Staff Reporter

More Fleets Move Toward Freight Matching

[Stay on top of transportation news: Get TTNews in your inbox.]

The trucking industry is seeing an increased shift toward freight-matching platforms as some major fleets become the latest users.

UPS Inc. recently announced the expansion of its third-party logistics provider Coyote Logistics’ digital freight platform. Knight-Swift Logistics will lead the pilot of automated freight-tendering technology DAT Book Now for DAT Solutions. Knight-Swift is also partnering with Truckstop.com’s web-based freight marketplace to bring more load options to carriers. And Averitt Express unveiled a transportation management system.

At Coyote, the expansion of its CoyoteGO digital freight platform includes the launch of new, on-demand features that put all of its digital solutions in one place.

“Our core goal is to offer the right capacity to shippers and the right freight to carriers, when and where they need it, in the most efficient way possible,” Coyote Chief Technology Officer Brian Work said in a Feb. 24 statement. “The expansion of CoyoteGO represents one of the ways we’re integrating digital solutions at critical stages throughout the shipping process, from quoting through settlement, to foster a better experience for all users.”

These new platforms or services are a trend that doesn’t surprise Gartner Research Vice President for Transportation Technology Bart De Muynck.

“No one wants to be left out,” Muynck said. “Everyone wants to play in this marketplace whether you’re a carrier, whether you’re a 3PL, even some of the telematics vendors.”

Knight-Swift Logistics’ pilot for DAT Book Now promises to eliminate manual processes like lengthy load searches, phone calls and negotiations.

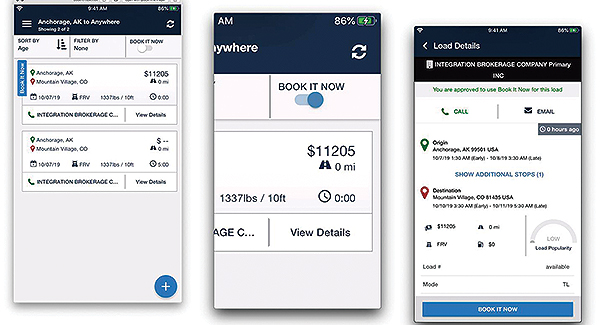

On the DAT network of load boards, carriers can search for freight and lock in the rate on their mobile or desktop device.

“DAT Book Now will allow carriers to make faster, more confident decisions about booking freight,” Shannon Breen, senior vice president of Knight-Swift Logistics and Intermodal, said in a statement Feb. 19.

The pilot program will run through the end of May, and the Book Now feature will become available to all freight brokerages in June.

As for Knight-Swift’s integration with Truckstop.com, there are two phases.

The first phase includes the integration of Truckstop.com’s Book It Now into Knight-Swift’s Logistics environment. Book It Now allows Knight-Swift Logistics to post a rate and for its preferred partner-carriers to instantly book loads and receive automated confirmation for the loads they choose.

“Book It Now gives carriers and owner-operators more options and ease to work with marketplace partners they know and trust,” Truckstop.com Chief Commercial Officer Bill Vitti said Feb. 18.

Truckstop.com's Book It Now allows Knight-Swift Logistics to post a rate and for its preferred partner-carriers to instantly book loads and receive automated confirmation for the loads they choose. (Truckstop.com)

In the second phase, Knight-Swift will bring a large contingency of its owner-operators to the Truckstop.com load board, providing substantial new capacity for Truckstop.com customers to tap. Freight brokers will be able to flag the Knight-Swift owner-operator group as a preferred carrier as they search for capacity, Truckstop.com said. The second phase should be complete by March.

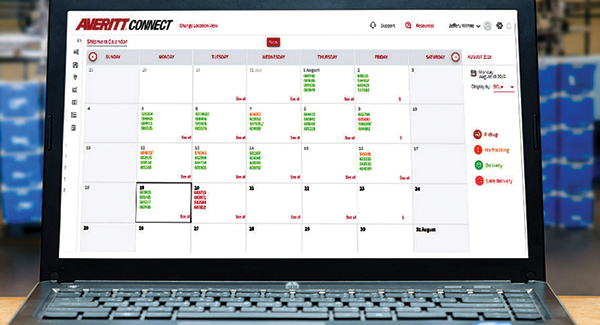

Averitt Express unveiled transportation management system Averitt Connect so users can quickly shop for rates from multiple less-than-truckload carriers throughout the country. The platform is designed specifically for small and mid-sized shippers. It also provides a variety of online shipment management tools.

“We are excited to be able to offer shippers an intuitive TMS that enables them to reduce the amount of time and resources that are needed to manage their LTL shipping needs,” Averitt President Wayne Spain said in a Feb. 19 statement. “Averitt Connect gives our customers the power and control to make quick and informed decisions without having to spend a lot of unnecessary time calling around to multiple carriers to find the best option.”

Averitt Connect allows users to quickly shop for rates from multiple less-than-truckload carriers throughout the nation.

Muynck said a lot of the companies adopting these types of technologies aren’t necessarily just the pure asset-based carriers. Some are common carriers that might have a dedicated carrier side, and a lot of them have a brokerage side.

“It is a natural progression, and everyone sees it obviously as a big opportunity,” Muynck said.

Muynck compared this trend to that of travel agents, whereby technology has enabled customers to access the services they need with accurate pricing in real time.

Host Seth Clevenger went to CES 2020 in Las Vegas and met with Rich Mohr of Ryder Fleet Management Solutions and Stephan Olsen of the Paccar Innovation Center to discuss how high-tech the industry has become. Listen to a snippet above, and to hear the full episode, go to RoadSigns.TTNews.com.

“It hasn’t disrupted the industry in the sense that it has really stolen or taken away a huge amount of volume or freight from the other methods of transportation,” Muynck said. “But what it has done that is similar to Uber is that it has reshaped the way people are thinking of how they should interact with a transportation company.”

He added that the change in mindset is a huge motivator for trucking, as some companies are afraid customers might not want to interact with them if they don’t provide such a platform.

“A lot of companies are investing more and more into technology because they want to be seen as a technology-enabled [company] or even as a technology company,” Muynck said. “So we’re really seeing a shift of companies wanting to be known as a technology company, even though they are really a carrier because of the evaluation they get in the market.”

Want more news? Listen to today's daily briefing: