FCStone Latin America in Miami. “You have these LNG facilities that can move the market around. The funds continue to aggressively sell the market, so until they hit something, we are going to keep falling.”

Gas was also pressured lower by a broader decline in energy and agricultural commodities as the U.S.-China trade war escalated, with Beijing responding to President Donald Trump’s tariff threat by letting the yuan tumble to the weakest level in more than a decade.

But the currency move is unlikely to have an immediate impact on the market for U.S. LNG. China imposed a 25% tariff on U.S. cargoes of the fuel earlier this year and hasn’t imported an American shipment since February, according to vessel tracking data compiled by Bloomberg.

China has received 62 cargoes of U.S. LNG since 2016, putting it behind South Korea, Mexico and Japan. If a trade deal is reached, however, it could put the U.S. on track to become the top supplier of the fuel to China by 2025, Morgan Stanley said in June.

“The yuan devaluation is a part of the escalation of the U.S.-China trade war, and natural gas was supposed to be big winner in that deal,” John Kilduff, a partner at hedge fund Again Capital in New York, said by phone. “And that deal looks like it’s far off.”

Gas for September delivery fell 5.5 cents, or 2.6%, to $2.066 per million Btu Aug. 5. Futures earlier dropped to $2.029, the lowest since May 26, 2016. The premium for March gas over April reached 14.4 cents after trading as low as 14.3 cents Aug. 2. Shares of gas drillers fell alongside the broader market, with Southwestern Energy Co. slipping as much as 6.8% and Range Resources Corp. down as much as 7.8%.