Bloomberg News

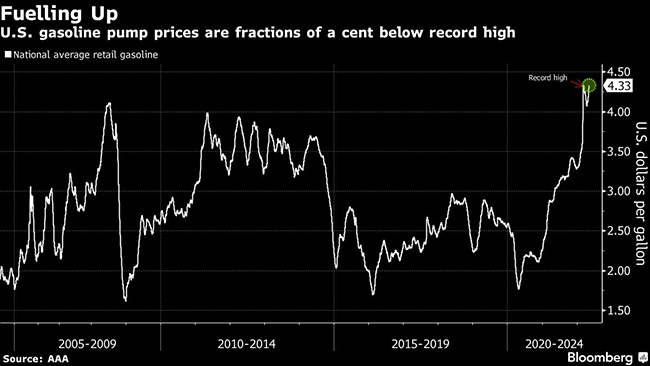

At More Than $4.30 a Gallon, Gasoline Nears Its March Record

[Stay on top of transportation news: Get TTNews in your inbox.]

Gasoline pump prices in the U.S. are rising to within a hair of an all-time record three weeks ahead of the peak driving season.

Futures in New York closed at a record high on May 6, as did wholesale prices in New York, Houston and Portland, Ore. The country’s average gasoline retail price rose to $4.328 a gallon on May 8, according to autoclub AAA, within a fraction of a cent to a record high of $4.331 a gallon reached in early March, shortly after the U.S. banned Russian oil due to the invasion of Ukraine.

Russia’s war took a significant chuck of diesel supply out of the global market and led to dwindling inventories and record prices in the U.S. Now the crisis is spreading to gasoline just ahead of the summer driving season — a scenario President Joe Biden has tried to avoid. Fuel prices are a key driver of inflation and can dampen consumer confidence.

There’s no easy solution. Inventories are below normal for this time of year. Efforts to refill tanks at home have been hindered by record exports as countries snap up fuel to replace lost Russian supply.

After losing more than 1 million barrels a day of capacity during the coronavirus pandemic, it won’t be easy for refiners to boost production further. On top of that, one of the biggest impacts of banning Russian oil imports is the loss of vacuum gasoil, a feedstock that gets turned into primarily gasoline. Russian VGO is difficult to replace and could hit gasoline yields, Amrita Sen, co-founder and director of research at Energy Aspects, recently told Bloomberg.

Gasoline production is also under pressure from higher-margin diesel and jet fuel. Fuelmakers are incentivized to prioritize output of those two fuels, and that dynamic likely will continue through the summer.

New York is one of the most vulnerable regions to gasoline supply disruptions. It relies on imports from the U.S. Gulf Coast and abroad. The country’s largest fuel pipeline has been operating at full capacity to send fuel to the East Coast from the Gulf Coast, but regional gasoline inventories have fallen to their lowest since 2011.

Still, U.S. drivers are expected to consume more gasoline this summer than they did during the same period in 2021 despite high prices.

— With assistance from Barbara Powell.

Want more news? Listen to today's daily briefing below or go here for more info: